US Dollar gains with US Services PMI outpacing Germany's positive print

- The US Dollar jumps after the prelimenary December PMI data got released.

- Traders are back favoring the Greenback with the Services PMI beating the previous number.

- The US Dollar Index (DXY) moves back above 107.00 and heads to 107.35.

The US Dollar (USD) is trading higher on Monday after spending most of its time in red numbers at the start of this week. The turnaround comes on the back of a very upbeat release in the preliminary S&P Global Services Purchase Managers Index (PMI) release for December. A print of 58.5 against the previous 56.1 and the concensus 55.7 is smashing it out of the park and is providing the needed tailwind for the Greenback to get out of its disappointing performance earlier this Monday.

The first move on Monday was initiated after Chinese Retail Sales came in at 3.0% for November, below analysts’ lowest estimate of 4.2% and far below the median estimate of 5.0%. Clearly, the stimulus measures the Chinese government has implemented are not having the impact markets expected them to.

Meanwhile, preliminary S&P Global and Hamburg Commercial Bank (HCOB) Purchase Managers Index (PMI) data for December have been released for European countries and the Eurozone. Overall, manufacturing is sinking further into contraction in both France and Germany. The sole outlier is German Services, which is popping back into expansion at 51.0 against the 49.3 expected.

German Chancellor Olaf Scholz will be able to use that last data point in his favor during his scheduled meeting at the Bundestag later this Monday, where the chancellor is facing a vote of no confidence. If he loses, the German government will fall, following France’s, with snap elections set to take place possibly on February 23.

Daily digest market movers: US plays in major league against Europe in second

- China’s Retail Sales data for November missed market estimates by coming in at 3.0% year-over-year, whereas 4.6% was expected, pushing the Greenback higher against the Chinese Yuan (USD/CNH).

- The surprise upbeat German Services PMI, combined with the possibility of an announcement about German snap elections, is pushing the Euro higher against the US Dollar (EUR/USD).

- At 14:45 GMT, the US preliminary S&P Global PMI data for December got released:

- Services PMI jumped to 58.5, beating the 55.7 estimate and quite far above the previous 56.1.

- The Manufacturing component fell further into contraction by 48.3, below the 49.4 estimate and the previous 49.7 print.

- The services component will be the leading element, with a weaker US Dollar should services shrink substantially, whereas an upbeat number would trigger more US Dollar strength across the board.

- Equities are split with Euro lagging while the S&P Global Services PMI release fires up US equities. The Nasdaq is leading the charge by heading nearly 0.70%.

- The CME FedWatch Tool is pricing in another 25 basis points (bps) rate cut by the Fed at the December 18 meeting by 97.1%.

- The US 10-year benchmark rate trades at 4.39%, just a sigh below the 4.40% from last week.

