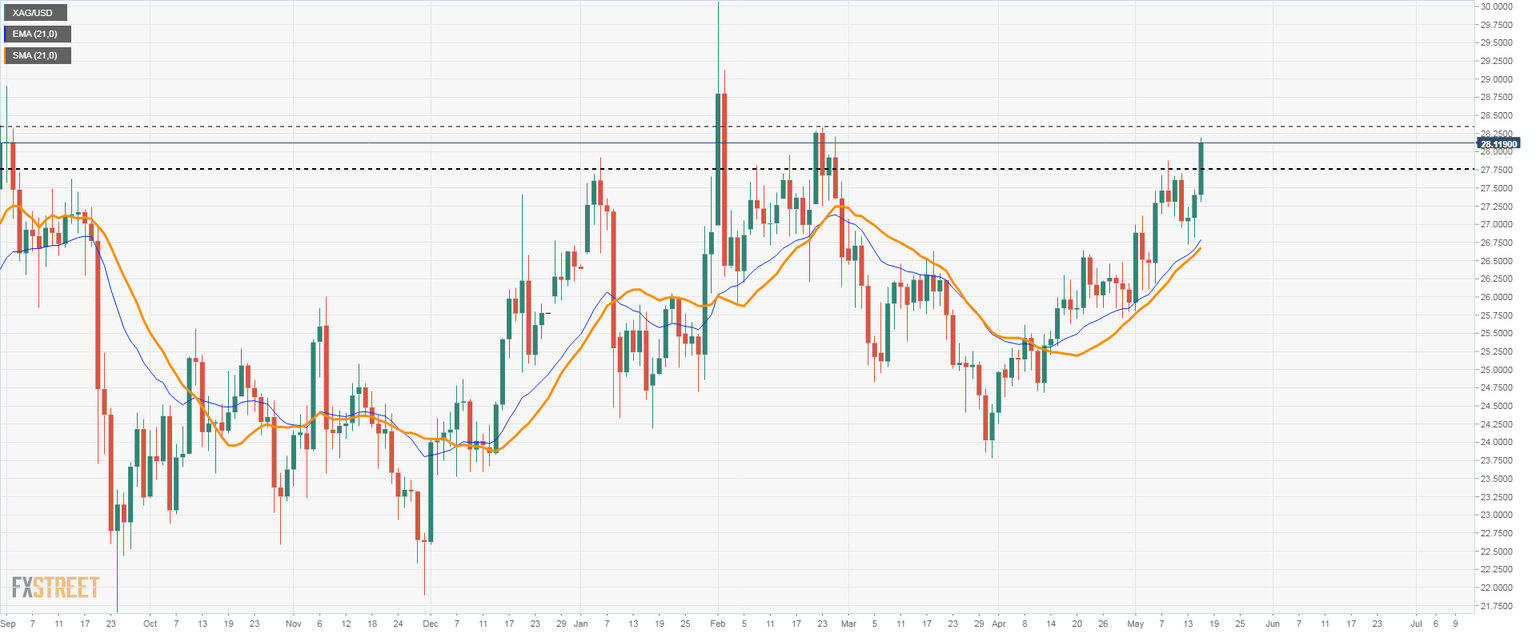

Silver Price Analysis: XAG/USD breaks above 28.00 for the first time since February

- Metals on fire at monthly highs, even as yields hold steady.

- XAG/USD heads for the third highest daily close since September.

After a correction, metals resumed the upside and jumped to monthly highs. Silver rose to $28.15, reaching the highest level since February. It is rising 2.60% on Monday. Gold is also sharply higher, above $1860.

A consolidation of XAG/USD above $28.00 would point to further gains. The next strong resistance is located around $28.25/30. The bullish bias is likely to remain intact while above $26.60. A break under the mentioned level should clear the way to more losses. On the upside, a daily close clearly above $28.30 would point to an extension to the upside toward the $29.00 area.

On Monday, the rally in metals is taking place even as US yields remain steady and as equity prices in Wall Street dropped modestly. A weaker US dollar contributes to boost metals, as the DXY approaches 90.00.

XAG/USD daily chart

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.