US Dollar salvages earlier losses ahead of US session

- The US Dollar trades softer at the start of the week.

- The Greenback continues eking out losses after Friday’s turmoil.

- The US Dollar index trades on the brink of entering the 101-region and might face more downside.

The US Dollar (USD) trades substantially softer this Monday, touching its lowest level since mid-January, mainly driven by a more than 1% appreciation of the Japanese Yen (JPY) against the Greenback. . The Commodity Futures Trading Commission (CFTC) reported on Friday that hedge funds are net long on the Japanese Yen, and Asian and European investors seem to follow through on Monday. . As the Japanese Yen accounts for 13.6% of the US Dollar Index (DXY), the rise weighs on the index’s performance this Monday, pushing it to lows not seen in roughly seven months.

On the economic data front, a rather soft start for the data this week where all eyes will be on Wyoming at the end of the week for the annual US Federal Reserve’s Jackson Hole Symposium. The event will have the crème-de-la-crème of central bankers speaking, including Fed Chairman Jerome Powell, and is known for being the occasion for the Fed to signal a change in monetary policy outside of its scheduled meetings. In the run-up to that event, several headlines will come out from other central bankers, and the US Purchasing Managers Index (PMI) data on Thursday will give the latest insights about the state of the economy.

Daily digest market movers: Stand still towards Friday

- President of the Federal Reserve Bank of Minneapolis Neel Kashkari said to the Wall Street Journal that inflation is making progress.

- The Commodity Futures Trading Commission (CFTC) issued on Friday its weekly holding of speculative and non-speculative positions in currency futures markets. The report revealed that hedge funds are net long JPY for the first time since 2021.

- This week kicks off with comments from Federal Reserve Governor Christopher Waller, who delivers welcoming remarks at the 2024 Summer Workshop on Money, Banking, Payments, and Finance in Washington, D.C at 13:15 GMT.

- The US Treasury is allocating a short-term 3-month and 6-month bill at 15:30 GMT.

- Asian equity markets are mixed, with Chinese indices up nearly 1%, while Japanese equities are sliding over 1% lower. European equities are also looking for direction while US futures are trading flat.

- The CME Fedwatch Tool shows a 72% chance of a 25 basis points (bps) interest rate cut by the Fed in September against a 28% chance for a 50 bps cut. Another 25 bps cut (if September is a 25 bps cut) is expected in November by 53.7%, while there is a 39.2% chance that rates will be 75 bps below the current levels and a 7.1% probability of rates being 100 basis points lower.

- The US 10-year benchmark rate trades at 3.86% and is looking for direction after last week’s dip.

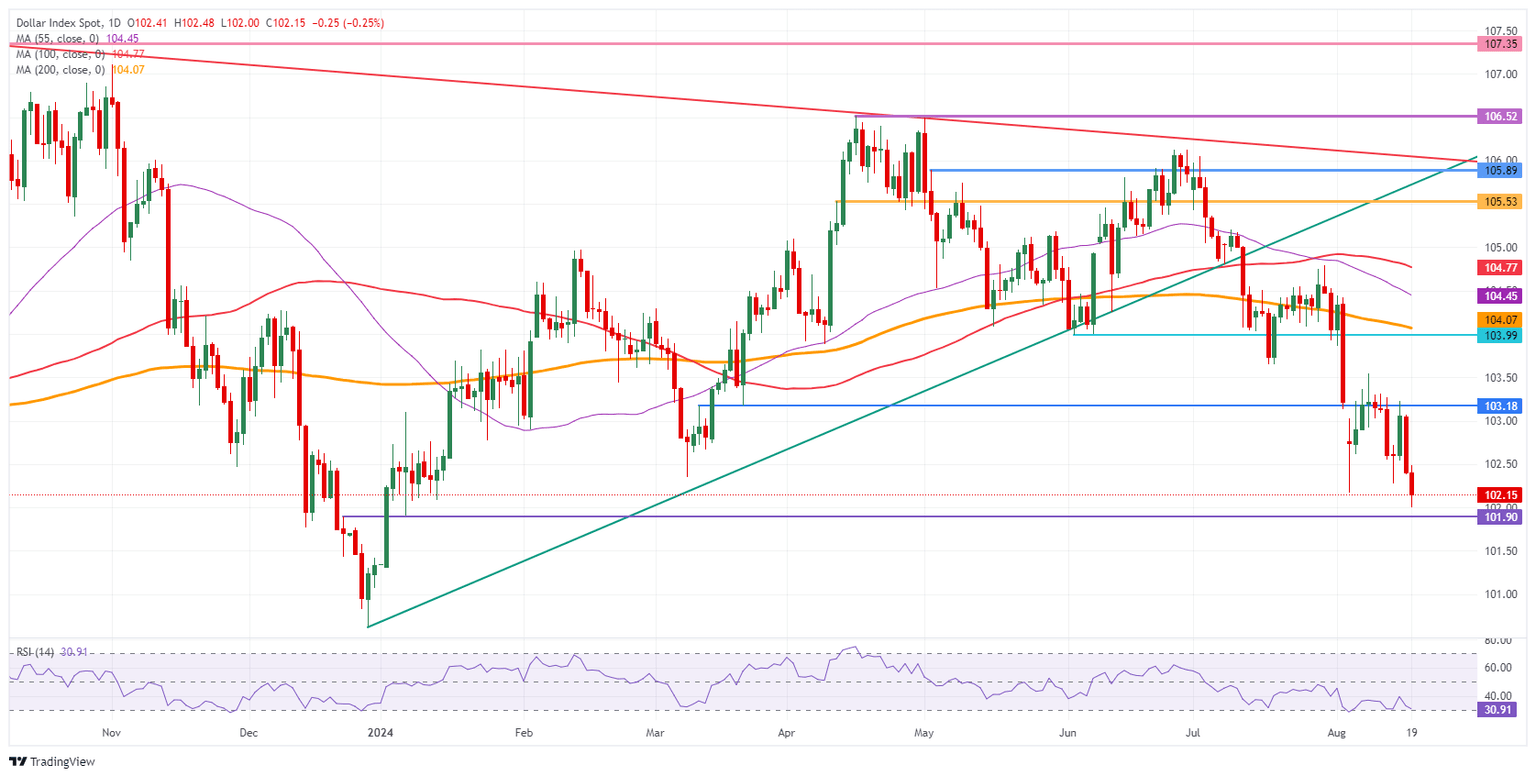

US Dollar Index Technical Analysis: Hedge fund positioning sign on the wall

The US Dollar Index (DXY) looks very bleak, and chances of recovery seem low. With this new information from the CFTC, traders have to ask themselves where they see the DXY heading to, considering that hedge funds will not pile into a currency on the back of some feeble belief.

Hedge funds are always in it to sit on their positions until their earnings projection is met. Seeing that this is just the beginning, and with more and more hedge funds and traders possibly joining this trade, the US Dollar could be set to bleed further. This could mean more downside, and then that 100-level might be showing up quicker than expected.

Defining pivotal levels becomes very important in order to avoid any “dead-cat bounces,” in which traders pile in too quickly in a trade and get caught on the wrong side of the fence once the course reverses. First up is 103.18, a level that traders were unable to hold last week. Next up, a heavy resistance level is at 103.99-104.00, and inches above there is the 200-day Simple Moving Average (SMA) at 104.07.

On the downside, the first immediate support comes up at the 101.90 level if prices breach below 102.00. Levels not seen since early January are popping up, and even a fresh yearly low could come into play once the DXY dips below 101.30 (low from January 2). The low of December 28 at 100.62 will be the ultimate level to look out for.

US Dollar Index: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.