Silver Price Forecast: XAG/USD declines below $29.40 as US Dollar rebounds

- Silver price slides below $29.40 as the US Dollar bounces back.

- Fed Bowman sees interest rates remaining at their current levels this year.

- Investors await the US core PCE inflation for fresh guidance.

Silver price (XAG/USD) slumps below lower end of Monday’s trading range near $29.40 in Tuesday’s New York session. The white metal faces selling pressure as the US Dollar (USD) has bounced back strongly after correcting on Monday. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rebounds from 105.40.

The US Dollar recovers as investors become doubtful over the Federal Reserve’s (Fed) interest rate outlook. Currently, financial markets expect that the Fed will start reducing interest rates from the September meeting and subsequent rate cuts will be announced in the November or December meeting.

However, Fed policymakers argue in favor of maintaining interest rates at their current levels until they see inflation declining for months. In Tuesday’s New York session, Fed Governor Michelle Bowman said in an interview that she doesn't see any rate cut this year. Bowman added that rate cuts at this point are inappropriate, and the option of more rate hikes remains on the table if progress in the disinflation process appears to stall or reverse in the future.

Going forward, investors will focus on the United States (US) core Personal Consumption Expenditure Price Index (PCE) for May, which will be published on Friday. The core PCE price index data is the Fed’s preferred inflation measure, and it will provide fresh cues on when and how much the central bank will reduce interest rates this year.

Silver technical analysis

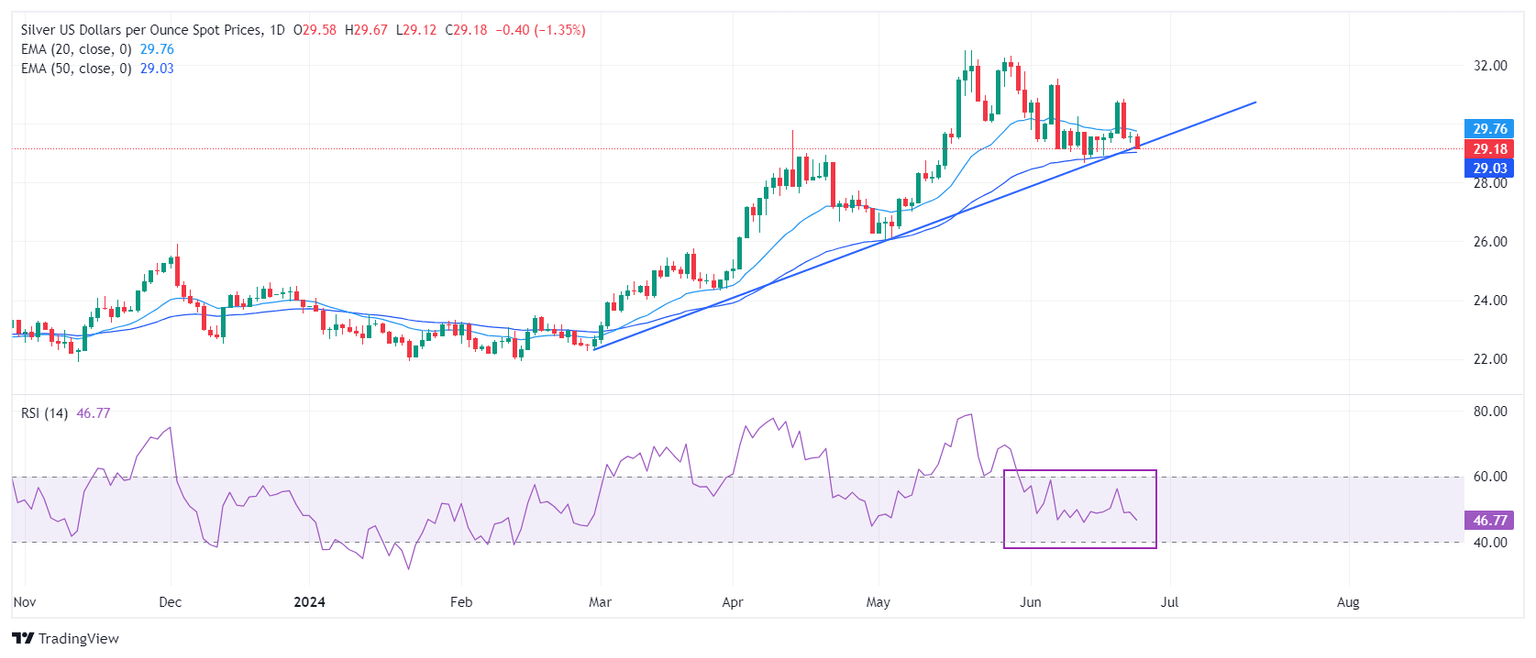

Silver price declines to near upward-sloping trendline plotted from February 29 low at $22.30 plotted on a daily timeframe. The asset corrects to near 50-day Exponential Moving Average (EMA) around $29.00. Sideways 20- and 50-day Exponential Moving Averages (EMAs) indicate a consolidation ahead.

The 14-day Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, suggesting indecisiveness among investors.

Silver daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.