Silver Price Analysis: XAG/USD corrects to $25 amid uncertainty ahead of US PPI, Retail Sales data

- Silver price drops to $24.90 as investors turn anxious ahead of US data.

- The Core PPI data is forecasted to have softened on both a monthly and an annual basis.

- Market expectations for Fed rate cuts in June have increased to 69%.

Silver price (XAG/USD) falls to $24.90 in Thursday’s European session after reaching a three-month high at $25.16. The white metal drops amid anxiety ahead of the United States Producer Price Index (PPI) and Retail Sales data for February, which will provide fresh cues about the inflation outlook.

The annual core PPI data, which strips off volatile food and energy prices, is forecasted to have softened to 1.9% from 2.0% in January. The monthly underlying inflation data is projected to have grown at a slower pace of 0.2% against the prior reading of 0.5%. Slower growth in prices of goods and services by producers at factory gates would soften the inflation outlook.

Meanwhile, monthly Retail Sales are expected to have grown by 0.8%, the same pace at which they contracted in January. In the same period, economists expect that Retail Sales excluding automobiles have grown by 0.6% against a decline of 0.5%. Upbeat Retail sales data indicate an increase in households’ spending, which fuels inflationary pressures.

The Silver price witnessed significant buying interest on Wednesday as market expectations for the Federal Reserve (Fed) reducing interest rates in the June meeting have improved again despite stubborn inflation data for February. The CME Fedwatch tool shows that the chances of the Fed reducing interest rates have increased to 69%, which is close to pre-inflation data expectations.

Silver technical analysis

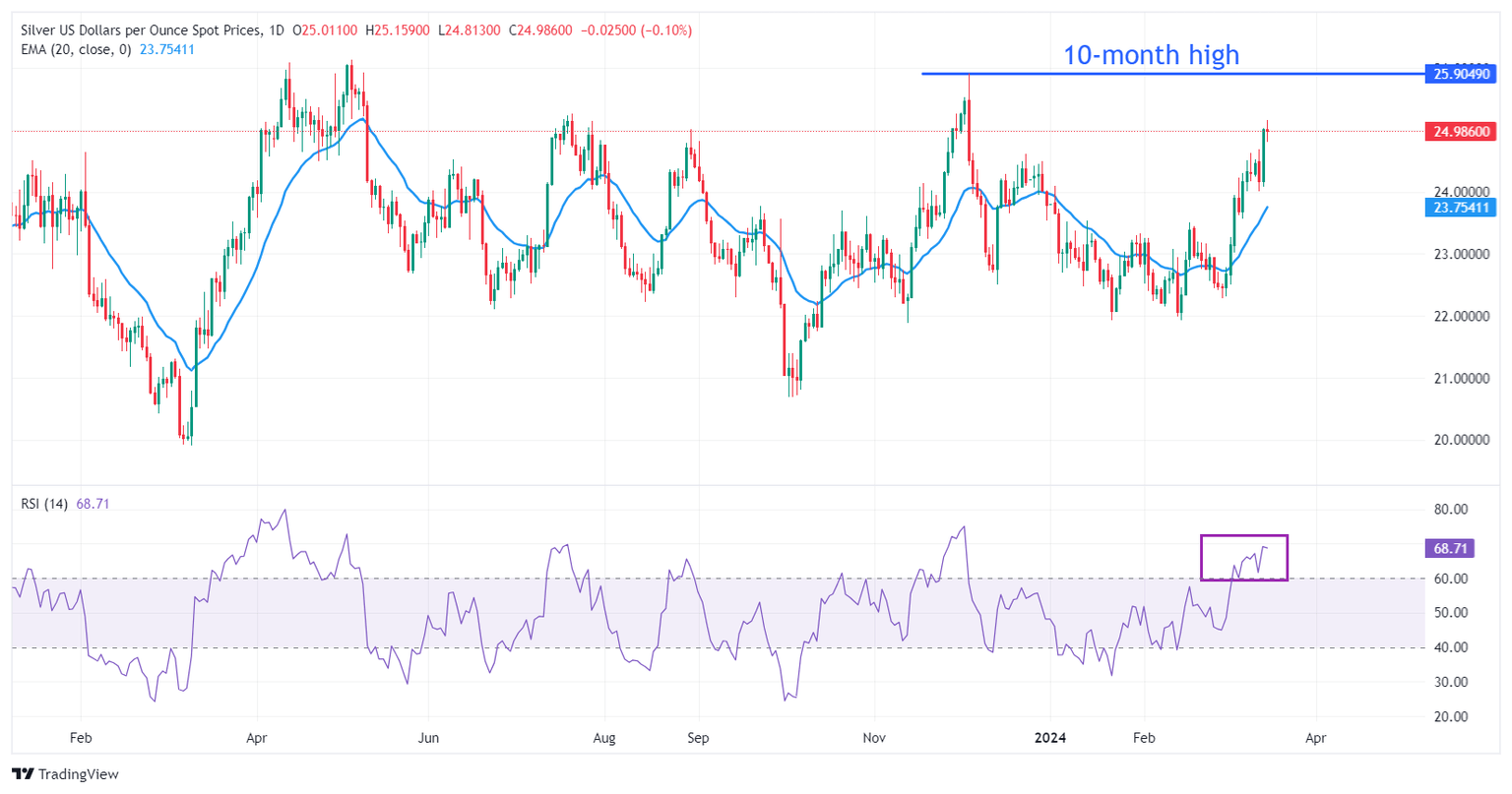

Silver price approaches a 10-month high of $25.90, which is the high of December 4. Near-term demand for the white metal is strong, as the 20-day Exponential Moving Average (EMA) around $23.80 is sloping north.

The 14-period Relative Strength Index (RSI) trades in the bullish range of 60.00-80.00, indicating a strong upside momentum.

Silver daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.