- Sundial Growers (SNDL) reports Q4 results, revenue missed expectations.

- SNDL shares turn lower, conference call wraps up.

- SNDL shares trending heavily as usual on social media.

Update: Sundial SNDL shares turned lower rom early highs during the morning as traders took some profits on the recent run and seemed not to be impressed with the conference call. Shares in Sundial have retreated from a session high of $1.68 to $1.55 at the time of writing. The conference call mentioned challenges with market share due to new participants in Canada, improvements to its potency, and no discussion on SPAC possibility with SAF Group JV for now.

Sundial Growers (SNDL) released Q4 2020 results on Wednesday, March 17 after the close. Revenue missed Refinitiv expectations coming in at C$13.9 million versus C$15.1 million.

Sundial is a Canadian cannabis company headquartered in Alberta, listed on the Nasdaq.

SNDL Stock news

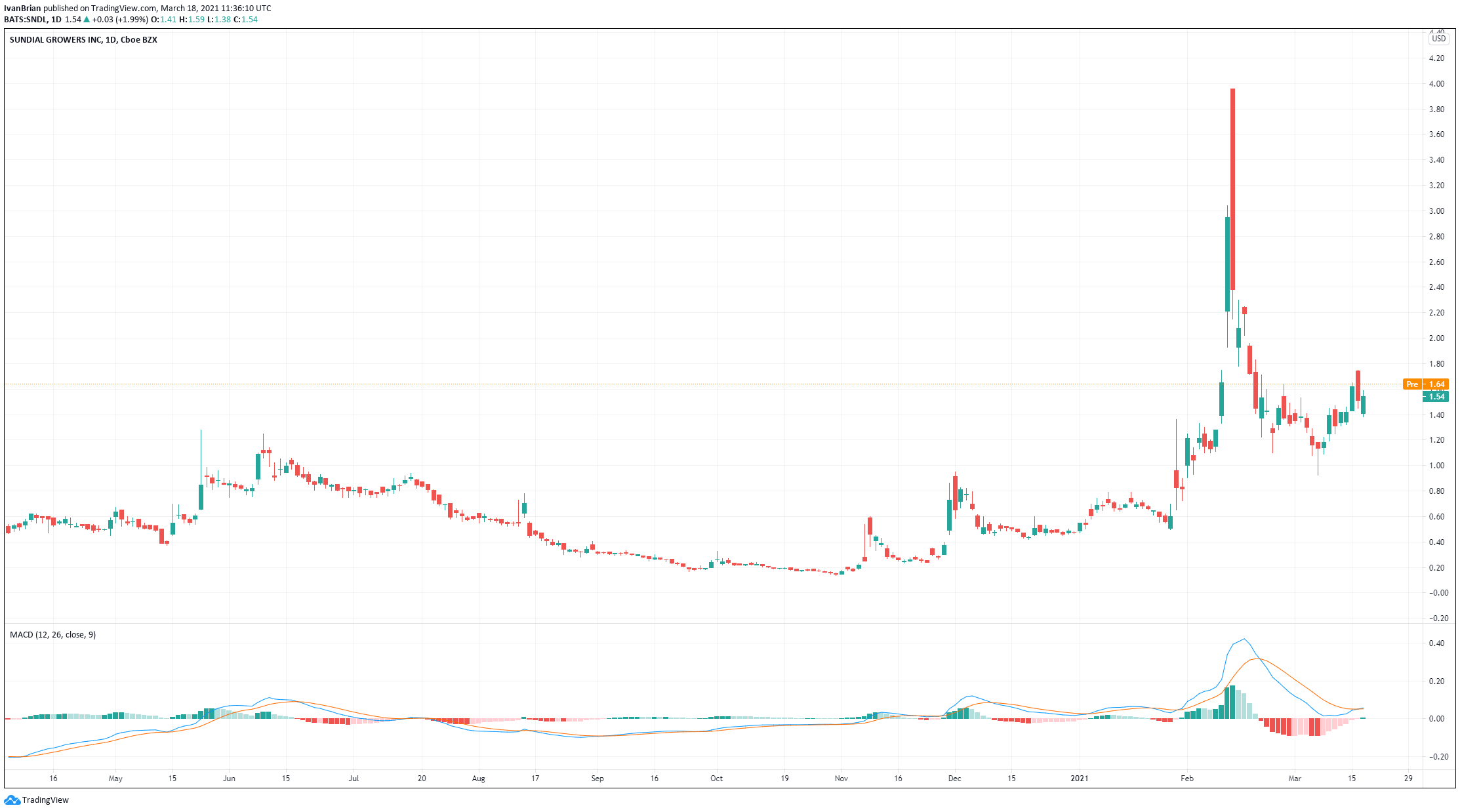

Sundial has been one of the retail meme stocks for 2021 and shares have been volatile but overall strong for 2021, with a gain of over 200%. Sundial and SAF Group announced a joint venture on Monday which has been a feature of the cannabis sector lately, either JV's or mergers acquisitions, etc. As the US cannabis opens up to legalization there are opportunities for well-placed, established companies and bolt-on acquisitions are a distinct possibility. This has underpinned cannabis stocks in 2021.

In February a number of small acquisitions were inked in the cannabis space as companies look to take advantage of a new area in cannabis legislation and legalization. This is likely to continue in the short to near term. Sundial has been raising capital to fund growth opportunities, recently filing for a $1 billion mixed shelf offering. In early February Sundial received US$74.5 million for a registered offering and Sundial announced it had unrestricted cash of C$610 million!

However, it should be noted that Sundial is still loss-making and is valued at a $2.8 billion market cap. This for a company with quarterly revenues of less than C$14 million. so the traditional valuation metrics look a little shaky. Ok, so most of those valuations have gone out the window so far in 2021 but given Sundials statement in Feb that it has $610 million in cash and securities of a further C$61 million the rating doesn't look quite as high, excuse the pun!

In comparison to its peers though Sundial still looks too high. A market cap of $2.8 billion versus revenue of C$77 million. Aurora Cannabis has a market cap of $1.9 billion on revenue of C$283 million, data from Refinitiv.

Overall valuation looks stretched in terms of long-term investment but short-term traders aren't really looking at that they are looking for quick trends to profit from.

Here though the situation looks also bearish. The huge spike in early February stopped just short of $4. Since then SNDL shares have slid back to currently trade at $1.60. A stabilization around the current price will lead to the formation of a bearish head and shoulders, with the target on breakout somewhere around $$0.60. In order to avoid this scenario SNDL shares need to breach the recent high and break above $2.

Every effort has been made to accurately report the appropriate dollar currency US$ or CAD$. But readers must exercise caution as Sundial is a Canadian company reporting in CAD, listed in the US Nasdaq exchange, but news providers typically convert into $US for earnings comparisons. In some cases, it is not clear in reports from news providers and Sundial which dollar CAD or US is being reported as just the $ symbol is used. For the most part, Sundial does specify CAD$ in press releases unless otherwise stated and this assumption is used in statements above re cash reserves.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays depressed near 1.0650, awaits US data and Fed verdict

EUR/USD holds lower ground near 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD keeps losses below 1.2500 ahead of US data, Fed

GBP/USD holds lower ground below 1.2500 early Wednesday. The stronger US Dollar supports the downtick of the pair amid the cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.