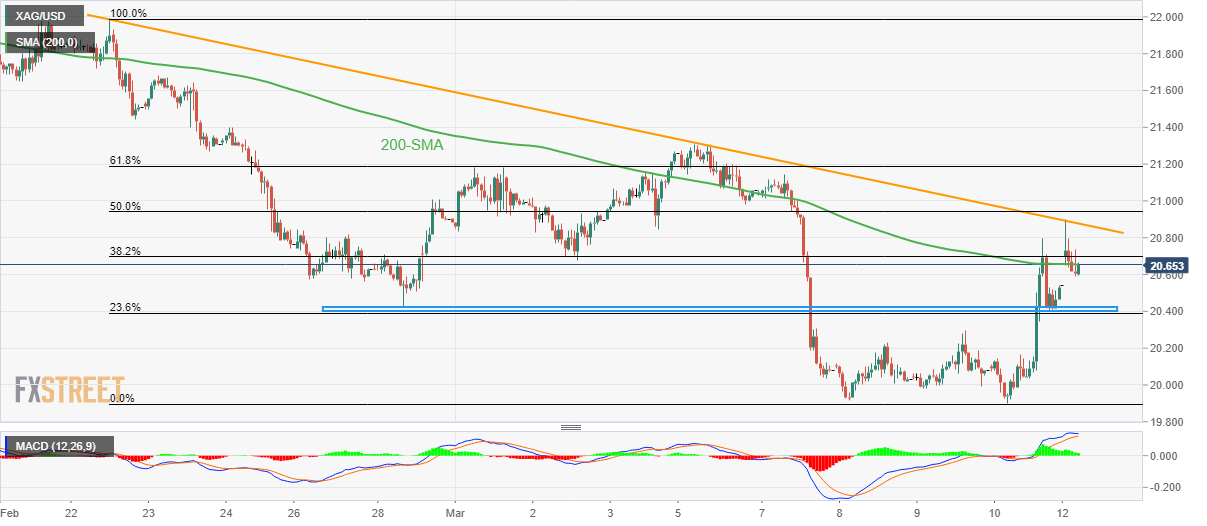

Silver price Analysis: XAG/USD retreats from 13-day-old resistance line below $21.00

- Silver price struggles to extend recovery from four-month low, pares intraday gains during a three-day uptrend.

- Failure to cross short-term resistance line, downside break of 200-SMA lure XAG/USD sellers.

- Two-week-old horizontal support zone restricts immediate Silver price downside.

Silver price (XAG/USD) clings to mild gains around $20.60 as it probes the metal’s pullback from a short-term key resistance line during early Monday. Even so, the XAG/USD prints the three-day winning streak, as well as extends the previous day’s rebound from the lowest levels since November 04, 2022.

That said, the looming bear cross on the MACD joins the bullion’s inability to stay beyond the 200-SMA, not to forget the failure to cross a two-week-old resistance line, which keeps the Silver price bears hopeful.

As a result, the bullion remains on the way to retesting the two-week-old horizontal support zone, close to $20.40 at the latest. However, the metal’s further downside may witness hardships in breaking the $20.00 psychological magnet.

Following that, the monthly low of $19.95 and the November 2022 bottom surrounding $18.85 will be in focus.

On the contrary, recovery moves remain elusive unless the XAG/USD stays below the downward-sloping resistance line from late February, around $20.90 at the latest. Also acting as an upside filter is the $21.00 round figure.

In a case where the Silver buyers keep control past $21.00, the last week’s high of around $21.30 may act as the last defense of the XAG/USD bears.

Silver price: Hourly chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.