US Dollar Index Technical Analysis: US back to exceptionalism

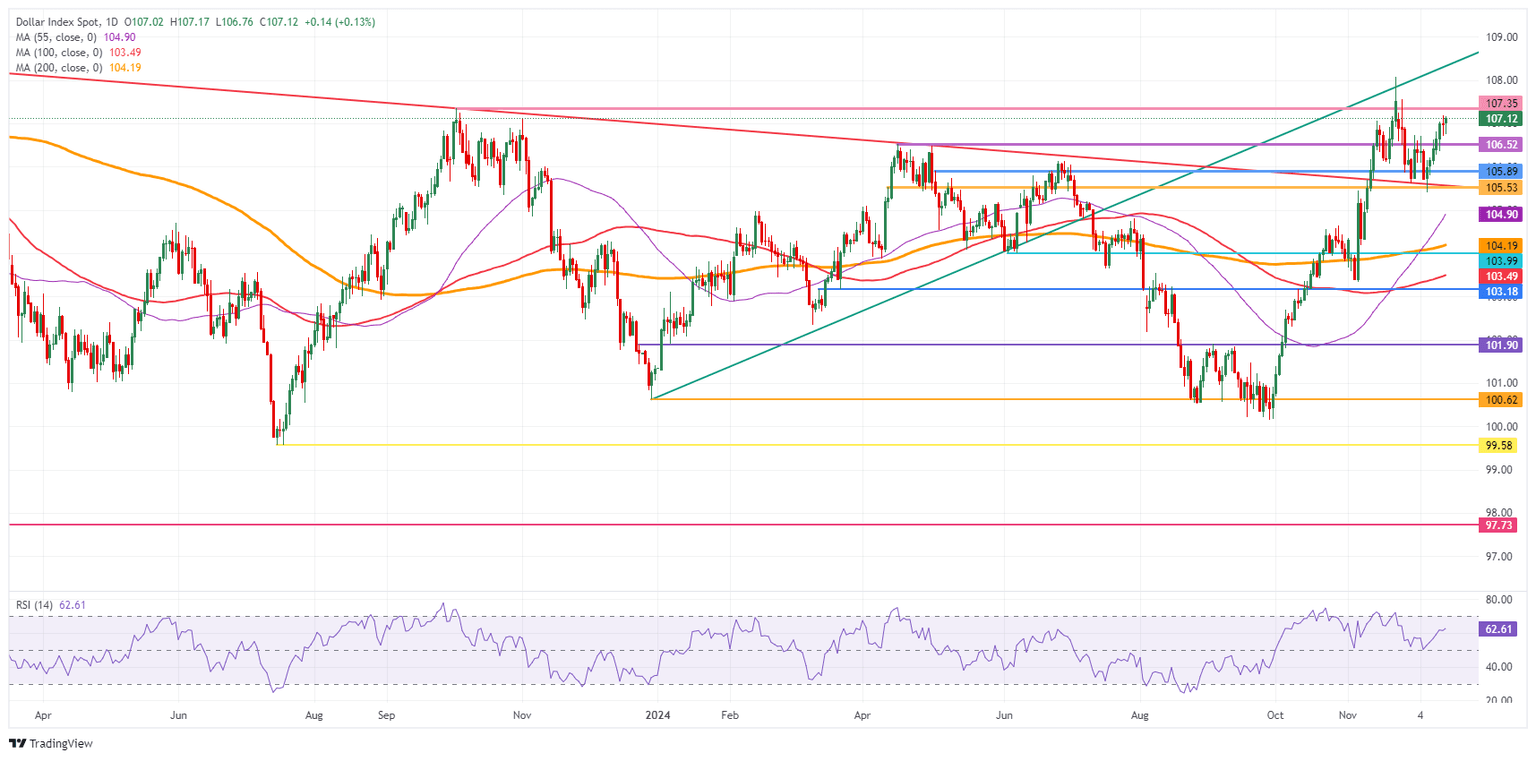

The US Dollar Index (DXY) shows signs of fatigue, with price action slowing down and starting to trade sideways. Traders feel comfortable with what has been priced in and are probably awaiting anything else until President-elect Donald Trump takes office or should US data fuel any move. The uncertainty on which measures Trump will put in place and which are just threats used as bargaining chips could keep the DXY in a chokehold until late January.

On the upside, 107.00 remains a key level that needs to be reclaimed before considering 108.00. When and if that finally happens, the fresh 2-year high at 108.07, recorded on November 22, is the next level to watch for.

Looking down, 106.52 is the new first supportive level in case of profit-taking. Next in line is the pivotal level at 105.53 (the April 11 high), which comes into play before heading into the 104-region. Should the DXY fall towards 104.00, the 200-day Simple Moving Average at 104.19 should catch any falling knife formation.

US Dollar Index: Daily Chart

Banking crisis FAQs

The Banking Crisis of March 2023 occurred when three US-based banks with heavy exposure to the tech-sector and crypto suffered a spike in withdrawals that revealed severe weaknesses in their balance sheets, resulting in their insolvency. The most high profile of the banks was California-based Silicon Valley Bank (SVB) which experienced a surge in withdrawal requests due to a combination of customers fearing fallout from the FTX debacle, and substantially higher returns being offered elsewhere.

In order to fulfill the redemptions, Silicon Valley Bank had to sell its holdings of predominantly US Treasury bonds. Due to the rise in interest rates caused by the Federal Reserve’s rapid tightening measures, however, Treasury bonds had substantially fallen in value. The news that SVB had taken a $1.8B loss from the sale of its bonds triggered a panic and precipitated a full scale run on the bank that ended with the Federal Deposit Insurance Corporation (FDIC) having to take it over.The crisis spread to San-Francisco-based First Republic which ended up being rescued by a coordinated effort from a group of large US banks. On March 19, Credit Suisse in Switzerland fell foul after several years of poor performance and had to be taken over by UBS.

The Banking Crisis was negative for the US Dollar (USD) because it changed expectations about the future course of interest rates. Prior to the crisis investors had expected the Federal Reserve (Fed) to continue raising interest rates to combat persistently high inflation, however, once it became clear how much stress this was placing on the banking sector by devaluing bank holdings of US Treasury bonds, the expectation was the Fed would pause or even reverse its policy trajectory. Since higher interest rates are positive for the US Dollar, it fell as it discounted the possibility of a policy pivot.

The Banking Crisis was a bullish event for Gold. Firstly it benefited from demand due to its status as a safe-haven asset. Secondly, it led to investors expecting the Federal Reserve (Fed) to pause its aggressive rate-hiking policy, out of fear of the impact on the financial stability of the banking system – lower interest rate expectations reduced the opportunity cost of holding Gold. Thirdly, Gold, which is priced in US Dollars (XAU/USD), rose in value because the US Dollar weakened.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.