US Dollar Index Price Analysis: DXY drops to nine-week low as Biden addresses joint Congress

- DXY stands on the slippery ground near the lowest since February 26.

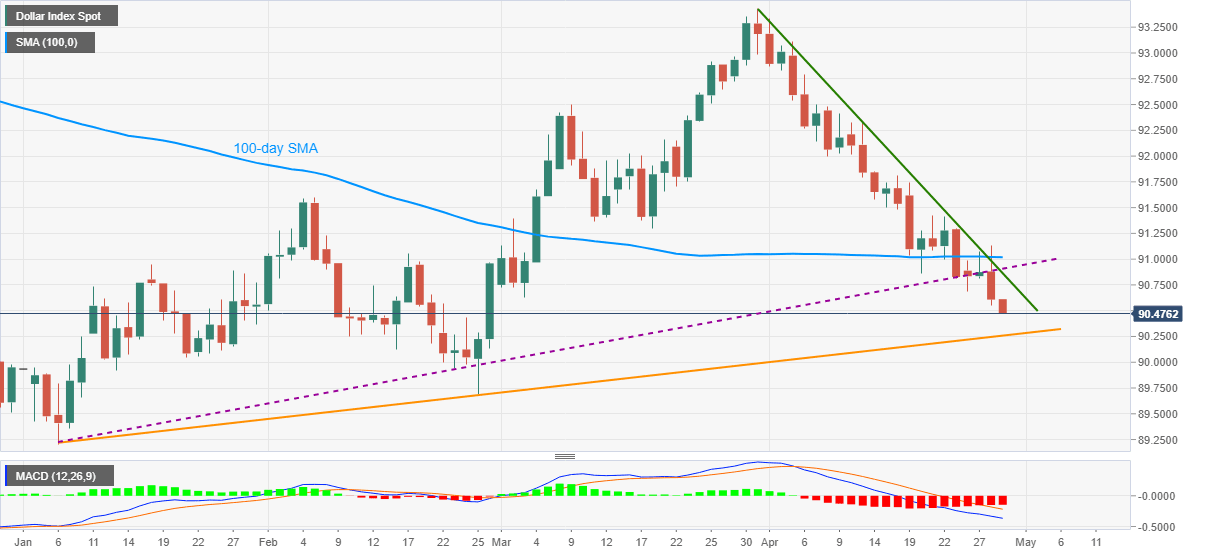

- Bearish MACD, sustained break of yearly support line and 100-day SMA favor sellers.

- An ascending trend line from January 06 is in the spotlight.

US dollar index (DXY) extends the Fed-led losses as US President Joe Biden speaks during early Thursday. The risk-on mood drags the greenback gauge towards refreshing the multi-day low, down 0.14% intraday near 90.48 by the press time.

Watch: Watch Live: President Biden's Joint Address to Congress

Not only fundamentals but the downside break of a short-term support line and 100-day SMA joins bearish MACD to also keep the DXY bears hopeful.

As a result, an ascending support line from early January, near 90.25, is on the sellers’ radar as the immediate target ahead of the 90.00 threshold.

If at all the dollar index drops below 90.00 round-figure, February’s low near 89.70 and the yearly bottom close to 89.20 should return to the charts.

On the flip side, the corrective pullback will have a tough time crossing the 90.85-90 resistance confluence, comprising the previous support line and a downward sloping trend line from March 31.

Also acting as an upside filter is the 100-day SMA level of 91.00 and multiple tops marked since mid-February around 91.05.

DXY daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.