US Dollar flat with extreme moves in several currencies after Trump threatens to issue more tariffs

- The US Dollar shakes up markets after President-elect Trump announced more tariff measures.

- Markets are heading left to right this Tuesday with European and Asian equities in red numbers.

- The US Dollar Index softens to 106.80, despite the Canadian Dollar, Mexican Peso and Chinese Yuan as main losers against the Greenback.

The US Dollar (USD) is rippling through markets on Tuesday after President-elect Donald Trump communicated on his social media channel that his government will issue an additional 25% tariff on imports from Canada and Mexico, with an additional 10% to the 60% already announced during his election campaign on Chinese goods. Markets are not doing well with this communication, as equities are printing red numbers across the board and the globe while US bond prices are dropping (yields are soaring).

The US economic calendar will show some housing data on Tuesday. With the Housing Price Index for September and the New Home Sales data for October, markets will be able to see if the housing market in the US is cooling down as the last piece that was driving inflation. At the end of the day, the Federal Reserve (Fed) publishes the Minutes of its November 7 meeting.

Daily digest market movers: Housing Inflation sticky

- The monthly Housing Price Index for September came in stronger at 0.7% for September against the previous 0.4% from August.

- At 15:00 GMT, the November Conference Board Consumer Confidence is due to come out, though no forecast is available with the previous reading at 108.70.

- At 15:00 GMT, New Home Sales data for October is expected to show a slide to 0.73 million units against 0.738 million previously.

- The Richmond Fed Manufacturing Index for November will be released at 15:00 GMT as well. The expectation is for a contraction of -10, less severe than the -14 previously.

- At 19:00 GMT, traders can look for clues about the December rate cut expectations in the release of the Fed’s Federal Open Market Committee (FOMC) Minutes for the November meeting.

- Equities are depressed across the board, with losses across Japan, China, Europe. Most losses remain contained to less than 1% on average. US equity futures are breaking the negative tone and are positive for this Tuesday.

- The CME FedWatch Tool is pricing in another 25 basis points (bps) rate cut by the Fed at the December 18 meeting by 59.6%. A 40.4% chance is for rates to remain unchanged.

- The US 10-year benchmark rate trades at 4.29%, substantially lower from the high printed two weeks ago of 4.50% on November 15.

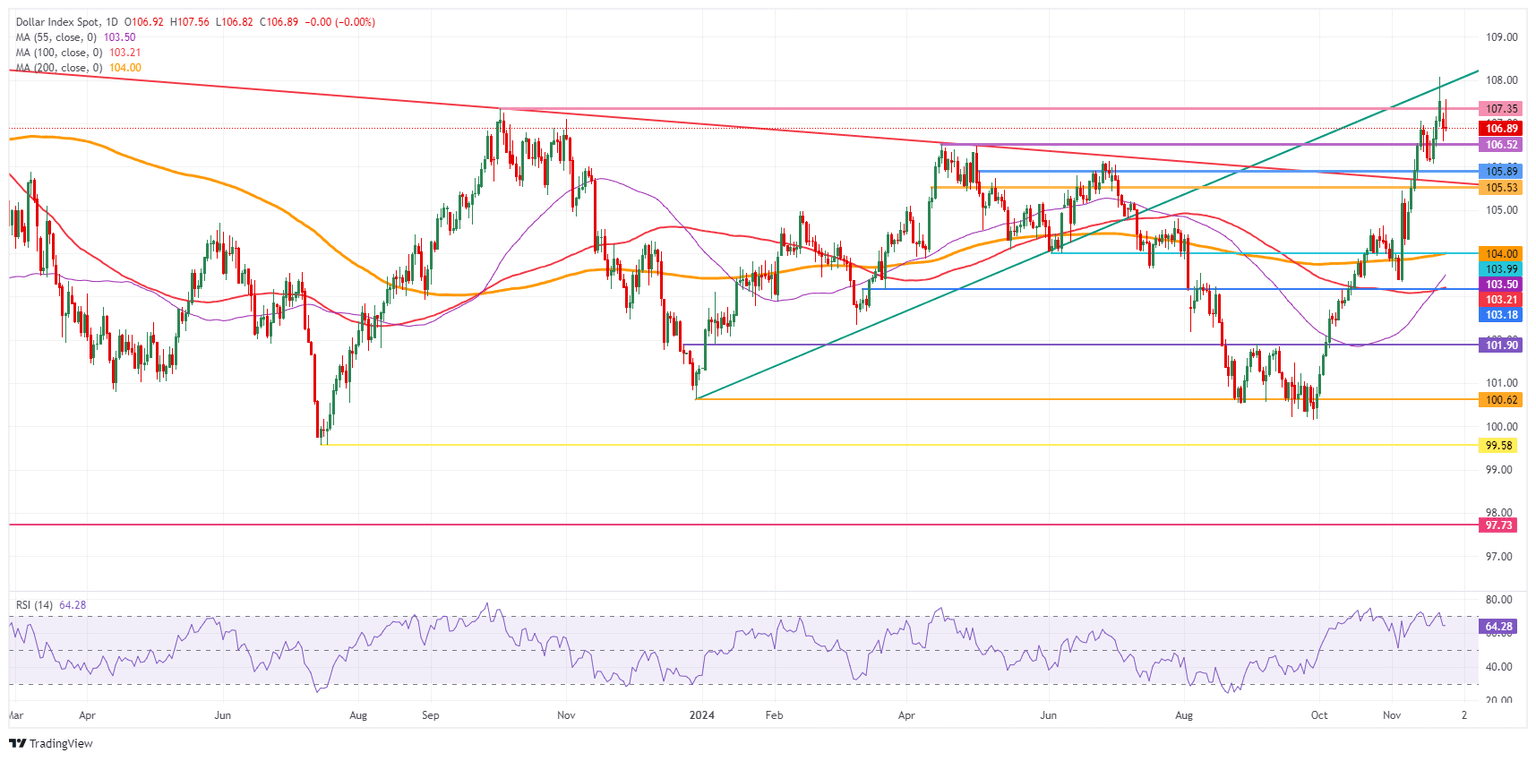

US Dollar Index Technical Analysis: Torn between two forces

The US Dollar Index (DXY) is going the other way as one would expect, after comments from President-elect Donald Trump imposing even more tariffs on neighbours Canada, Mexico, and the usual suspect China. The weaker Canadian Dollar (CAD) component is being offset by a stronger Euro (EUR) and Swedish Krona (SEK).

The DXY does not really reflect what is actually taking place in the targeted countries. Hence, the muted reaction in the US Dollar Index does not seem to break out in a way on the back of this tariff announcement.

The fresh two-year high at 108.07 seen on Friday is the first level to beat. Further up, the 109.00 big figure level is the next one in line. The support from October 2023 at 109.36 is certainly a level to watch out for on the topside.

Support comes in around 106.52, the double top from May. A touch lower, the pivotal 105.53 (April 11 high) should avoid any downturns towards 104.00. Should the DXY fall all the way towards 104.00, the big figure and the 200-day Simple Moving Average at 103.98 should catch any falling knife formation.

US Dollar Index: Daily Chart

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.