US Election 2024: Exit polls suggest a nail-biter race; Trump leads in key swing states

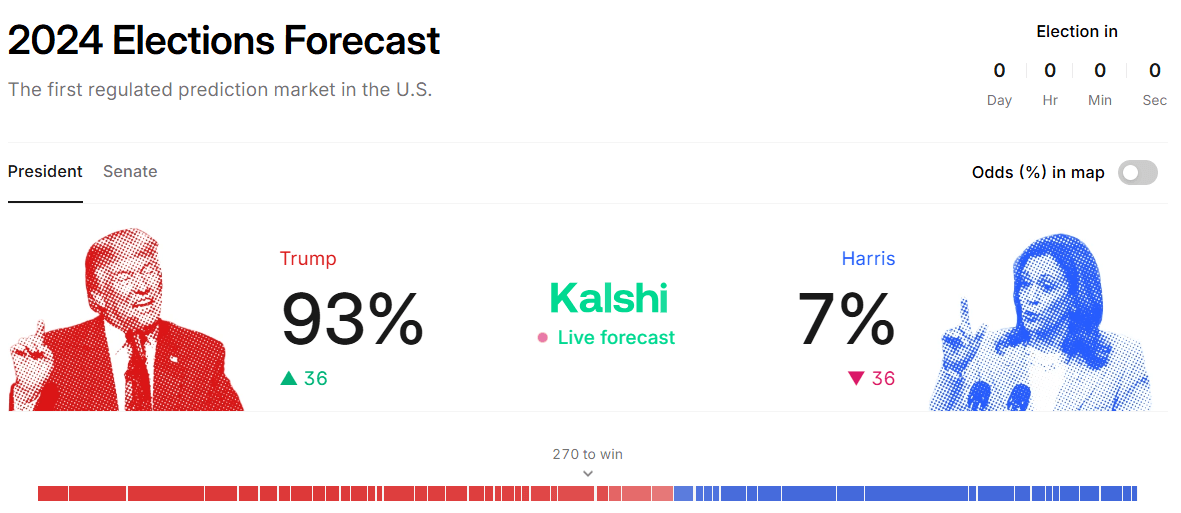

Republican nominee Donald Trump is most likely to become the 47th US president, according to the exit polls, as he leads in several major battlegrounds by a minor margin after taking more than 20 reliably red states. The Trump trade optimism is back in play, bolstering the US Dollar (USD) and global stocks.

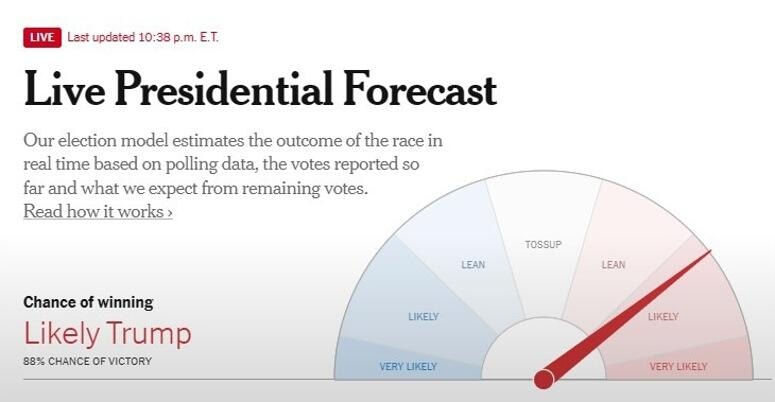

The current electoral vote tally is 211 for Trump and 145 for Harris and the New York Times (NYT) needle puts Trump at 88% chance of winning the presidency.

The presidential race still remains too close a call in these swing states, as some states may take a couple of days to offer final results.

Exit polls result in Wisconsin point to a Trump lead, as the former US president secures 51% of the votes to 48%, with 63% of the expected votes counted.

However, human error and hoax bomb threats have held up vote counts at some polling stations in Wisconsin. In Milwaukee, election officials are recounting more than 30,000 absentee ballots because doors on the ballot tabulators were not properly sealed. The recount could delay results in Wisconsin, considered one of seven critical swing states.

North Carolina exit polls also show similar results, with 88% of votes counted

About 30% of votes were counted in Michigan and Trump sees a 51.6% lead to 46.7%.

Nebraska District 2 initial results show Harris leading, with 54.4% while the support for Trump stands at 38%, as 78% of the votes get counted.

With roughly 50% of the votes counted in Arizona, the exit polls show Trump and Harris are evenly tied.

Meanwhile, 47% of voters in Nevada said they had a favorable view of Trump, compared to 48%, as reported by Edison Research.

Georgia, a key swing state, was among the first of those with available exit polls, showing a Trump victory. The state, which holds 16 electoral votes, shows Trump securing about 51.1% of the votes against Harris’ 48.2%, according to CBC News, with 90% of the expected votes counted.

Some media outlets have called North Carolina and Georgia for Trump already.

Preliminary results in Pennsylvania, the most closely watched swing state, shift in favor of Trump, per CBC News. With about 76% of the expected votes counted, Kamala now secures 48% vs. Trump’s 51.0%. The state holds 19 electoral votes.

Market reaction

The US Dollar has retraced some gains against its major rivals, with the US Dollar Index currently trading back under 105.00, still up 1.42% on the day.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.