Silver Price Analysis: Meets key long-term resistance at $30.00

- Silver price has rallied up to just shy of $30.00, a key resistance level.

- The $30.00 barrier lies at the top of a four-year consolidation range.

- A breakout above would be a significant technical event for Silver.

Silver (XAG/USD) price is rising up in an ascending channel and on Thursday reached just shy of the $30.00 mark, a significant resistance level.

The precious metal is currently pulling back as traders book profits, however, it remains in a short-term uptrend, which given the old saying that “the trend is your friend” is likely to resume and continue pushing higher.

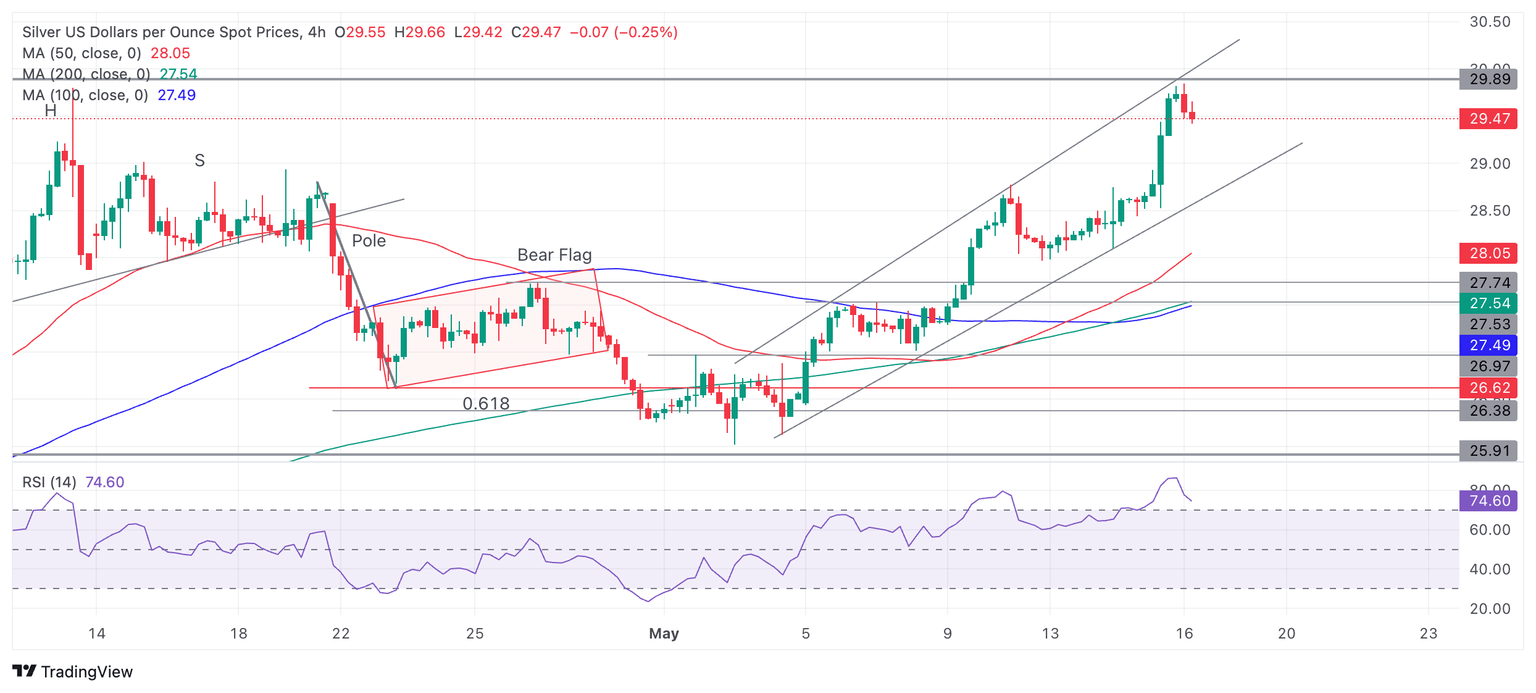

4-hour Chart

The Relative Strength Index (RSI) is in the overbought zone, suggesting traders should be cautious about adding longs to their bullish positions. If the RSI exits overbought on a closing basis it will signal a deeper correction is taking place.

Eventually the short-term uptrend should reassert itself, however, and Silver price probably rally higher. Key long-term resistance for Silver lies at circa $30.00 which is likely to present a formidable barrier to further upside.

