US Dollar slumps below 103.00 as Fed rate-cut bets remain firm

- The US Dollar falls as investors seemed confident about the Fed reducing interest rates in September.

- Robust US Retail Sales growth and lower weekly Jobless Claims diminish the risks of a hard landing.

- Traders pare bets favoring a 50 basis point interest-rate cut by the Fed.

The US Dollar (USD) slips in Friday’s North American session after recovering from a 10-day low on Thursday. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, struggles to hold the recovery seen on Thursday and declines to near 102.75.

The asset faced selling pressure as investors remain confident that the Federal Reserve (Fed) will start reducing interest rates from the September meeting. However, market expectations that the Fed will begin its policy-easing cycle with an aggressive approach have been diminished significantly. Earlier, market participants started anticipating a 50-basis-point (bps) interest-rate reduction from the Fed in September amid worries that the US could enter a recession.

According to the CME FedWatch tool, 30-day Federal Funds Futures pricing data shows that the likelihood of a 50-bps interest-rate reduction has diminished to 29.5% from the 51% recorded a week ago. Firm speculation for Fed interest rate cuts in September has also weighed on bond yields. 10-year US Treasury yields slump to near 3.91%

Meanwhile, Fed policymakers have also admitted that interest rate cuts have become appropriate as risks have now widened to the labor market too. This week, Atlanta Fed Bank President Raphael Bostic said in an interview with the Financial Times (FT) that he is open to rate cuts in September. When asked about the rate cut size, Bostic said that he is comfortable with half a percentage point if the labor market deteriorates further.

Daily digest market movers: US Dollar remains on backfoot while Michigan Consumer Sentiment Index improves

- The US Dollar struggles to hold its Thursday's recovery that was driven by the upbeat United States (US) economic data, which ebbed traders’ fears about a recession.

- The data on Thursday showed that the US Retail Sales grew at a robust pace in July after contracting in June. Retail Sales, a key measure of consumer spending, rose strongly by 1% against expectations of 0.3%, diminishing fears of a hard landing.

- Also, fewer-than-expected Americans filing for jobless benefits for the first time for the second consecutive week indicated that labor market conditions are not as bad as they seemed after the release of the Nonfarm Payrolls (NFP) data for July. The US Department of Labor showed that Initial Jobless Claims came in at 227K, lower than estimates of 235K and the prior release of 234K.

- Meanwhile, the preliminary Michigan Consumer Sentiment Index (CSI) improved sharply to 67.8 from the estimates of 66.9 and the prior release of 66.4. The sentiment data exhibits consumers' expectations regarding the outlook of the economy.

- Going forward, investors will focus on Fed Chair Jerome Powell’s speech at the upcoming Jackson Hole (JH) symposium, which will be held from August 22-24. Fed Powell is expected to provide cues about the interest rate cut path as inflation remains on track to return to the desired rate of 2% and the labor market is not overheated anymore.

US Dollar Price Today:

US Dollar PRICE Today

The table below shows the percentage change of the US Dollar (USD) against listed major currencies today. The US Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.16% | -0.38% | -0.42% | -0.08% | -0.36% | -0.54% | -0.43% | |

| EUR | 0.16% | -0.23% | -0.25% | 0.05% | -0.23% | -0.51% | -0.25% | |

| GBP | 0.38% | 0.23% | -0.02% | 0.30% | 0.00% | -0.28% | -0.03% | |

| JPY | 0.42% | 0.25% | 0.02% | 0.38% | 0.05% | -0.23% | -0.02% | |

| CAD | 0.08% | -0.05% | -0.30% | -0.38% | -0.29% | -0.59% | -0.34% | |

| AUD | 0.36% | 0.23% | -0.01% | -0.05% | 0.29% | -0.28% | -0.05% | |

| NZD | 0.54% | 0.51% | 0.28% | 0.23% | 0.59% | 0.28% | 0.25% | |

| CHF | 0.43% | 0.25% | 0.03% | 0.02% | 0.34% | 0.05% | -0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Technical Forecast: US Dollar remains inside woods

