US Dollar Index struggles for direction around 96.20 ahead of NFP

- DXY looks for direction in the low-96.00s ahead of Payrolls.

- US yields remain on the rise supported by speculation of rate hikes.

- December’s Nonfarm Payrolls, Unemployment Rate next of relevance.

The greenback, when gauged by the US Dollar Index (DXY), trades within an inconclusive fashion around the 96.20/30 band at the end of the week.

US Dollar Index focuses on data, yields

The index fades Thursday’s modest advance and returns to the low-96.00s on Friday amidst rising cautiousness ahead of the publication of the key US labour market report for the month of December.

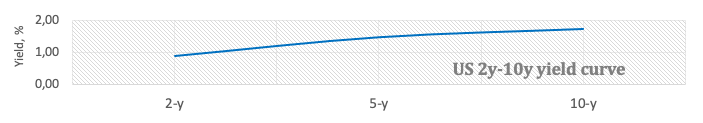

Once again, the US dollar continues to ignore the march higher in US yields, where the 2y note revisits levels last seen in early March 2020 past the 0.88% yardstick, the belly of the curve flirts with 10-month peaks above 1.75% and the 30y note advances to the area close to 2.10%, last traded in mid-October.

The index moved within a consolidative range following Monday’s uptick despite the bear steepening in US yields, the hawkish message from the FOMC Minutes and recent supportive Fedspeak (after St. Louis Fed J.Bullard suggested an interest rate hike as soon as in March), as investors appear vigilant ahead of the NFP figures due later on Friday.

On the latter, the economy is expected to have created 400K jobs during last month and the jobless rate to have ticked lower to 4.1%. Following this release, San Francisco Fed M.Daly (2024 voter, hawkish), Atlanta Fed R.Bostic (2024 voter) and Richmond Fed T.Barkin (2024 voter, centrist) are all due to speak.

What to look for around USD

The index trades in a cautious tone above the 96.00 hurdle, so far somewhat decoupled from the strong move higher in US yields, particularly following the hawkish message from the FOMC release (Wednesday). As markets slowly return to normality, the dollar’s constructive outlook is forecast to remain bolstered by the Fed’s intentions to hike the Fed Funds rates later in the year amidst persevering elevated inflation, supportive Fedspeak, higher yields and the solid performance of the US economy.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Start of the Fed’s tightening cycle. US-China trade conflict under the Biden’s administration. Debt ceiling issue. Potential geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is retreating 0.11% at 96.13 and a break above 96.46 (weekly top Jan.4) would open the door to 96.90 (weekly high Dec.15) and finally 96.93 (2021 high Nov.24). On the flip side, the next down barrier emerges at 95.57 (monthly low Dec.31) followed by 95.51 (weekly low Nov.30) and then 94.96 (weekly low Nov.15).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.