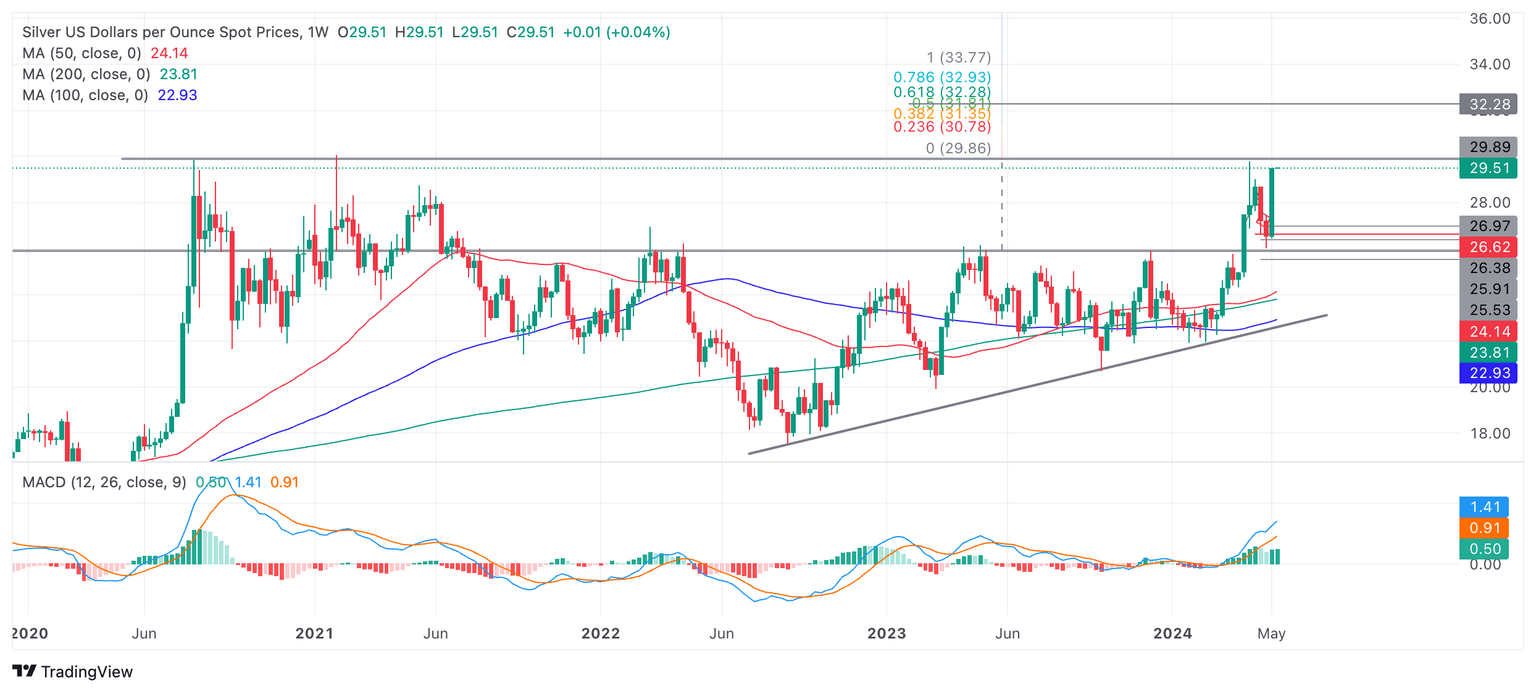

Silver Weekly Chart

The importance of the $30.00 level can be seen more clearly on the weekly chart above, which shows the level has repeatedly been tested since 2020 when Silver’s long-term sideways consolidation began.

This is the fourth time the level has been tested and it is possible that it will repel price once again, however, a decisive break above the level would probably lead to a volatile move higher. This is so because levels that have been repeatedly touched often generate volatile moves when they are finally penetrated.

A decisive break above $30.00, therefore, would result in an extension of the short-term uptrend and a breakout from a four-year consolidation range. At a minimum such a move ought to reach $32.28, the Fibonacci 0.618 extension of the upper part of the consolidation range higher. This is only an estimate, however, and there is a possibility Silver could go much higher as confidence in the uptrend draws more bulls to the trade. If exuberance is high, $33.83 could be reached, followed even by $36.28, the 1.618 ratio extension of the height of the range.

It would require a decisive break below the rising channel lows at roughly $29.00 to bring the short-term uptrend into doubt and suggest the possibility of a more bearish outlook.

A decisive break would be one accompanied by a long red candlestick that closed near its lows or three red candlesticks in a row.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.