US GDP expands less that expected in Q1

In the initial estimate released on Thursday by the US Bureau of Economic Analysis (BEA), it was revealed that the actual Gross Domestic Product (GDP) of the US expanded by 1.6% on an annualized basis in the January-March period. This expansion, coming in short of market predictions of 2.5%, followed a 3.4% growth in Q4 2023.

Join us in our live coverage of the US GDP release

According to the press release: "Compared to the fourth quarter, the deceleration in real GDP in the first quarter primarily reflected decelerations in consumer spending, exports, and state and local government spending and a downturn in federal government spending. These movements were partly offset by an acceleration in residential fixed investment. Imports accelerated."

Additional data saw the GDP Price Index increase by 3.1% in the same period, a tad above estimates (3.0%) and up from the previous 1.7% gain.

Market Reaction

The Greenback gathers extra pace in the wake of the release, motivating the USD Index (DXY) to refocus on the upside and the 106.00 hurdle. Furthermore, the uptick in the index comes in tandem with a climb to fresh highs in US yields across the curve.

US Dollar price this week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.37% | -0.85% | -0.28% | -1.28% | 0.64% | -0.69% | 0.38% | |

| EUR | 0.37% | -0.48% | 0.07% | -0.88% | 1.00% | -0.28% | 0.77% | |

| GBP | 0.85% | 0.48% | 0.54% | -0.41% | 1.47% | 0.19% | 1.24% | |

| CAD | 0.27% | -0.07% | -0.55% | -0.97% | 0.93% | -0.36% | 0.69% | |

| AUD | 1.22% | 0.85% | 0.41% | 0.94% | 1.85% | 0.54% | 1.64% | |

| JPY | -0.63% | -1.00% | -1.49% | -0.94% | -1.90% | -1.28% | -0.24% | |

| NZD | 0.63% | 0.29% | -0.21% | 0.36% | -0.60% | 1.26% | 1.08% | |

| CHF | -0.42% | -0.80% | -1.28% | -0.71% | -1.66% | 0.22% | -1.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

This section below was published as a preview of the US Gross Domestic Product (GDP) data at 07:00 GMT.

- The United States Gross Domestic Product is seen expanding at an annualized rate of 2.5% in Q1.

- The current resilience of the US economy bolsters the case for a soft landing.

- Markets now see the US Federal Reserve starting its easing cycle in September.

The US Bureau of Economic Analysis (BEA) will publish the first estimate of the US Gross Domestic Product (GDP) for the January-March period on Thursday. The report is expected to show an economic expansion of 2.5% after growing at an annualized pace of 3.4% during the prior quarter.

Forecasting US Gross Domestic Product: Deciphering the Numbers

Thursday's economic agenda in the US features the unveiling of the initial GDP report for the first quarter, set to be disclosed at 12:30 GMT. Analysts anticipate that the first assessment will reveal a 2.5% growth rate for the world's largest economy in the January–March period, a moderately robust pace, albeit markedly slower than the 3.4% expansion recorded in the preceding quarter.

From the latest release of the BEA: “Real GDP increased 2.5 percent in 2023 (from the 2022 annual level to the 2023 annual level), compared with an increase of 1.9 percent in 2022. The increase in real GDP in 2023 primarily reflected increases in consumer spending, nonresidential fixed investment, state and local government spending, exports, and federal government spending that were partly offset by decreases in residential fixed investment and private inventory investment. Imports decreased”.

Market participants will also pay close attention to the GDP Price Index (GDP Deflator), which represents the average change in prices of all new, domestically produced final goods and services in an economy over a specific period, typically a year or a quarter. It essentially reflects the inflation or deflation rate within an economy. During the last quarter of 2023, the GDP Price Index rose by 1.7% and is now seen rising by 3.0%.

