Pound Sterling weakens against US Dollar amid uncertainty over US election

- The Pound Sterling remains under pressure but it could rebound as market participants reassess the BoE rate cut path.

- Unexpectedly strong UK Retail Sales data for September could dampen expectations that the BoE will opt for large interest-rate cuts.

- Kamala Harris leads by a slight margin in national polls against Donald Trump in US presidential elections.

The Pound Sterling (GBP) weakens against its major peers at the start of the week. The British currency, which has suffered in the past weeks on the broad assessment that the Bank of England (BoE) will cut interest rates aggressively, could now be facing a different scenario after the release of strong United Kingdom (UK) Retail Sales data for September.

The Retail Sales data, a key measure for consumer spending, surprisingly rose by 0.3% month-over-month. Economists had projected a decline in the consumer spending measure at a similar pace.

Before the UK Retail Sales data, traders started pricing in the BoE to cut interest rates in both the policy meetings remaining this year amid slowing inflation. However, upbeat Retail Sales data is expected to weigh on bets supporting the BoE to cut its key borrowing rates in December.

For more guidance on interest rates, investors will pay close attention to speeches from BoE Governor Andrew Bailey, Governor Sarah Breeden, and policymaker Megan Greene on Tuesday. Bailey will speak several times during the week.

On the economic front, investors will focus on the preliminary S&P Global/CIPS Composite Purchasing Managers’ Index (PMI) data for October, which will be published on Thursday. The overall business activity is expected to have expanded at a slower pace.

Daily digest market movers: Pound Sterling falls as traders brace for US election

- The Pound Sterling drops to near 1.3020 against the US Dollar (USD) in Monday’s North American session. The GBP/USD pair stays under pressure as the US Dollar resumes its upside journey after a slight correction on Friday. The Greenback gains on expectations that the policy-easing cycle from the Federal Reserve (Fed) will be more gradual than previously expected.

- According to the CME FedWatch tool, 30-day Federal Funds futures pricing data shows that the Fed will lower rates by 50 basis points (bps) in the remaining year, suggesting that the US central bank will cut its borrowing rates by 25 bps both in November and December. The Fed seems to follow a moderate policy-easing cycle as a string of upbeat United States (US) data for September has diminished risks of an economic slowdown.

- However, Atlanta Fed Bank President Raphael Bostic said on Friday that he sees only one interest rate cut in the remaining two meetings this year. Bostic added that he sees the federal funds rate heading between 3% and 3.5% at the end of 2025, but that he is not in a rush to reach this neutral level.

- Meanwhile, the immediate reaction in the US Dollar will be guided by how speculation over US presidential elections will shape going forward. Currently, Vice President Kamala Harris is running ahead of former President Donald Trump in national polls, according to the Emerson College’s poll.

Technical Analysis: Pound Sterling struggles to hold 1.3000

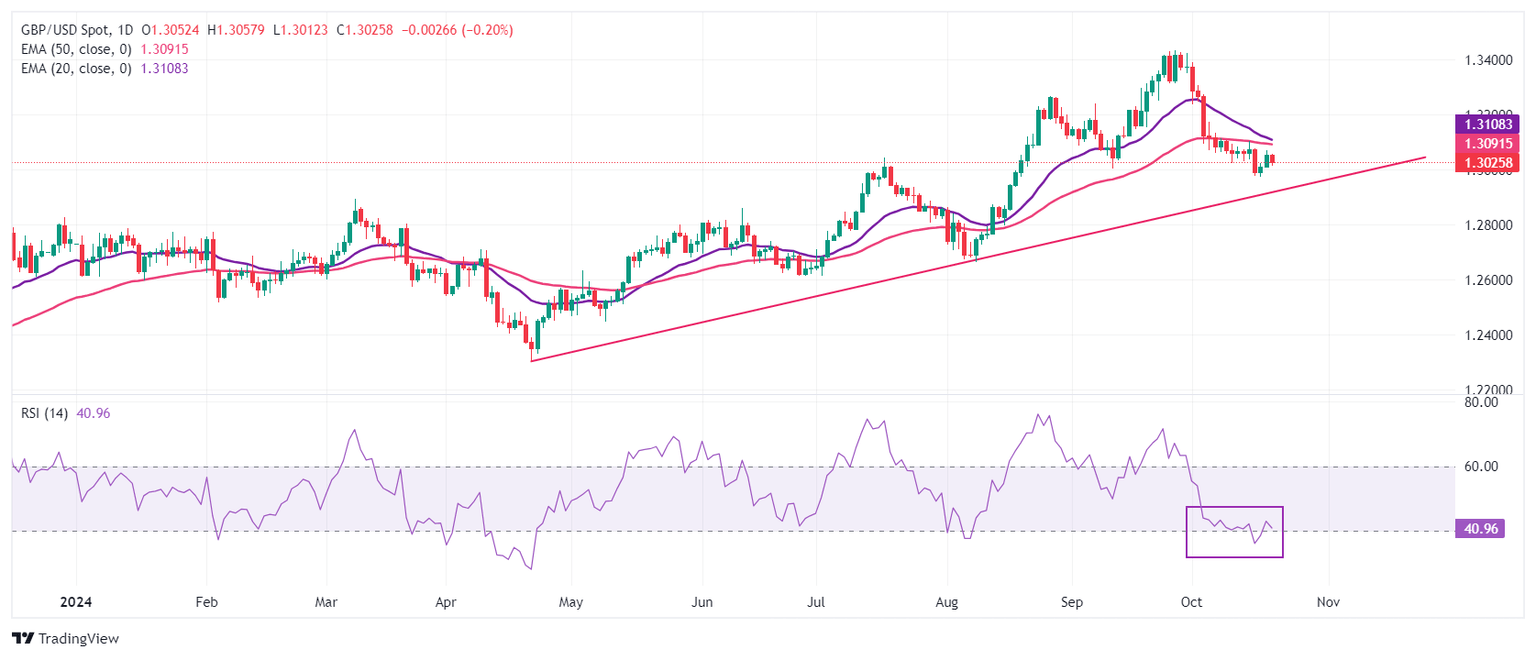

The Pound Sterling trades at make or a break near the psychological support of 1.3000 in European trading hours. The near-term outlook of the GBP/USD remains bearish as it hovers below the 50-day Exponential Moving Average (EMA), which trades around 1.3090.

The 14-day Relative Strength Index (RSI) hovers near 40.00. A breakdown will the same will strengthen the bearish momentum.

Looking down, the upward-sloping trendline drawn from the April 22 low at 1.2300 will be a major support zone for Pound Sterling bulls near 1.2920. On the upside, the Cable will face resistance near the 20-day EMA around 1.3110.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.