US Dollar jumps higher after Fed's Logan dampens hopes for December rate cuts

- The US Dollar jumps on the back of hawkish Fed comments.

- Dallas Fed President Logan issues cautious approach for December rate cut becoming an uncertainty.

- The US Dollar index trades above 106.00, at a fresh six-month high.

The US Dollar (USD) is picking up steam again after comments from Federal Reserve Bank of Dallas President Lorie Logan. Fed's Logan said that a December rate cut might not be such a certainty as markets are pricing in at the moment. This could point to the Fed having a change of heart, ending its cutting cycle premature in the outlook that President-Elect Donald Trump could fire up inflation and rates in the US with his suggested policy.

The US economic calendar is having one of its focal points for this week with the release of the US Consumer Price Index reading for October. Despite the very narrow ranges, all numbers came in line of expectations. That explains the muted reaction in the Greenback on the numbers.

Daily digest market movers: Logan cuts off December

- The Mortgage Bankers Association (MBA) kicked off this Wednesday’s calendar at 12:00 GMT with its weekly Mortgage Applications tracker. This week applicatiosn rose marginally by 0.5% against the steep fall last week by 10.8%.

- The US Consumer Price Index (CPI) release for October came in as no surprise:

- Monthly headline inflation remained stable at 0.2%, and the yearly reading ticked up to 2.6% from 2.4%.

- Monthly core inflation remained unchanged at 0.3%, with the yearly figure also stable at 3.3%.

- Five Federal Reserve members are set to speak out this Thursday:

- Federal Reserve Bank of Minneapolis President Neel Kashkari is interviewed on Bloomberg TV at 13:30 GMT.

- Near 14:30, Federal Reserve Bank of New York President John Williams delivers welcome remarks at the Academy for Teachers Master Class in New York.

- Federal Reserve Bank of Dallas President Lorie Logan delivers opening remarks at the ninth joint energy conference hosted by the Federal Reserve Banks of Dallas and Kansas City near 14:45 GMT.

- Federal Reserve Bank of St.Louis President Alberto Musalem delivers a speech and participates in a Q&A session about the US economy and monetary policy at the Economic Club of Memphis at 18:00 GMT.

- Around 18:30 GMT, comments are expected from Federal Reserve Bank of Kansas City President Jeffrey Schmid, who delivers a keynote speech at the ninth joint energy conference hosted by the Federal Reserve Banks of Dallas and Kansas City.

- Equities are turning red across the board after comments from Dallas Fed Chairman Logan.

- The CME FedWatch Tool is pricing in another 25 basis points (bps) rate cut by the Fed at the December 18 meeting by 62.4%. A 37.6% chance is for rates to remain unchanged. While the rate-cut scenario is the most probable, traders have pare back some of the rate-cut bets compared with a week ago.

- The US 10-year benchmark rate trades at 4.42%, swing back higher again after Fed's Logan comments.

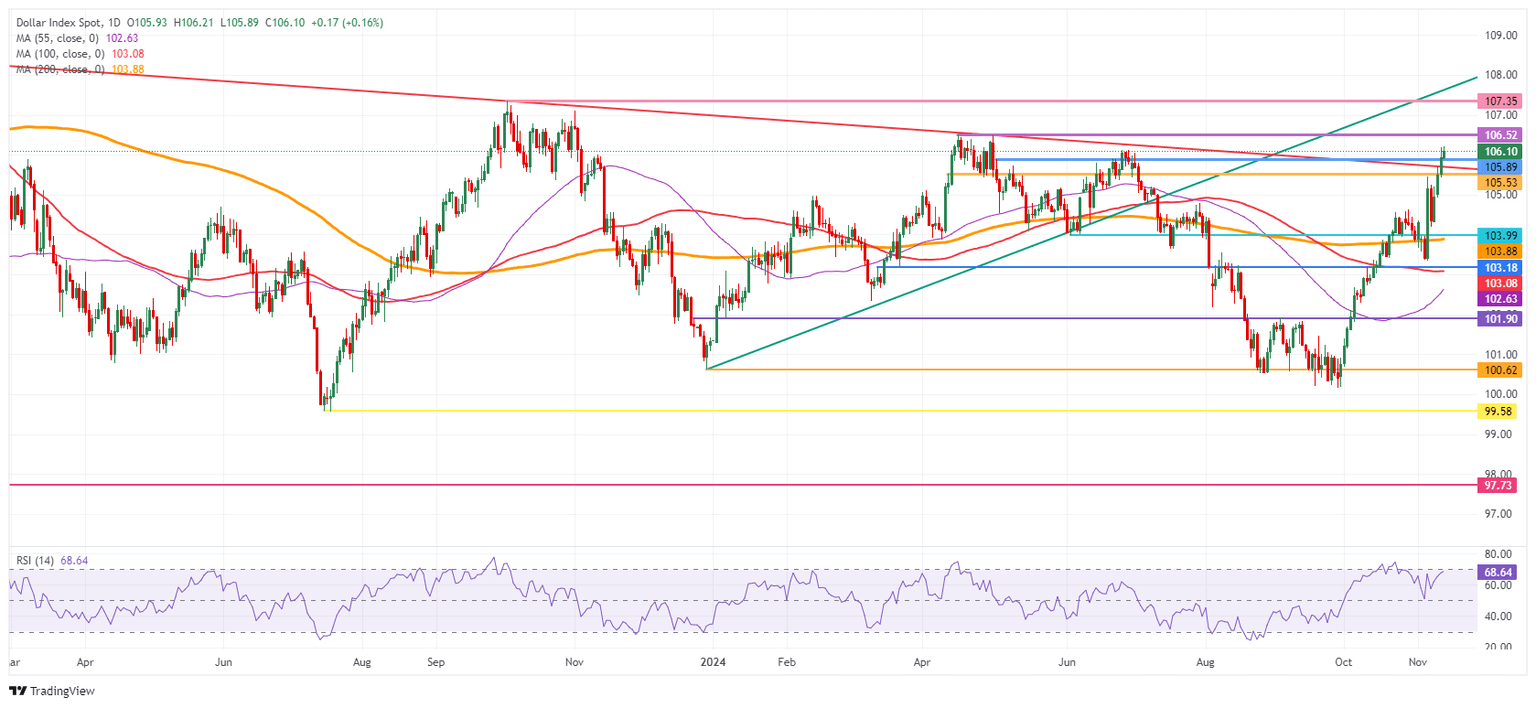

US Dollar Index Technical Analysis: Another stretch

The US Dollar Index (DXY) is adding more gains to its rally. That makes sense seeing where US yields are trading since this summer. The main issue could be that the trading is starting to overheat, increasing the chances of a correction soon under some profit taking.

All eyes are now on 106.52, the high of April and a double top, as it would mean a fresh 2024 high. Once the level would snap, 107.00 comes into play with 107.35 the next pivotal level to look out for.

On the downside, the round level of 104.00 and the 200-day Simple Moving Average (SMA) at 103.88 should refrain from sending the DXY any lower. Before that level, there is not much in the way with maybe some slim support at 104.63 (high of October 30).

US Dollar Index: Daily Chart

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.