Pound Sterling bounces back on slower than expected decline in UK inflation

- The Pound Sterling recovers above 1.2400 against the US Dollar as UK inflation rose higher than expected in March.

- UK’s annual headline and core CPI rose by 3.2% and 4.2% in March, respectively.

- Fed Powell’s hawkish guidance on interest rates has strengthened the US Dollar’s appeal.

The Pound Sterling (GBP) rebounds strongly in Wednesday’s early New York session as the United Kingdom Office for National Statistics (ONS) reported that the Consumer Price Index (CPI) for March grew more than what economists had expected. Despite beating estimates, inflation has softened from February, suggesting that higher interest rates by the Bank of England (BoE) contribute to abate price pressures.

Meanwhile, producer price inflation has also slowed, indicating prices of goods and services at factory gates are easing. Business owners generally slash their prices when they expect demand to remain subdued.

After the release of the inflation data, BoE Monetary Policy Committee (MPC) member Megan Greene said, "We're closer to target than we were just a few months ago, so the inflation data has been encouraging," but warned that global supply shocks and volatile oil prices could dampen progress in inflation.

A less-than-expected decline in the inflation data keeps speculation that the BoE will start lowering interest rates from November unabated, although Tuesday’s employment data suggested that the UK’s job market is cooling. The labor market report showed that the Unemployment Rate rose sharply to 4.2% in the three months ending February from expectations of 4.0% and the prior release of 3.9%. The number of employed people fell by 156K in the three months to February, more than the 89K jobs lost in the quarter to January.

Daily digest market movers: Pound Sterling eyes a firm footing

- The Pound Sterling bounces back to 1.2460 as the United Kingdom ONS reports a higher-than-expected inflation rate for March. Annual headline inflation rose 3.2%, higher than expectations of 3.1% but slowed from the prior reading of 3.4%. Monthly headline inflation grew steadily by 0.6%.

- UK’s annual core CPI data, which strips off volatile food and energy prices, grew by 4.2%, more than the expected 4.1% but significantly decelerating from February’s reading of 4.5%. The core inflation data is the Bank of England’s preferred inflation measure for decision-making on interest rates. Even as the measure came in slightly higher than expected, it clearly shows that price pressures are on course to return to the BoE’s desired rate of 2%.

- March’s inflation data is expected to hold expectations for the BoE pivoting to rate cuts steady, which financial markets are currently expecting from November, according to rate future markets, Reuters reports.

- On the global front, market sentiment remains upbeat despite worsening Middle East tensions and a hawkish interest rate guidance from Federal Reserve Chair Jerome Powell has been maintaining downward pressure on risk-sensitive assets. The S&P 500 has opened on a positive note.

- Fears of further escalation in Iran-Israel tensions have deepened as Israel vowed to retaliate against Iran’s attack. The US said it is prepared to impose sanctions on Iran.

- The US Dollar Index (DXY), which measures the US Dollar’s value against six major currencies, hovers near a fresh five-month high around 106.40. The USD Index is expected to extend its upside, as Fed Powell said on Tuesday that there is a need to hold interest rates higher for longer, given the strong labor demand and slow progress in inflation, which is declining to the desired rate of 2%.

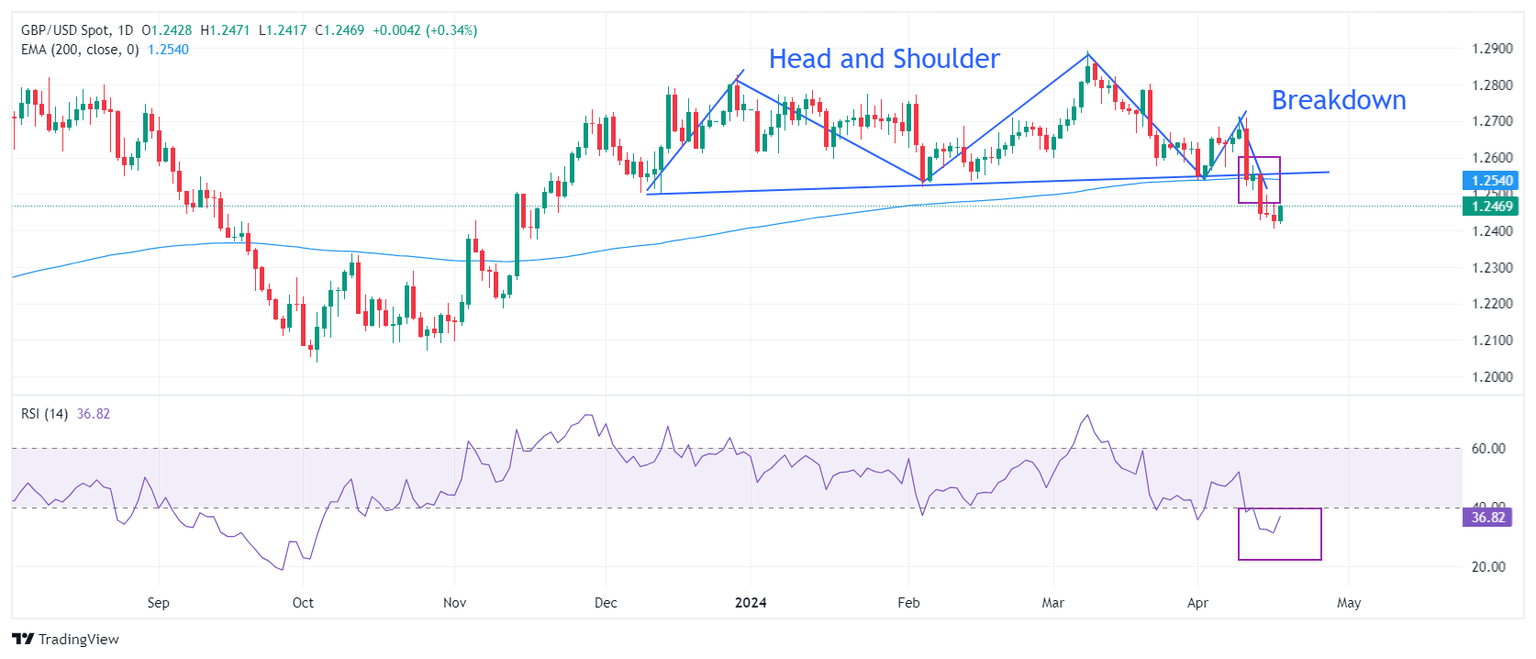

Technical Analysis: Pound Sterling rebounds from 1.2400

The Pound Sterling exhibits a firm footing after the release of the UK inflation report for March. The GBP/USD pair sees strong buying near the crucial support at 1.2400. The upside in the Cable is seen limited near the psychological resistance of 1.2500. This coincides with the breakdown region of the Head and Shoulder chart formation on the daily time frame.

The long-term outlook turns bearish as the Cable drops below the 200-day Exponential Moving Average (EMA), which trades around 1.2560.

The 14-period Relative Strength Index (RSI) shifts into the bearish range of 20.00-40.00, suggesting an active downside momentum.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.