Silver Price Forecast: XAG/USD retreats to $29 as Fed officials advocates only one rate-cut this year

- Silver price falls after a less-confident pullback move as US bond yields recover.

- US yields recover as Fed advocates only one rate-cut this year.

- Investors await the US Retail Sales data for fresh cues on interest rates.

Silver price (XAG/USD) falls back to the crucial support of $29.00 in Monday’s European session after a short-lived pullback to near $29.60. The white metal comes under pressure as US bond yields rebound. 10-year US Treasury yields recover to near 4.24% as Federal Reserve (Fed) officials continue to argue in favor of reducing interest rates only one this year.

Higher yields on interest-bearing assets increase the opportunity cost of holding an investment in non-yielding assets, such as Silver.

On Friday, Chicago Fed Bank President Austan Goolsbee said that cooler consumer and producer inflation reports for May have relieved him. However, he wants to see similar data for months before lowering interest rates.

This weekend, Minneapolis Fed Bank President Neel Kashkari said it’s a "reasonable prediction" that the central bank will cut interest rates once this year and wait until December to do so.

Contrary to Fed officials’ verdict, investors expect that the Fed will deliver two rate cuts this year one in September and next in November or December’s meeting.

Meanwhile, the US Dollar Index (DXY) holds gains near a six-week high around 105.80. Going forward, investors will focus on the United States (US) monthly Retail Sales data for May, which will be published on Tuesday. The Retail Sales data is estimated to have grown by 0.3% after remaining flat in April.

Silver technical analysis

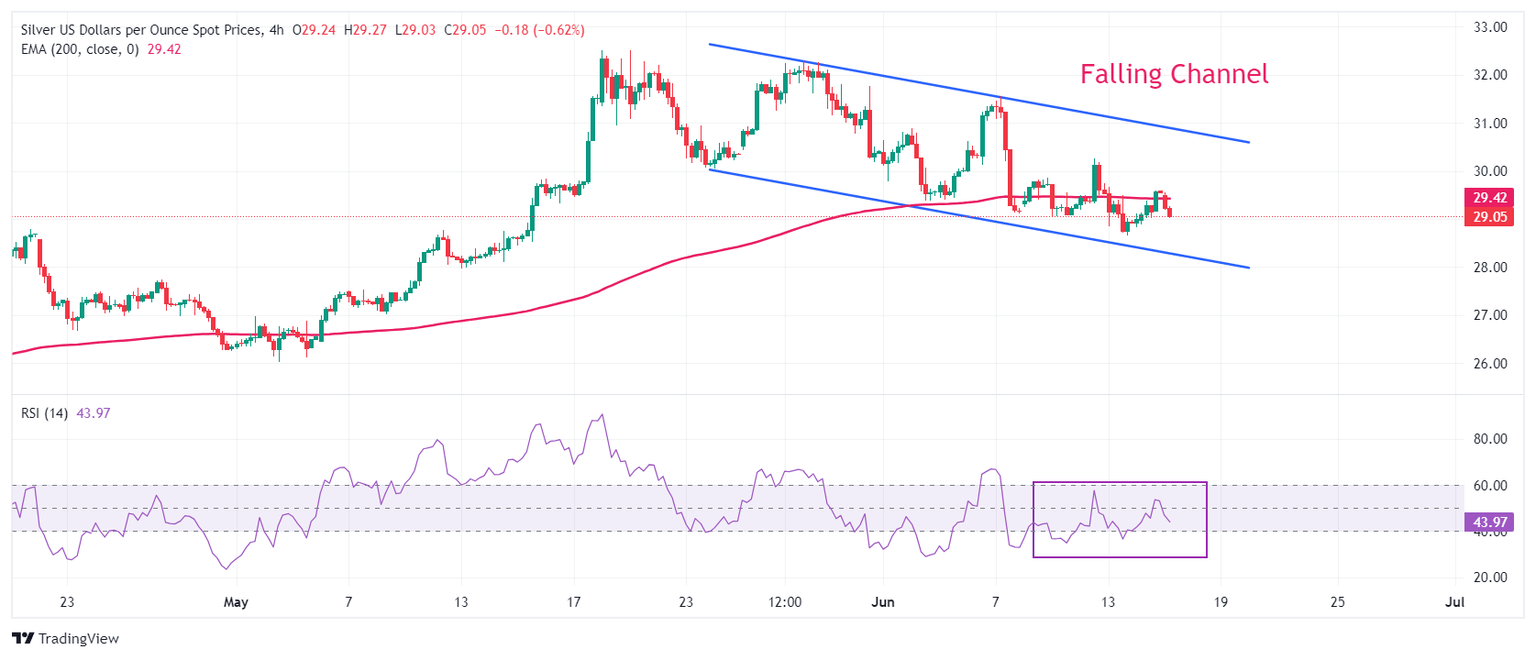

Silver price trades in a Falling Channel chart pattern in which each pullback is considered a selling opportunity by market participants. The asset struggles to hold above the 200-period Exponential Moving Average (EMA), which trades around $29.40, indicating uncertainty in the overall trend.

The 14-period Relative Strength Index (RSI) oscillates in the 40.00-60.00 range, suggesting a consolidating ahead.

Silver four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.