Pound Sterling surges against USD despite upbeat US Nonfarm Payrolls

- The Pound Sterling climbs to near 1.2800 against the USD after the release of the US NFP report for November.

- Investors expect the Fed to cut interest rates by 25 bps in the policy meeting on December 18.

- BoE hawk Megan Greene warned on Thursday that UK inflation may remain above the 2% target in the medium term.

The Pound Sterling (GBP) advances above 1.2800 against the US Dollar (USD) in North American trading hours on Friday. The GBP/USD jumps higher as the US Dollar declines even though the United States (US) Nonfarm Payrolls (NFP) data for November came in better than expected. The US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, slumps below 105.50.

The NFP report showed that the US economy added 227K fresh workers, higher than estimates of 200K and the former release of 36K, upwardly revised from 12K. The Unemployment Rate rose to 4.2%, as expected, higher than October's reading of 4.1%.

Average Hourly Earnings data, a key measure for wage growth, rose steadily on a monthly as well as an annual basis by 0.4% and 4%, respectively, faster than estimates. Higher-than-expected employment growth and steadily rising Average Hourly Earnings could weigh on market expectations that the Federal Reserve (Fed) will cut interest rates in its policy meeting on December 18. The Fed started its policy-easing cycle in September as officials were worried about deteriorating labor demand and were confident about inflation returning to the bank’s target of 2%.

Currently, there is an 89% chance that the Fed will reduce interest rates by 25 basis points (bps) to 4.25%-4.50% this month, while the rest supports leaving interest rates unchanged, according to the CME FedWatch tool.

Daily digest market movers: Pound Sterling gains amid fears of persistent UK inflation

- The Pound Sterling performs strongly against its major peers on Friday as Bank of England (BoE) officials showed concerns over price pressures remaining persistent. BoE Monetary Policy Committee (MPC) external member Megan Greene said on Thursday that UK inflation could remain above the 2% target in the medium term as it is becoming “fundamentally more persistent,” Bloomberg reports.

- Megan Green’s doubts over the central bank bringing inflation within the desired range were backed by the assumption that wage growth remains persistent. “Wage growth is not falling as quickly as I would like,” Greene said.

- Wednesday, BoE Governor Andrew Bailey also emphasized that the central bank has still some work to do to bring inflation down below the bank’s target of 2% but was confident that the disinflation process is well embedded.

- Due to the absence of critical United Kingdom (UK) economic indicators in the near term, market speculation for the likely interest rate decision by the BoE in the monetary policy meeting on December 19 will drive the Pound Sterling’s valuation. Traders expect that the BoE will leave interest rates unchanged at 4.75%.

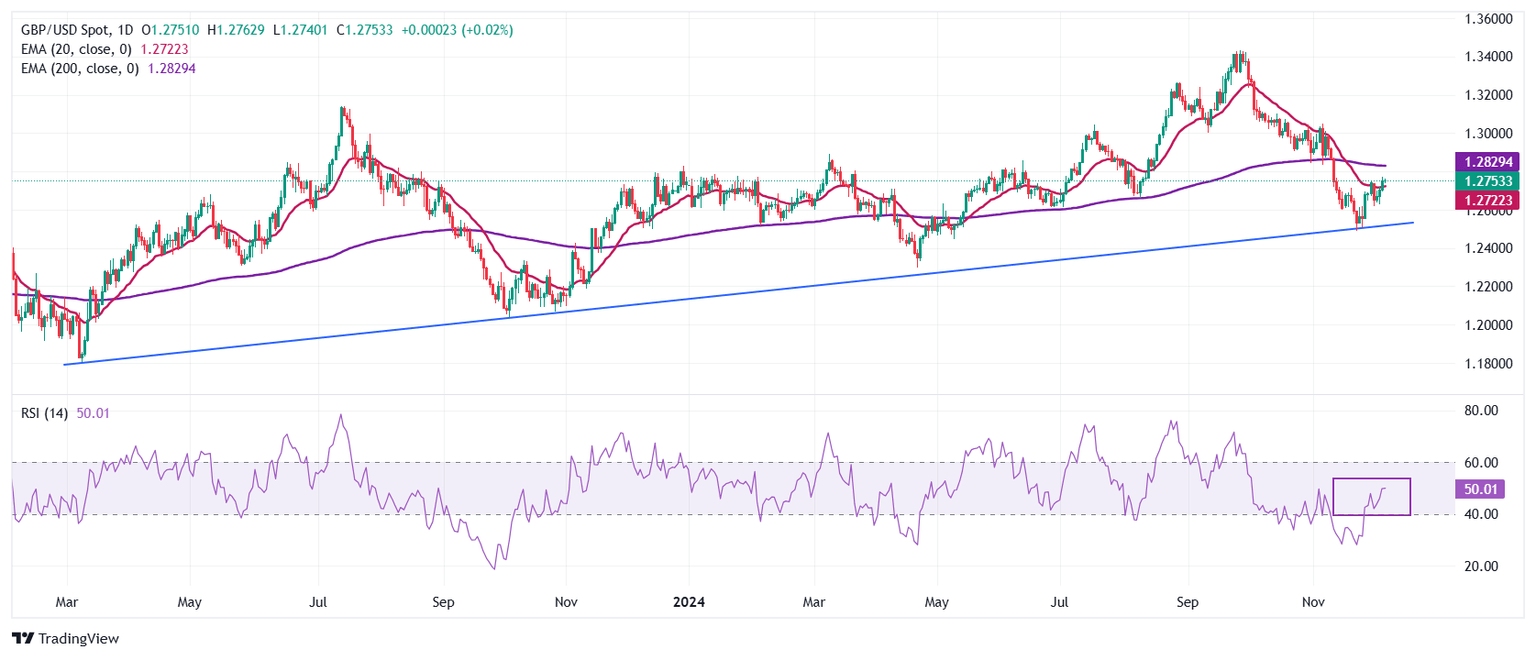

Technical Analysis: Pound Sterling holds above 20-day EMA

The Pound Sterling holds onto Thursday’s upside move near 1.2770 against the US Dollar (USD) in Friday’s London session. The GBP/USD pair steadies above the 20-day Exponential Moving Average (EMA) around 1.2715 and aims to sustain above it. However, the broader outlook remains bearish as the pair stays below the 200-day Exponential Moving Average, which trades around 1.2825.

The 14-day Relative Strength Index (RSI) has rebounded to neutral levels after turning oversold on November 22. However, the downside bias is still intact.

Looking down, the pair is expected to find a cushion near the upward-sloping trendline around 1.2500, which is plotted from the March 2023 low near 1.1800. On the upside, the 200-day EMA will act as key resistance.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Dec 06, 2024 13:30

Frequency: Monthly

Actual: 227K

Consensus: 200K

Previous: 12K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.