Silver Price Forecast: XAG/USD rallies to $28.60 with eyes on Middle East tensions

- Silver price jumps higher to $28.60, driven by worsening geopolitical tensions.

- Israel’s response to Iran’s attack will escalate fears of Middle East tensions spreading beyond Gaza.

- US bond yields edge down despite Fed lean towards higher interest rates for a longer period.

Silver price (XAG/USD) advances to $28.60 in Wednesday’s early New York session. The white metal witnesses significant buying interest as deepening Middle East tensions keep safe-haven bid firm. Investors are worried that tensions in the Middle East region could spread beyond Gaza as Israel said it will respond to Iran’s attack on their territory.

The Iranian military launched hundreds of missiles and drones on Saturday in retaliation to Israel’s attack on the Iranian embassy near Damascus in Syria in which two high-rank generals were killed. After Iran’s attack on Israel Tehran said, “the matter deemed to be closed.” However, should the Israeli regime make another mistake, Iran’s response will be considerably more severe, Wall Street Journal reported. The appeal for bullions strengthens when investors see geopolitical tensions escalating further.

Meanwhile, 10-year US Treasury yields fall to 4.63% despite Federal Reserve (Fed) sees interest rates remaining higher for a longer period. A decline in yields on interest-bearing assets eases the opportunity cost of holding an investment in non-yielding assets, such as Silver.

The US Dollar Index (DXY) exhibits strength near 106.20 as robust US Retail Sales data for March has improved the economic outlook. Higher spendings by households are done when labor market conditions remain tight, suggest strong economic outlook.

Silver technical analysis

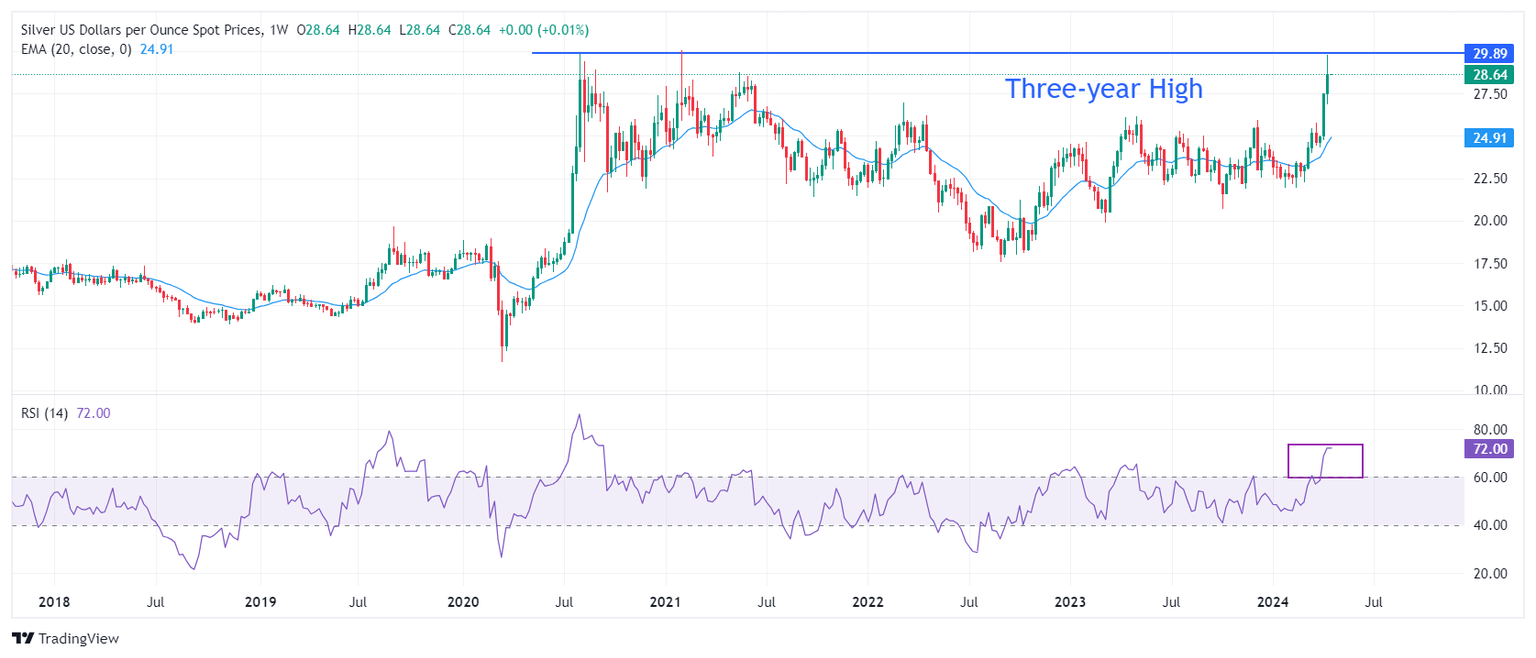

Silver price faces selling pressure while attempting to break above horizontal resistance plotted from 3 August 2020 high at $29.86. The long-term outlook of the white metal is bullish as the 20-week Exponential Moving Average (EMA) at $24.85 is sloping higher.

The 14-period Relative Strength Index (RSI) shifts into the bullish range of 60.00-80.00, suggesting a strong upside momentum.

Silver weekly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.