US Dollar snaps losing streak and bounces higher post-Fed

- The US Dollar pops higher after strong Durable Goods

- Fed Chairman Jerome Powell committed to a September interest-rate cut in its Jackson Hole speech.

- The US Dollar index trades above 100.00 with US data underway this week.

The US Dollar (USD) is trading in positive territory on Monday after very upbeat Durable Goods numbers. The US Dollar Index – which weighs the value of the US Dollar against a bucket of other currencies – shed 1.75% last week, with the latter part of those losses driven by US Federal Reserve (Fed) Chairman Jerome Powell’s words in Jackson Hole. Now that Powell has committed to a rate cut in September, markets could start to speculate over what this means for the Fed’s meeting in November and further down the line.

Concerns could already start to pick up on Monday as the economic calendar features the market-moving Durable Goods Orders numbers. Overall Orders came in very strong with a whopping 9.9% uptick for July. That was so strong and that far above consensus it overshadowed the downdard -6.9% revision, which is often more market moving than the actual number.

Daily digest market movers: Dust settles over Powell

- Tensions grew over the weekend between Israel and Hezbollah with several attacks from both sides.

- The United Kingdom is on a bank holiday this Monday, which means reduced flows during the European trading session.

- In the US economic calendar, the Durable Goods Orders data for July has come out strong:

- Headline Durable Goods Orders have rebounded 9.9%, which was more than double the 4% increase from the 6.7% plunge seen a month earlier. That plunge was revised even lower to 6.9%.

- Durable Goods without Transportation went from 0.1% to -0.2%.

- Revisions got overshadowed by the big beat on estimates on the actual number.

- Equities are softening into the Monday session with European equities marginally lower while US futures ares starting to tick up.

- The CME Fedwatch Tool shows a 61.5% chance of a 25 basis points (bps) interest rate cut by the Fed in September against a 38.5% chance for a 50 bps cut. Another 25 bps cut (if September is a 25 bps cut) is expected in November by 36.3%, while there is a 47.9% chance that rates will be 75 bps (25 bps + 50 bps) below the current levels and a 15.8% probability of rates being 100 (25 bps + 75 bps) basis points lower.

- The US 10-year benchmark rate trades at 3.81%, and ticks up from a fresh three-week low earlier.