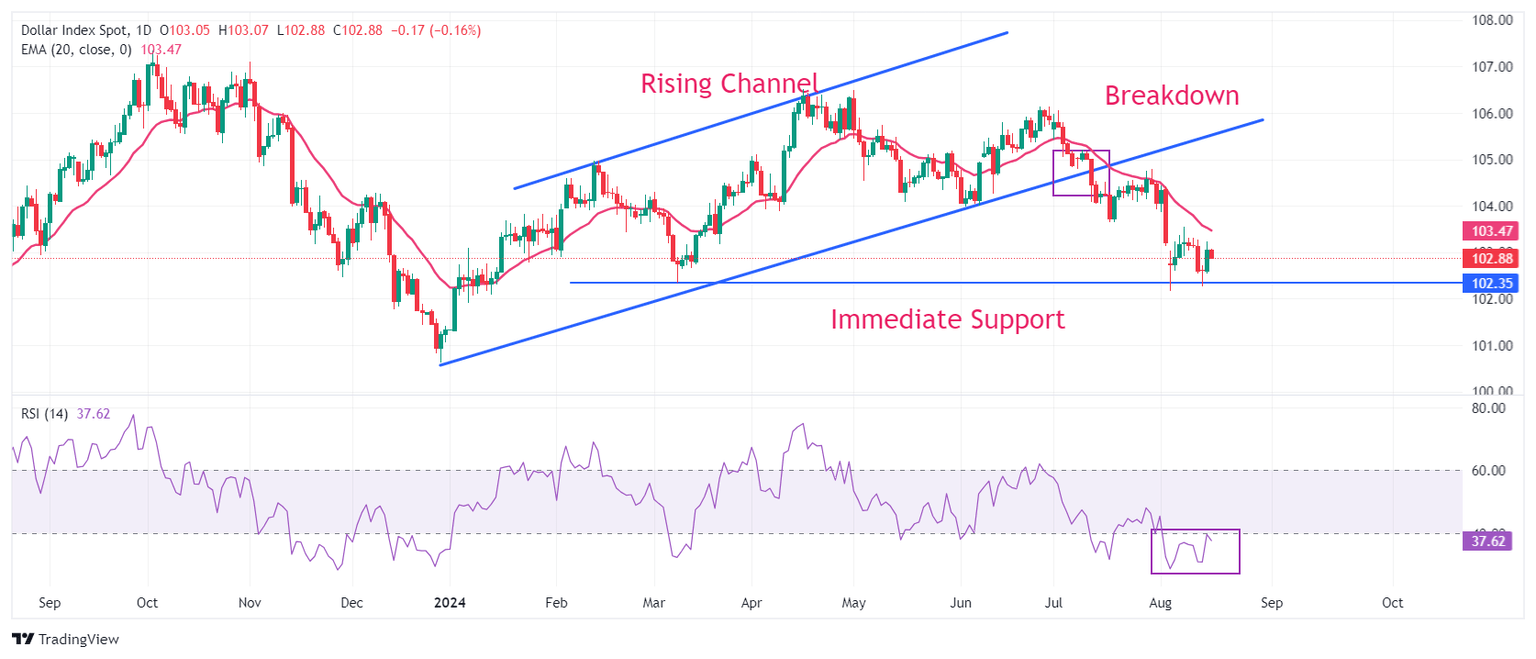

The US Dollar continues to form lower highs and lower lows since the breakdown of the Rising Channel formation on a daily time frame. The declining 20-day Exponential Moving Average (EMA) near 103.50 suggests that the near-term trend is bearish.

The 14-day Relative Strength Index (RSI) oscillates in the 20.00-40.00 range, indicating that the momentum leans strongly to the downside.

Looking down, the March 8 low at 102.35 and the psychological level of 102.00 are immediate support levels for the US Dollar. On the upside, the August 8 high at 103.54 and the June 4 low of 104.00 will act as major resistance for Greenback bulls.

Economic Indicator

Michigan Consumer Sentiment Index

The Michigan Consumer Sentiment Index, released on a monthly basis by the University of Michigan, is a survey gauging sentiment among consumers in the United States. The questions cover three broad areas: personal finances, business conditions and buying conditions. The data shows a picture of whether or not consumers are willing to spend money, a key factor as consumer spending is a major driver of the US economy. The University of Michigan survey has proven to be an accurate indicator of the future course of the US economy. The survey publishes a preliminary, mid-month reading and a final print at the end of the month. Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Last release: Fri Aug 16, 2024 14:00 (Prel)

Frequency: Monthly

Actual: 67.8

Consensus: 66.9

Previous: 66.4

Source: University of Michigan

Consumer exuberance can translate into greater spending and faster economic growth, implying a stronger labor market and a potential pick-up in inflation, helping turn the Fed hawkish. This survey’s popularity among analysts (mentioned more frequently than CB Consumer Confidence) is justified because the data here includes interviews conducted up to a day or two before the official release, making it a timely measure of consumer mood, but foremost because it gauges consumer attitudes on financial and income situations. Actual figures beating consensus tend to be USD bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.