Tesla Stock News and Forecast: TSLA stock set to resume fall and test $800

- Tesla stock is set to open lower on Monday.

- TSLA stock will likely test $800 on more geopolitical tensions.

- Lucid Group reports earnings after the close on Monday.

Tesla (TSLA) shares look set to open lower on Monday as Russia Ukraine headlines continue to set the global financial markets narrative. It is hard to avoid the dominance despite what some might say are mildly positive signs for the electric vehicle leader.

Tesla Stock News

Cathie Wood has begun buying the dip in Tesla and took in another $3 million worth of Tesla stock on Friday. Despite this, Tesla shares are looking like they will open some 1% lower on Monday with Tesla currently at $802.83 in Monday's premarket. This would not be as bad as feared given the significant losses in European markets this morning. The German Dax is down nearly 2.5%, and the Eurostoxx 50 is down over 3%. Forecasting on a micro-level is being overpowered by the Russia-Ukraine conflict, so look for headlines here for future direction. Tesla is high beta and considered one of the riskier assets. Currently, we are in extreme risk-off mode across global financial markets. This has led to a surge in the dollar and gold, traditional safe-havens. Keep an eye on these assets and geopolitical headlines for the more meaningful directional queues.

Tesla Stock Forecast

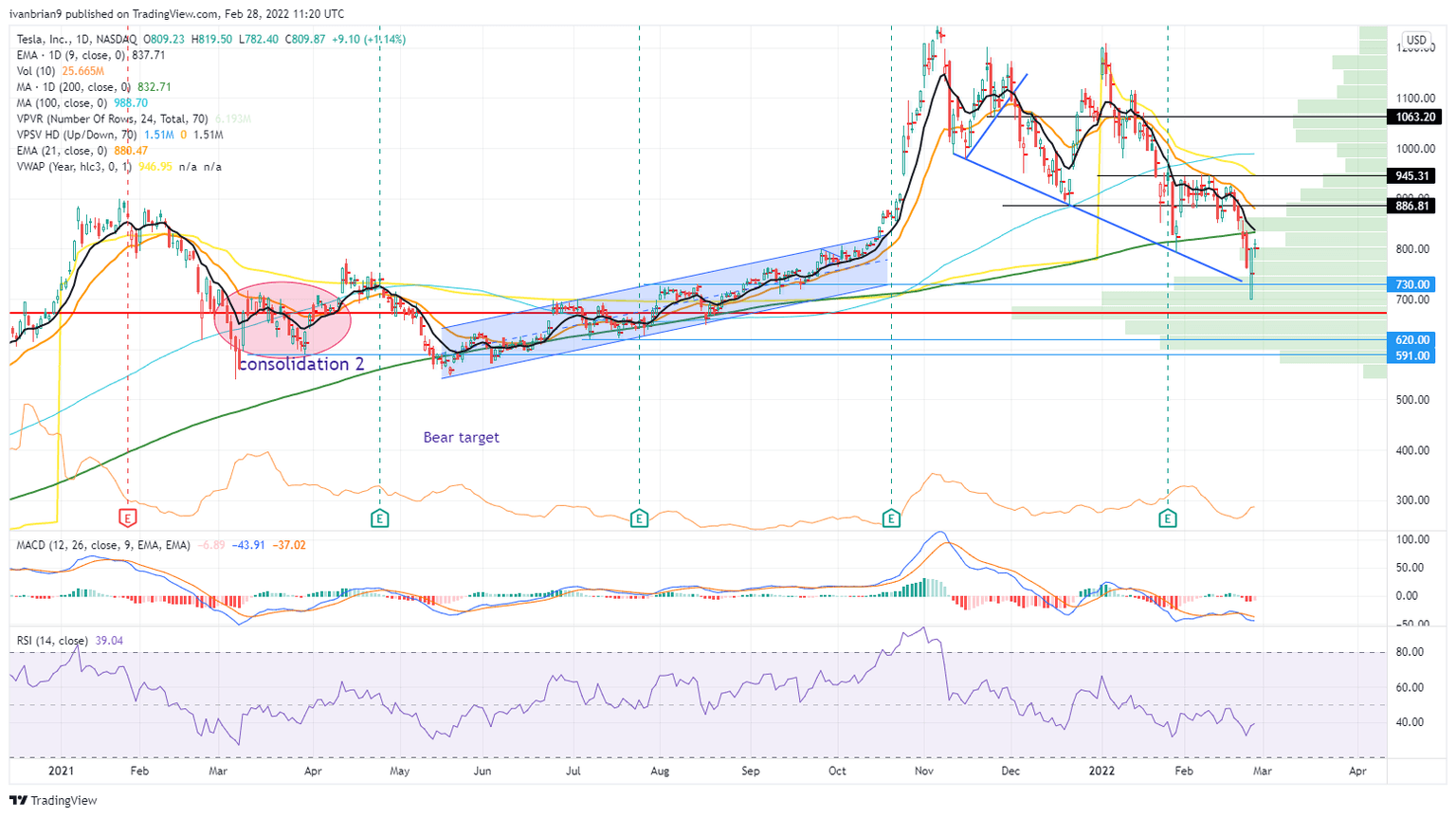

Looking back with the benefit of hindsight, the repeated failure to break above $945 set up the technical picture for the recent falls. Tesla stock has now cleanly broken below the 200-day moving average, a feat it has not managed since June of last year. Back then it was a brief flirtation as it retook the 200-day the very next day. This time the case is different and could lead to long-term pressure on TSLA. $730 was briefly broken on Friday, but this level is significant and a close below will set stop losses in play most likely. The 9-day moving average is about to cross the 200-day, again significant as this has not happened in Tesla since October 2019.

Tesla (TSLA) chart, 1-day chart

From the weekly chart, we can see breaking and holding below $730 takes Tesla back to the consolidation phase from March and April of last year. This is a neat range between $700 and $600. That may hold Tesla stock for a time, but the bears will target $400 if they can push Tesla out of the support at $600. This is the consolidation phase from September and October 2020.

Tesla chart, weekly

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.