Silver Price Analysis: Pulling back within a probable downtrend

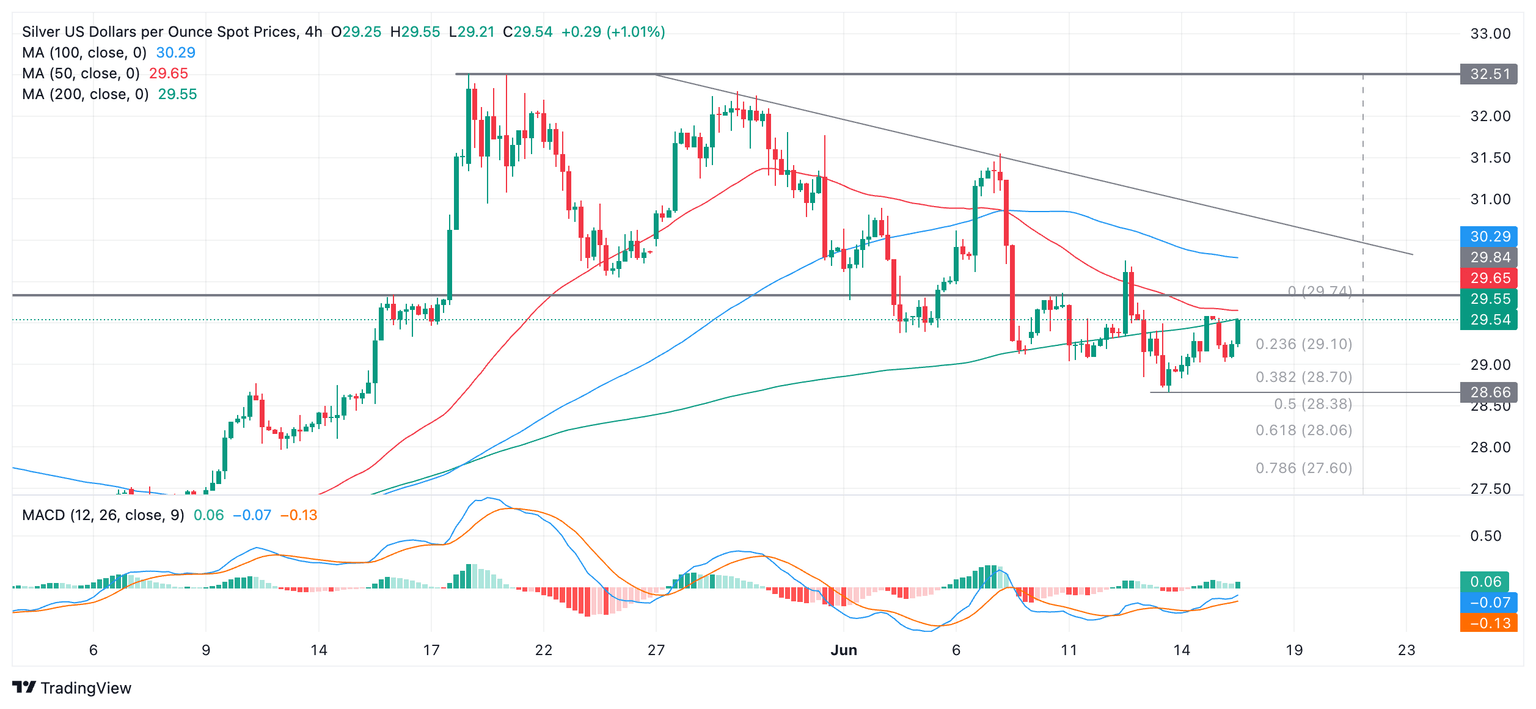

- Silver is correcting within a short-term downtrend.

- A break below the June 13 lows would probably lead to a continuation of the trend of lower lows.

- The 50-day Simple Moving Average is an obstacle to bears pushing price lower.

Silver (XAG/USD) trades a third of a percent lower in the $29.40s on Monday. Despite trading marginally lower on the day it has overall recovered since falling to a low of $28.66 on June 13.

The precious metal is in a short-term downtrend, on balance, and given “the trend is your friend” this is likely to continue. The recovery since June 13 is probably a pull back rather than a reversal – once it finishes the downtrend will probably resume.

Silver 4-hour Chart

A break below $28.66 (June 13 low) would confirm another lower low, and a continuation of the bearish sequence.

After that, Silver could fall to an initial, conservative target at $28.06, the 0.618 Fibonacci ratio of the height of the range that unfolded in the second half of May, extrapolated lower.

The 50-day Simple Moving Average (SMA) at $29.01 could act as an obstacle to progress lower.

Even more bearishness could see Silver reach as low as $27.02 (100% extrapolation of the height of the range lower).

It would require a close above $30.50 to bring the short-term downtrend into doubt. A move above the $31.55 lower high would suggest the possibility of a recovery to the range high at $32.51, and a reversal of the short-term trend.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.