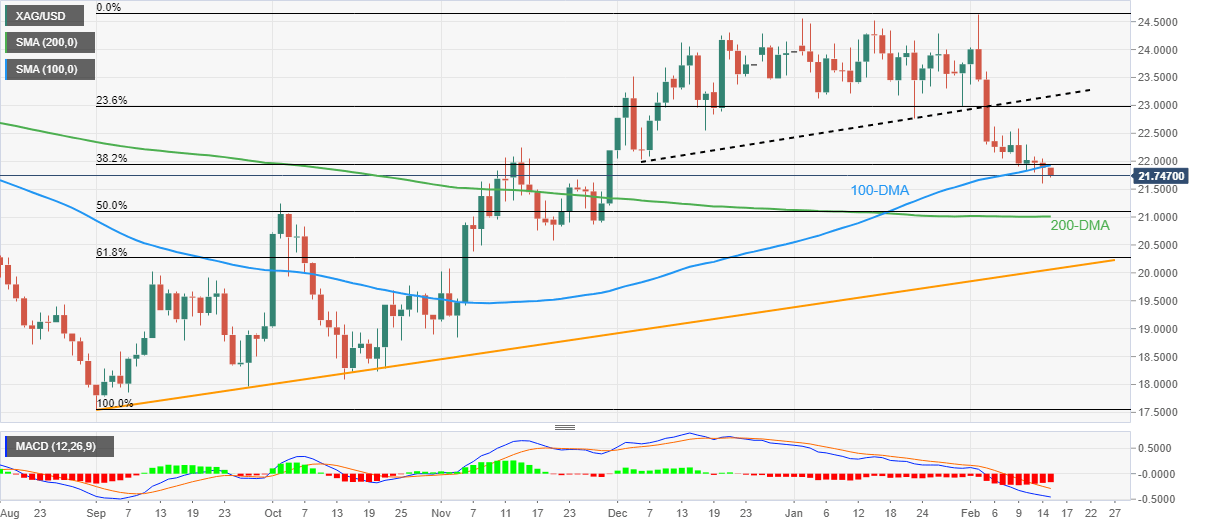

Silver Price Analysis: XAG/USD bears keep the reins around 10-week low under $22.00

- Silver prints three-day losing streak as sellers flirt with 2.5-month low.

- Clear downside break of 100-DMA, bearish MACD signals favor sellers.

- 50% Fibonacci retracement, 200-DMA challenge further downside.

- Recovery remains elusive unless crossing $23.15, ascending trend line from early September 2022 adds to the downside filters.

Silver price (XAG/USD) remains on the bear’s radar as the bright metal renews intraday low near $21.70 during early Wednesday in Europe. In doing so, the bullion stays pressured around the lowest levels since November 30 amid a three-day downtrend.

The quote’s weakness could be linked to the daily closing below the 100-DMA, as well as sustained trading below the previous support line from early December 2022, respectively near $21.95 and $23.15.

As a result, the XAG/USD bears have a free hand while expecting further downside of the metal.

However, the 50% Fibonacci retracement of September 2022 to February 2023 upside, near $21.10, precedes the 200-DMA level of $21.00 to offer a strong challenge to the Silver sellers.

Following that, the 61.8% Fibonacci retracement surrounding $20.30, also known as the golden Fibonacci ratio, as well as a 5.5-month-old ascending support line, close to $20.00 round figure, will become the key for the XAG/USD sellers to watch.

Alternatively, recovery moves need to stay beyond the 100-DMA hurdle of $21.95, as well as the $22.00 round figure to convince intraday buyers of the Silver.

Even so, the previous weekly high near $22.60 and the support-turned-resistance line from December 06, 2022, close to $23.15, could challenge the XAG/USD bulls before giving them control.

Silver price: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.