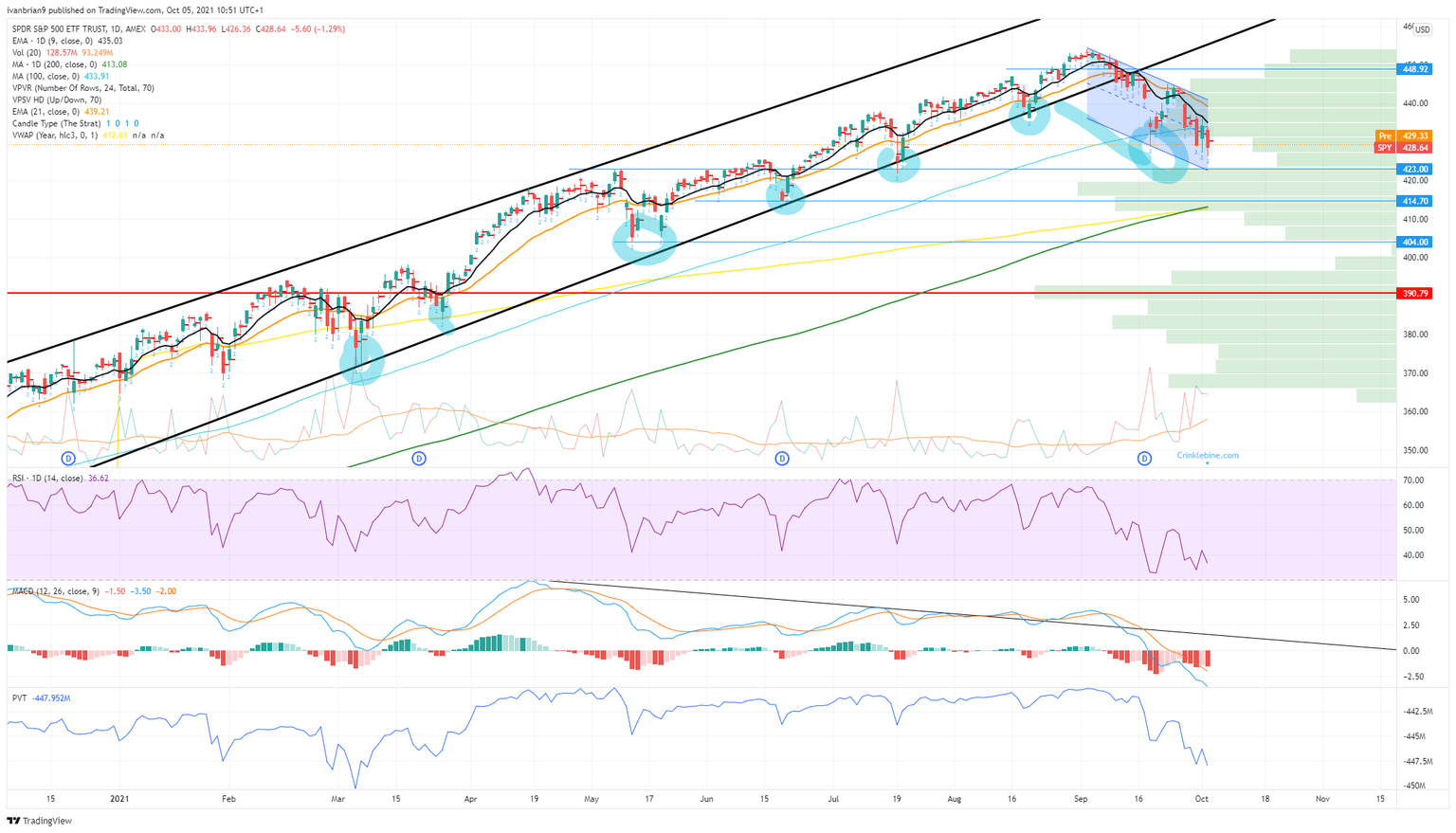

SPDR S&P 500 ETF Trust (SPY) News and Forecast: Is it time to buy SPY?

- SPY keeps on sliding as bears in control.

- Yields remain in focus as inflation concerns heat up.

- Fed may look to taper sooner and put a rate hike plan in place.

The S&P 500 (SPY) remains stuck in a downward spiral that has been set solidly in place for most of September, and so far October is not proving any easier for investors. Monday is never a particularly bullish day for stock markets, and readers old enough will remember Black Monday from 1987. Ok, so most of you won't, but it was bad! Anyway, enough rambling, but Monday kept things bearish with the main indices all closing lower and the SPY closing down 1.29% to $428.64. Once again it was the Nasdaq that led the way by losing over 2% while the small caps continue to outperform with the Russell 2000 Exchange Traded Fund (IWM) closing less than 1% lower.

The rotation out of big tech and Nasdaq names has been a feature of the recent sell-off as investors keep a watchful eye on yields and hawkish comments from central bankers. Recent inflation data from Europe and the US has not been helpful with EU inflation hitting a 30-year high, energy costs soaring in Europe leading to government interference, while in the US the Fed's favorite measure of inflation just hit a 30-year high last week.

SPY 15-minute chart

SPY stock news

The latest data from Europe is not exactly reassuring on the inflation front with Producer Prices surging by 13.4% YoY. Inflation it would appear is here, and it is not transitory as central bankers had hoped.

SPY stock forecast

Monday's move continued the steady trend lower, taking out the low from Friday. No sign of a bounce yet though, and we remain with our extended dip buy zone at $415. This is a nice support zone in our view with a confluence of support from the 200-day moving average and the yearly Volume Weighted Average Price (VWAP). The volume profile bars are also quite strong down at this level, meaning more support. This only takes the SPY back to levels see in June, so it is not exactly a stretched view.

We remain bearish below $436, turning neutral above.

FXStreet View: Bearish, neutral above $436.

FXSTreet Ideas: Buy the dip at $415 as mentioned, stong support from the 200-day moving average and a lot of voume at this level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.

-637690238795893490.png&w=1536&q=95)