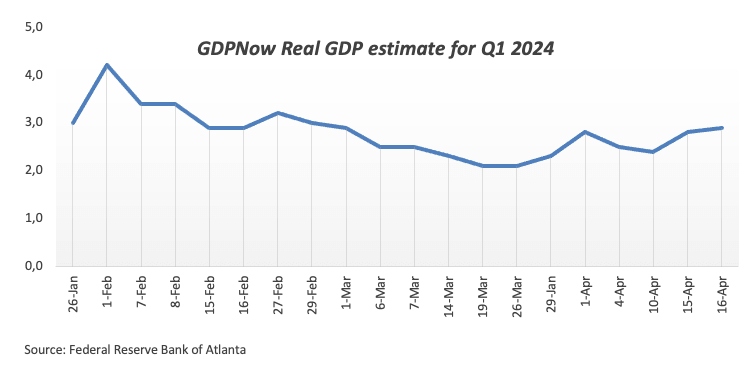

Furthermore, the Atlanta Fed GDPNow real GDP estimate for Q1 also props up the case for a solid performance of the US economy during that period.

According to analysts at TD Securities: “GDP growth likely modestly cooled to start the year, but to a still firm pace following two stronger expansions at 4.9% and 3.4% q/q annualized rate (AR) in Q3 and Q4 of last year, respectively. Growth in final domestic sales was likely firmer in 24Q1 than the headline would suggest (TD: 2.8% q/q AR), as we look for net trade & inventories to modestly dent still solid consumer spending.”

When is the GDP print released, and how can it affect the USD?

The US GDP report will be published at 12:30 GMT on Thursday. Meanwhile, the Greenback seems to have embarked on a consolidative phase ahead of the first estimate of US Q1 GDP as well as the inflation tracked by the Personal Consumption Expenditures Price Index (PCE) due on Friday.

Meanwhile, the macroeconomic outlook remains consistent with growing anticipation among market participants of the US Federal Reserve's (Fed) first interest rate reduction in September. On this, CME Group’s FedWatch Tool sees the probability of a lower interest rate at around 70%, up from nearly 3% a month ago.

Still around the commencement of the Fed’s easing cycle, Atlanta Federal Reserve Bank President Raphael Bostic predicted US inflation would reach 2% more gradually than previously predicted but did not rush to cut rates. New York Federal Reserve Bank President John Williams emphasized that the Fed's decisions are based on positive data and the strength of the economy, adding that the Fed may adjust if higher rates are needed. Fed Governor Michelle Bowman suggests that efforts to reduce inflation may have hit a snag, leaving uncertainty about interest rates' ability to return to the bank's target. Finally, in his latest comments, Fed Chairman Jerome Powell showed no rush to start reducing interest rates, matching the broad-based rate setters’ views.

A sneak peek ahead of the results

Stronger-than-anticipated GDP growth in the first quarter could bolster expectations that the Fed will delay the start of its easing programme, probably until September or December, which should in turn morph into further strength in the US Dollar (USD). The Greenback is also expected to hold its ground in the case of a higher GDP Price Deflator.

Alternatively, an abrupt change of heart around the US Dollar and, hence, a challenge to the current markets’ bets for a rate cut later in the year, should require an unexpectedly worse-than-estimated print, which appears quite unlikely for the time being.

Techs on the US Dollar Index (DXY)

Pablo Piovano, Senior Analyst at FXStreet, notes: “In case the bullish sentiment gathers steam, the USD Index (DXY) could confront the so-far 2024 top at 106.51 (April 16). Surpassing this level could encourage market participants to embark on a potential visit to the November peak at 107.11 (November 1), just ahead of the 2023 high at 107.34 (October 3).”

Pablo adds: “If we look in the opposite direction, the April bottom at 103.88 (April 9) remains underpinned by the 200-day Simple Moving Average (SMA) at 103.99, and this area is expected to offer decent contention. The breakdown of this region exposes a drop to the 100-day SMA at 103.67 prior to the March low at 102.35 (March 8).”

Author

FXStreet Team

FXStreet