US Dollar could see follow through if Fed Waller dampens hope for a 50 basis point cut in September

- The US Dollar erases all losses for this Friday and Thursday included.

- Markets have to ease on their expectations ahead of Fed's Waller

- The US Dollar Index bounces off 100.62 and jumps back above 101.00.

The US Dollar (USD) is trading in the green after earlier revisiting levels seen at the end of August in the US Dollar Index (DXY). Reason for the dip is the miss on expectations for the Nonfarm Payrolls print which came in at 142,000, below the 160,000, while July's number got revised down from 114,000 to only 89,000. Though, hold your horses, as a sidenote in the report pointed to a lot more overtime being reported, which could point to a pickup in demand again and healthy robust activitiy, which is certainly not the right environment for the US Federal Reserve to cut 50 basis points in September.

All eyes now on Federal Reserve Governor Christopher Waller, who is due to speak. Fed Waller is known for delivering some market-moving comments, and he might be the one to confirm if in September the Fed will go for a 25-basis-point or a 50-basis-point rate cut.

Daily digest market movers: A kick in the nuts for sure

- The US Jobs Report for August was released by the Bureau of Labor Statistics this Friday. Here are the main key takeaways to watch:

- Nonfarm Payrolls came in at 142,000, below the 160,000 estimate, while July's number got revised down from 114,000 to only 89,000.

- Monthly Average Hourly Earnings jumped from a -0.1% previously to a +0.4%.

- The Unemployment Rate dipped to 4.2% from 4.3%.

- Two Fed speakers are on the docket after the US Jobs Report is published:

- Federal Reserve Bank of New York President John Williams delivers keynote remarks and participates in a Q&A session at the C. Peter McColough Series on International Economics around 12:45 GMT.

- Around 15:00 GMT, Federal Reserve Governor Christopher Waller delivers a speech about the US economic outlook and participates in a Q&A session at the University of Notre Dame in Indiana.

- Equities are struggling to find direction, with all three indices trading in the red.

- The CME Fedwatch Tool shows a 59.0% chance of a 25 basis points (bps) interest rate cut by the Fed in September against a 41.0% chance for a 50 bps cut. Another 25 bps cut (if September is a 25 bps cut) is expected in November by 29.9%, while there is a 49.9% chance that rates will be 75 bps (25 bps + 50 bps) below the current levels and a 20.2% probability of rates being 100 (25 bps + 75 bps) basis points lower.

- The US 10-year benchmark rate trades at 3.73%, off the low for this week.

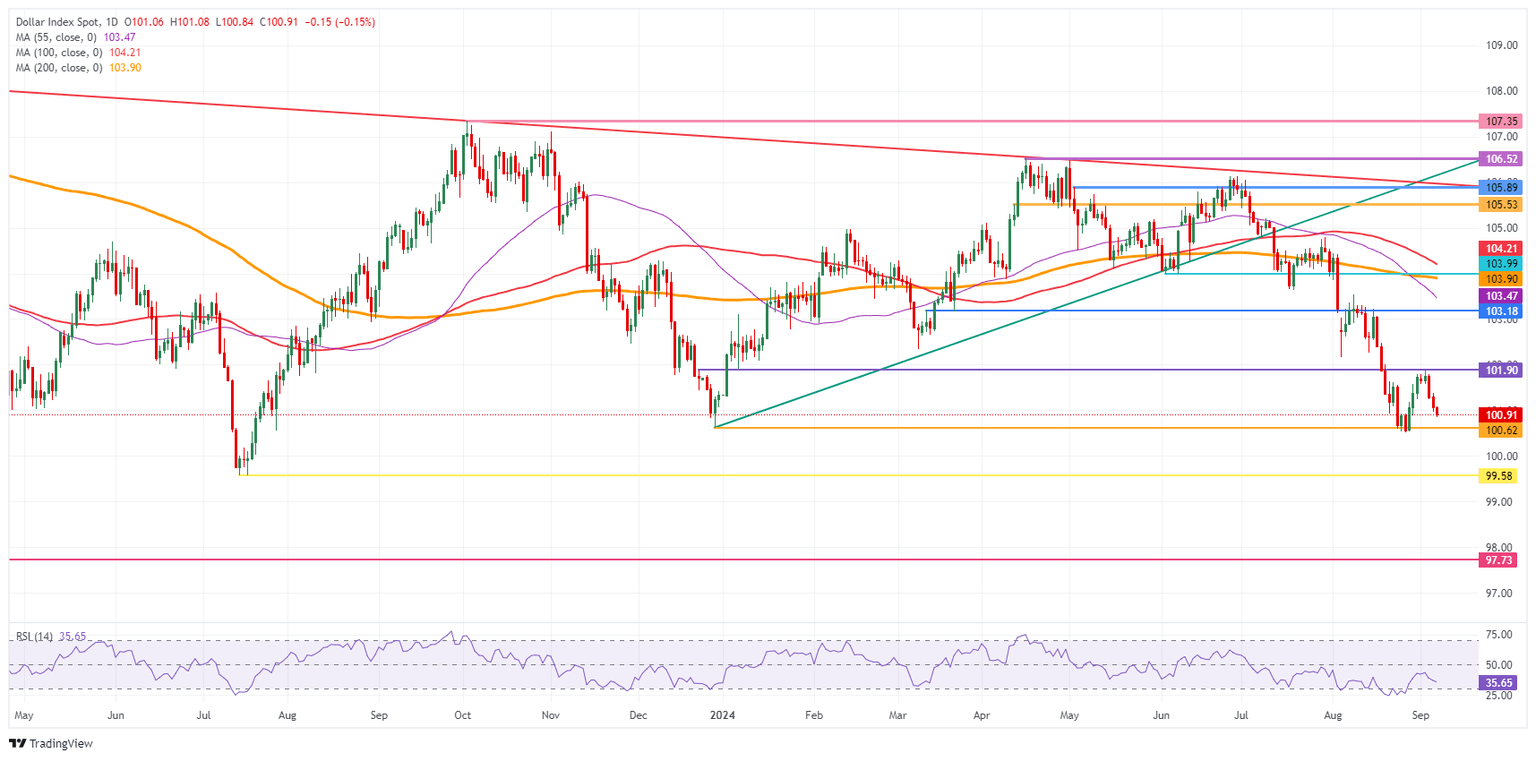

US Dollar Index Technical Analysis: Do not get your hopes up that high

The US Dollar Index (DXY) is the sum of all parts that are taking place in the markets. Investors increasingly price in that the Fed will need to cut interest rates by more than what was anticipated a few weeks ago. Although a rate cut might be granted, the recent US economic data still puts the economy on a glide path for a soft landing, which means the Fed isn’t likely to cut aggressively as that would risk sparking inflation again.

Looking at key technical levels, the first resistance at 101.90 is starting to look very difficult to break through after it already triggered a rejection earlier this week. Further up, a steep 2% uprising would be needed to get the index to 103.18. Finally, a heavy resistance level near 104.00 not only holds a pivotal technical value, but it also bears the 200-day Simple Moving Average (SMA) as the second heavyweight to cap price action.

On the downside, 100.62 (the low from December 28) could soon see a test in case data supports more rate cuts from the Fed. Should it break, the low from July 14, 2023, at 99.58, will be the ultimate level to look out for. Once that level gives way, early levels from 2023 are coming in near 97.73.

US Dollar Index: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.