Silver Price Forecast: XAG/USD holds key support of $29.40 as US Dollar slumps

- Silver price holds the key support of $29.40 with a focus on US core PCE Inflation data.

- The US core PCE inflation will provide cues about when the Fed will start reducing interest rates.

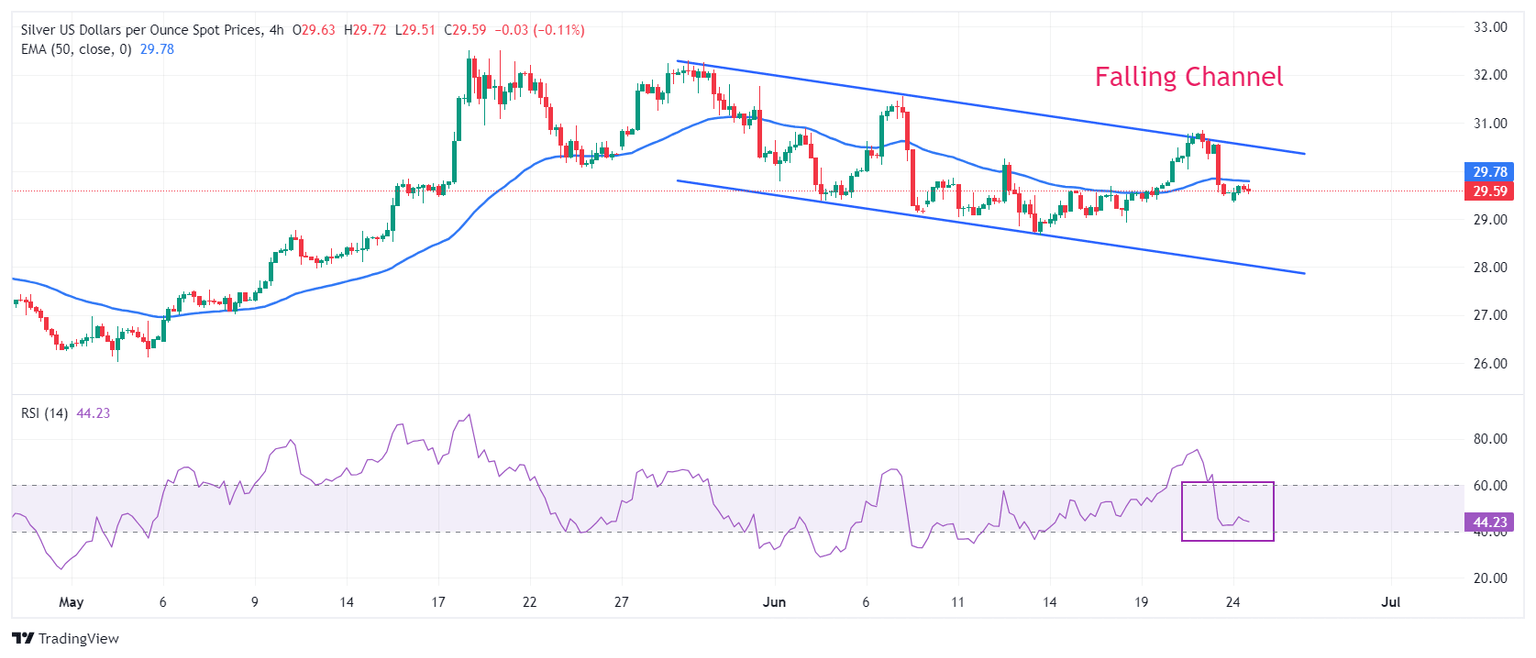

- Silver price oscillates in a Falling channel chart formation.

Silver price (XAG/USD) hovers above the crucial support of $29.40 in Monday’s New York session. The white metal witnesses slight gains as the US Dollar (USD) slumps despite strong preliminary United States (US) S&P Global PMI for June raises doubts over market expectations pointing to two rate cuts by the Federal Reserve (Fed) this year.

The US Dollar Index (DXY), which tracks the Greenback’s value against ix major currencies, declines to 105.40. 10-year US Treasury yields remain sluggish near 4.26%.

Data released on Friday showed that activities unexpectedly expanded at a faster pace in the manufacturing and service sectors. However, the report showed that price inflation cooled down after ticking higher in May.

Currently, financial market participants expect that the Fed will begin reducing interest rates from the September meeting and will deliver subsequent rate cuts in November or December meeting.

This week, investors will focus on core Personal Consumption Expenditure price index (PCE) for May. The core PCE price index data is Fed’s preferred inflation measure, which will provide fresh cues on when and how much the central bank will reduce interest rates this year.

Silver technical analysis

Silver price trades in a Falling Channel chart pattern formed on a four-hour timeframe in which each pullback is considered as selling opportunity by market participants. The white metal hovers near the 50-period Exponential Moving Average (EMA) near $29.80, indicating indecisiveness among investors.

The 14-period Relative Strength Index (RSI) shifts into the 40.00-60.00 range from the bullish territory of 60.00-80.00, suggesting that the upside momentum has faded.

Silver four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.