Pound Sterling trades sideways against USD as investors gauge Trump's tariff plans

- The Pound Sterling remains on tenterhooks against its major peers as investors are concerned over the UK economic outlook.

- Traderds price in a 25 bps interest rate reduction by the BoE in February.

- Investors seek more clarity on President Trump’s tariff structure to make informed decisions.

The Pound Sterling (GBP) consolidates around 1.2300 against the US Dollar (USD) in Thursday’s European session. The GBP/USD pair consolidates as investors await US President Donald Trump's concrete tariff plans to build fresh positions. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, oscillates in a tight range above 108.00.

Until now, Donald Trump has threatened to raise 25% tariffs on his neighbors Mexico and Canada and 10% on China, which could come into effect on February 1. He has also commented that he is considering imposing tariffs on Europe to fix trade imbalances but has not yet provided any explicit details. Before Trump’s inauguration, market participants anticipated he would implement full-scale tariffs universally on his first day at the White House.

Investors should brace for a sideways trend in the US Dollar until Trump explicitly declares a tariff structure. Also, the Federal Reserve’s (Fed) monetary policy decision on Wednesday is unlikely to stem volatility in the US Dollar, as the central bank is certain to keep interest rates steady in the range of 4.25%- 4.50%, according to the CME FedWatch tool. However, market participants will pay close attention to the Fed’s monetary policy guidance.

Daily digest market movers: Pound Sterling trades cautiously as BoE interest rate cut next month seems a done deal

- The Pound Sterling trades cautiously against its major peers on Thursday as the higher-than-expected United Kingdom (UK) Public Sector Net Borrowing in December has weighed on the economic outlook. The Office for National Statistics (ONS) reported on Wednesday that higher borrowing costs and a one-off payment for the repurchase of military accommodation swelled the budget deficit. This scenario could force Chancellor of the Exchequer Rachel Reeves to raise the tax burden on individuals or trim public spending, which could slow down the already moderate growth rate in the UK. However, Reeves is confident we can get growth numbers up, said at World Economic Forum (WEF) in Davos.

- UK government’s borrowing costs have accelerated lately amid concerns that higher tariffs by United States (US) President Donald Trump would dampen growth prospects. This led to a sharp increase in 30-year gilt yields to 5.47% on January 14, the highest level seen in over 26 years.

- Meanwhile, investors are shifting their focus to the Bank of England’s (BoE) first monetary policy decision of the year, which will be announced on February 6. Traders have almost fully priced in a 25 basis points (bps) interest rate reduction that will push borrowing rates to 4.5%. BoE dovish bets accelerated due to soft inflation, a decline in Retail Sales in December, and weak labor demand in the three months ending November.

- This week, market participants will pay close attention to the flash UK S&P Global/CIPS Purchasing Managers Index (PMI) data for January, which will be published on Friday. The agency is expected to show the overall business activity expanded at a slower pace.

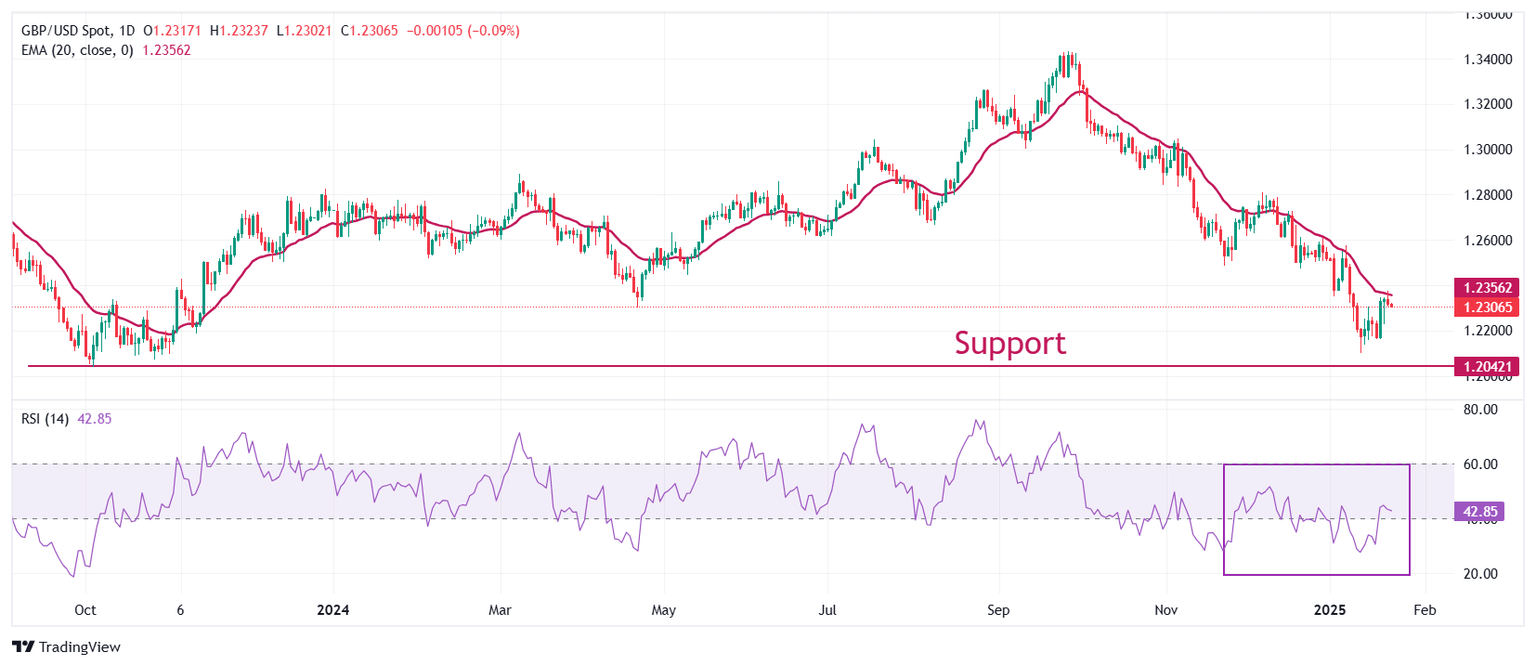

Technical Analysis: Pound Sterling struggles to extend recovery above 20-day EMA

The Pound Sterling strives to break above the 20-day Exponential Moving Average (EMA), which trades around 1.2356, against the US Dollar. The GBP/USD pair rebounded after posting a fresh over-one-year low of 1.2100 on January 13.

The 14-day Relative Strength Index (RSI) rebounds to near 43.50 from the 20.00-40.00 range, suggesting that the bearish momentum has ended, at least for now.

Looking down, the pair is expected to find support near the October 2023 low of 1.2050. On the upside, the 20-day EMA and the round level of 1.2400 will act as key resistances.

Economic Indicator

S&P Global/CIPS Composite PMI

The Composite Purchasing Managers Index (PMI), released on a monthly basis by the Chartered Institute of Procurement & Supply and S&P Global, is a leading indicator gauging private-business activity in UK for both the manufacturing and services sectors. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation.The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the UK private economy is generally expanding, a bullish sign for the Pound Sterling (GBP). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for GBP.

Read more.Next release: Fri Jan 24, 2025 09:30 (Prel)

Frequency: Monthly

Consensus: 50

Previous: 50.4

Source: S&P Global

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.