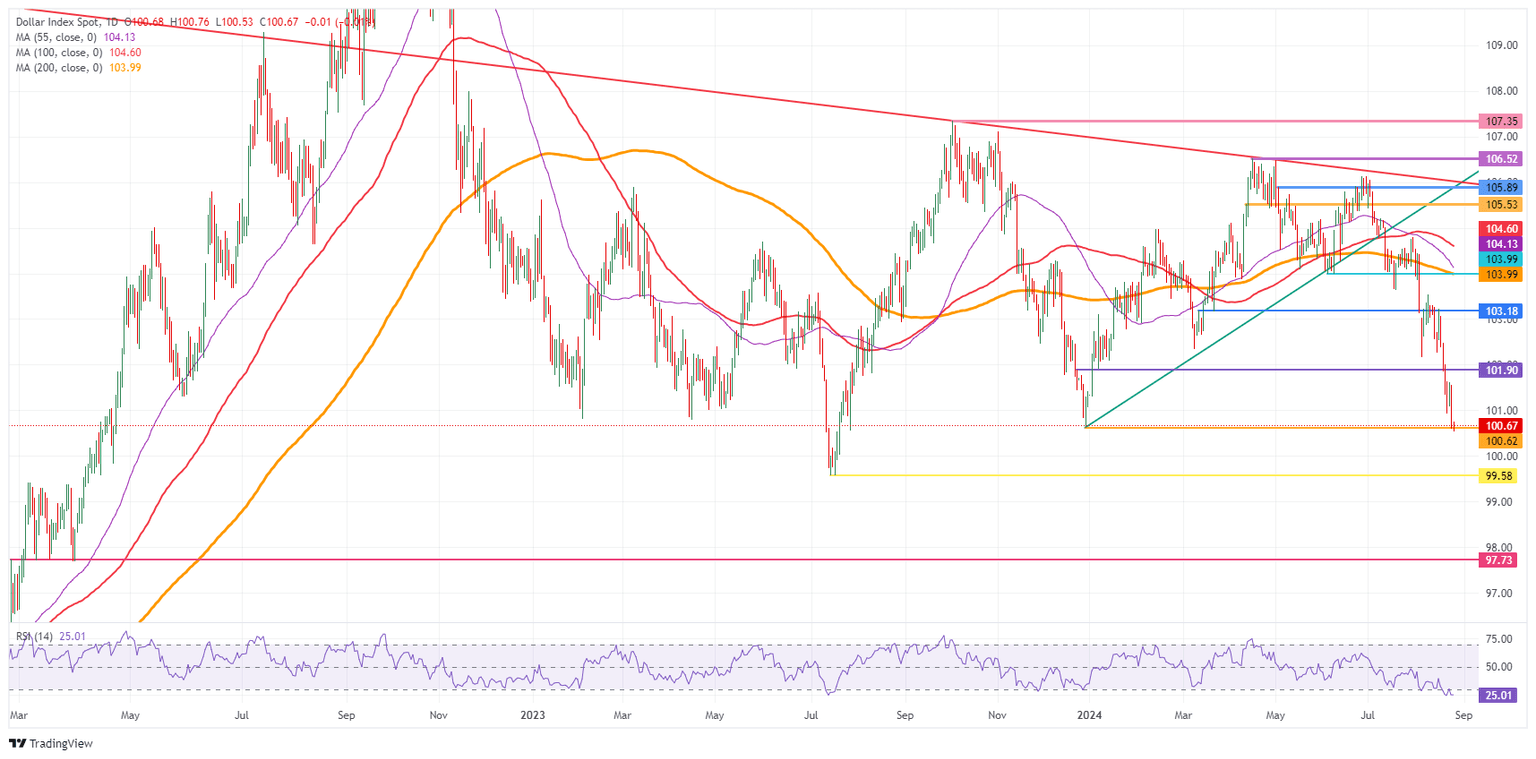

US Dollar Index Technical Analysis: Creeping up

The US Dollar Index (DXY) saw a substantial move lower last week, snapping several important support levels, as markets are pricing in aggressive rate cuts by November. Expectations could be going too far, as the Fed appears unlikely to start cutting by 50 bps or more in the current scenario of a soft landing for the US economy.

For a recovery, the DXY faces a long road ahead. First, 101.90 is the level to reclaim. A steep 2% uprising would be needed to get the index to 103.18 from the current 101.00. A very heavy resistance level near 104.00 not only holds a pivotal technical value, but it also bears the 200-day Simple Moving Average (SMA) as the second heavyweight to cap price action.

On the downside, 100.62 (the low from December 28) tries to hold support, although it looks rather feeble. Should it break, the low from July 14, 2023, at 99.58 will be the ultimate level to look out for. Once that level gives way, early levels from 2023 are coming in near 97.73.

US Dollar Index: Daily Chart

Banking crisis FAQs

The Banking Crisis of March 2023 occurred when three US-based banks with heavy exposure to the tech-sector and crypto suffered a spike in withdrawals that revealed severe weaknesses in their balance sheets, resulting in their insolvency. The most high profile of the banks was California-based Silicon Valley Bank (SVB) which experienced a surge in withdrawal requests due to a combination of customers fearing fallout from the FTX debacle, and substantially higher returns being offered elsewhere.

In order to fulfill the redemptions, Silicon Valley Bank had to sell its holdings of predominantly US Treasury bonds. Due to the rise in interest rates caused by the Federal Reserve’s rapid tightening measures, however, Treasury bonds had substantially fallen in value. The news that SVB had taken a $1.8B loss from the sale of its bonds triggered a panic and precipitated a full scale run on the bank that ended with the Federal Deposit Insurance Corporation (FDIC) having to take it over.The crisis spread to San-Francisco-based First Republic which ended up being rescued by a coordinated effort from a group of large US banks. On March 19, Credit Suisse in Switzerland fell foul after several years of poor performance and had to be taken over by UBS.

The Banking Crisis was negative for the US Dollar (USD) because it changed expectations about the future course of interest rates. Prior to the crisis investors had expected the Federal Reserve (Fed) to continue raising interest rates to combat persistently high inflation, however, once it became clear how much stress this was placing on the banking sector by devaluing bank holdings of US Treasury bonds, the expectation was the Fed would pause or even reverse its policy trajectory. Since higher interest rates are positive for the US Dollar, it fell as it discounted the possibility of a policy pivot.

The Banking Crisis was a bullish event for Gold. Firstly it benefited from demand due to its status as a safe-haven asset. Secondly, it led to investors expecting the Federal Reserve (Fed) to pause its aggressive rate-hiking policy, out of fear of the impact on the financial stability of the banking system – lower interest rate expectations reduced the opportunity cost of holding Gold. Thirdly, Gold, which is priced in US Dollars (XAU/USD), rose in value because the US Dollar weakened.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.