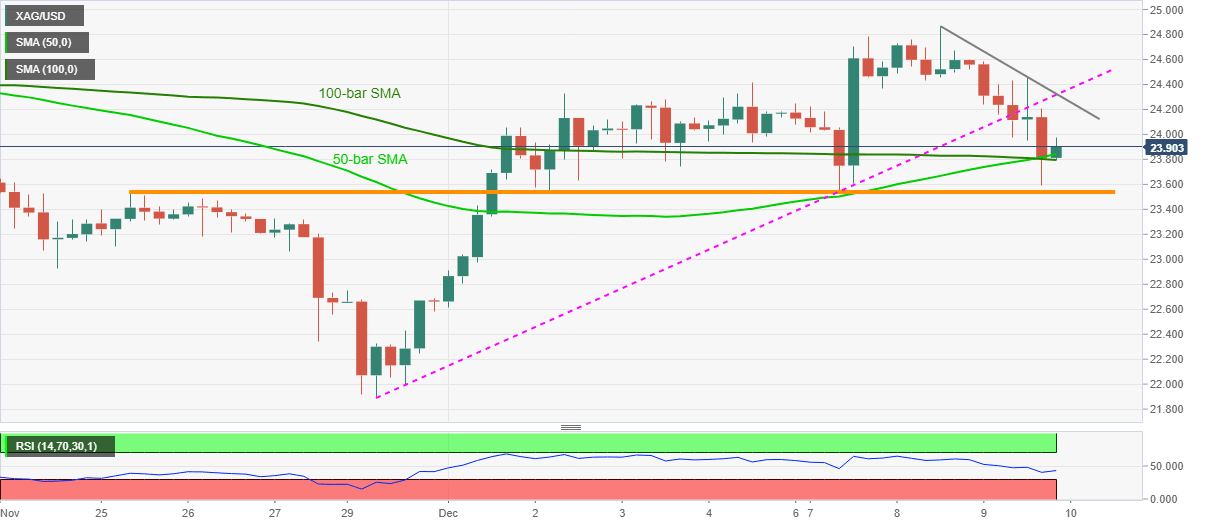

Silver Price Analysis: XAG/USD battles $24.00 as key SMAs probe monthly support break

- Silver consolidates recent losses from a confluence of 50-bar and 100-bar SMAs.

- Sustained break of seven-day-old rising trend line highlights fortnight-long horizontal support on the bear’s radar.

- Bulls need to cross a falling resistance line from Tuesday for fresh entries.

Silver retraces the heaviest losses in two weeks around $23.90 during Thursday’s Asian session. The white metal’s declines the previous day could be traced to a downside break of an ascending trend line from November 30. Though, a confluence of important Simple Moving Averages (SMAs) probes the bears, for now.

Even so, the corrective bounce is yet to regain the trend line support, now resistance, which in turn directs the quote to multiple highs marked since November 25 around $23.55/50.

If at all the sellers keep the reins past-$23.50, November-end top near $22.70 and the previous month’s low near $21.90 will become their favorites.

On the contrary, an upside break of the previous support line, at $24.30 needs to cross the immediate resistance line, currently around $24.35, to recall the silver buyers targeting to refresh the monthly high of $24.86.

In doing so, the commodity bulls will eye November’s peak close to $26.00.

Silver four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.