S&P 500 Index Weekly Forecast: Stocks struggle for momentum as Fed-backed stimulus traders fight bond market bullies

- Inflation concerns are likely to keep investors' focus for the week ahead.

- Equities stage a modest recovery on Friday after Thursday’s thrashing.

- Fed Chair Jerome Powell on the wires throughout next week.

Equity markets are finishing out the week with mixed feelings after a solid thrashing on Thursday. This led to profit-taking ahead of the weekend on Friday, coupled with some rebalancing action to give stability to the session. It felt a lot worse than the actual scorecard shows but the S&P 500 dropped 0.77% for the week, while the Nasdaq fell 0.79% and the Dow dropped 0.46% on the week. Energy stocks suffered the most as oil dragged the sector lower with a 7.5% weekly fall, followed by Tech down 1%. Health and Real estate were just about positive for the week.

Stay up to speed with hot stocks' news!

The week had seemed to be moving along nicely with all major indices smashing records post-Powell, however, the bond and currency markets intervened to dampen equity investors' enthusiasm.

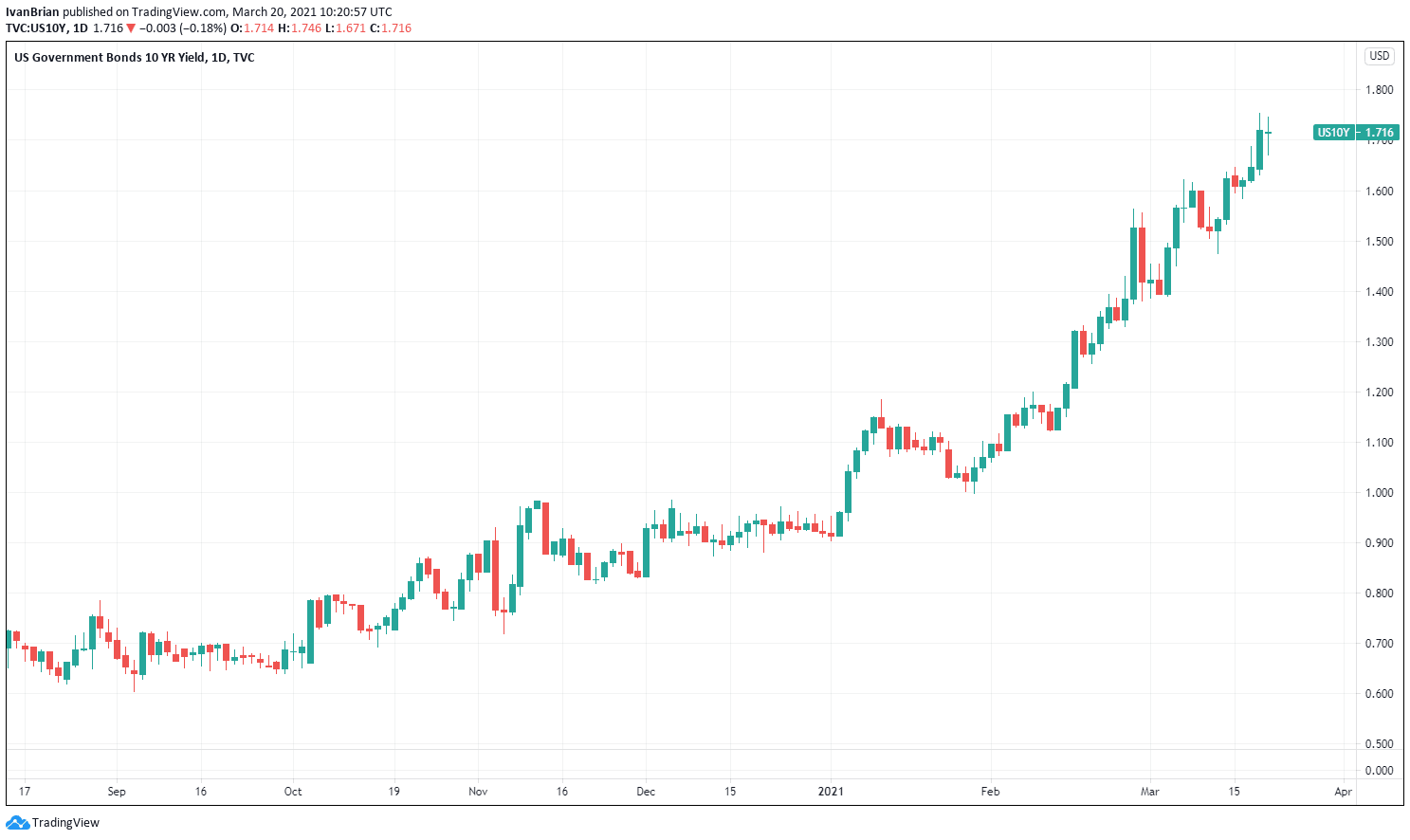

The US 10-year Treasury shot to new highs while the dollar strengthened against all opponents, breaching 1.19 before giving up some ground on Friday.

The chart makes for a sobering reading showing the US 10-year Treasury yield nearly doubling this year alone.

Oil took a hammering as the front-month cheapened versus longer-dated deliveries (known as contango) meaning traders could buy for cheap and store Oil at higher prices. OPEC+ in February, a stronger dollar, higher US oil reserves, and fears over European demand due to virus control also weighed on oil prices. WTI crashed nearly 8% on Thursday, below $60 before staging a rebound to $61.50 on Friday.

S&P 500 Week Ahead

Fed Chair Jerome Powell is out and about giving multiple speeches during the week which will be closely watched.

On Monday, Powell speaks at a BIS Summit at 1300 GMT.

Monday also sees Richmond Fed President Thomas Barkin speak at 1430 GMT.

Tuesday and Wednesday see Powell testify before the House Financial Services Committee at 1600 GMT Tuesday and 1400 GMT Wednesday.

All that talking takes a lot out of you so later on for Wednesday and most of Thursday the baton is handed over to Fed of New York President John Williams.

Russian Foreign foreign Minister Sergei Lavrov will visit China on Monday.

On Tuesday, we have a US 2-year note auction that takes on added significance in the current environment.

Wednesday gives us a US 5-year auction and Durable Goods goods orders for February, expecting a 1% rise.

On Thursday, the European Council meets in a full-day event so keep an eye for random headlines and statements.

Thursday also sees US Jobless Claims claims expected to be 770k but looking for signs of improvement.

Facebook, Google, and Twitter CEO’s to testify before the US House of Representatives on Thursday.

Friday sees German IFO Business Sentiment Index in the morning while later we get the US trade balance. This will likely be horrible so watch the dollar for direction on this. Consumer spending data will also be watched for signs of recovery.

University of Michigan Inflation Expectation is the other big release for Friday, expected to come in at 83.5.

Earnings due

Monday sees Tencent report an expected rise in Q4 revenue.

Tuesday will be the big one for retail fans as Gamestop releases Q4 2020 results. Investors will be looking for more clarity on the shift into digital commerce and any possibility of a capital raise.

Adobe also reports on Tuesday.

Jefferies reports on Wednesday along with General Mills.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.