Pound Sterling rebounds on strong UK Manufacturing PMI

- The Pound Sterling rebounds, although easing UK inflation keeps its broader appeal weak.

- Upbeat S&P Global/CIPS UK Manufacturing PMI supported the Pound Sterling.

- UK’s shop price inflation grew 1.3% in March, the slowest pace since December 2021.

The Pound Sterling (GBP) finds support near a six-week low around 1.2540 in Tuesday’s early American session after the S&P Global/CIPS reported an upbeat Manufacturing PMI for March. The United Kingdom's Manufacturing PMI returns to expansion, landing above the 50.0 threshold that separates expansion from contraction at 50.3, higher than expectations and the former reading of 49.9.

Rob Dobson, Director at S&P Global Market Intelligence, said: “The end of the first quarter saw UK manufacturing recover from its recent doldrums. Production and new orders returned to growth, albeit only hesitantly, following yearlong downturns, with the main thrust of the expansion coming from stronger domestic demand.

The broader appeal of the GBP/USD pair is still poor, mainly due to weak market sentiment. The near-term outlook of the Cable is downbeat as traders push back prospects for the Federal Reserve’s (Fed) first rate cut, which is expected in the June meeting, after keeping them higher for more than two years. The prospect of higher interest rates for longer than anticipated benefits the US Dollar and weighs on the pair.

The robust recovery in the United States manufacturing sector, which exhibits a strong economic outlook, forced traders to roll back their bets on rate cuts by June. Higher demand for the US manufacturing sector indicates solid household spending, allowing Fed policymakers to avoid rushing for interest rate cuts. Upbeat economic prospects buy significant time for the Fed to observe more inflation data before jumping on rate cuts.

The US Dollar Index (DXY) prints a fresh four-month high slightly above 105.00 amid a cheerful safe-haven bid and good prospects for the US economy. More uncertainty is anticipated in global markets as the US Bureau of Labor Statistics (BLS) will report the Nonfarm Payrolls (NFP) data for March on Friday.

Daily digest market movers: Pound Sterling finds support after UK factory data

- The Pound Sterling seems vulnerable near more than six-week low around 1.2540 due to multiple headwinds. Slowing United Kingdom inflation and dismal market mood have weighed heavily on the Pound Sterling.

- The British Retail Consortium (BRC) reported on Tuesday that the UK’s shop price inflation grew 1.3% in March, its slowest pace in more than two years. This marks a deceleration from the 2.5% increase seen in February. Shop price inflation fell due to softer prices of both food and non-food items. Non-food prices rose meagrely by 0.2% from the 1.3% rise seen a month earlier, while food prices grew by 3.7%, down from 5.0%.

- BRC Chief Executive Helen Dickinson said fierce competition among retailers to bring prices down for their customers has eased shop price inflation to its lowest since December 2021. However, she warned that increasing cost pressures could put the progress in bringing down inflation at risk.

- Lower shop price inflation could be a relief for Bank of England policymakers, providing them with ground for reducing interest rates after keeping them at high levels for more than two years. Currently, the market expects that the BoE will begin reducing interest rates from the June meeting.

- The market sentiment has turned downbeat as traders have pared expectations for the Federal Reserve to cut interest rates in June. The prospects for a Fed rate cut that month eased after the United States Institute of Supply Management (ISM) reported stronger-than-expected Manufacturing PMI data for March. The Manufacturing PMI landed above the 50.0 threshold for the first time after 16 straight months of contraction. The US factory sector seems to be recovering from the high interest rate environment, which has weighed on activity for the last year and a half.

- Meanwhile, the US JOLTS Job Openings data for February remain steady. US employers posted 8.756 million, against expectations of 8.74 million, and the former release of 8.748 million.

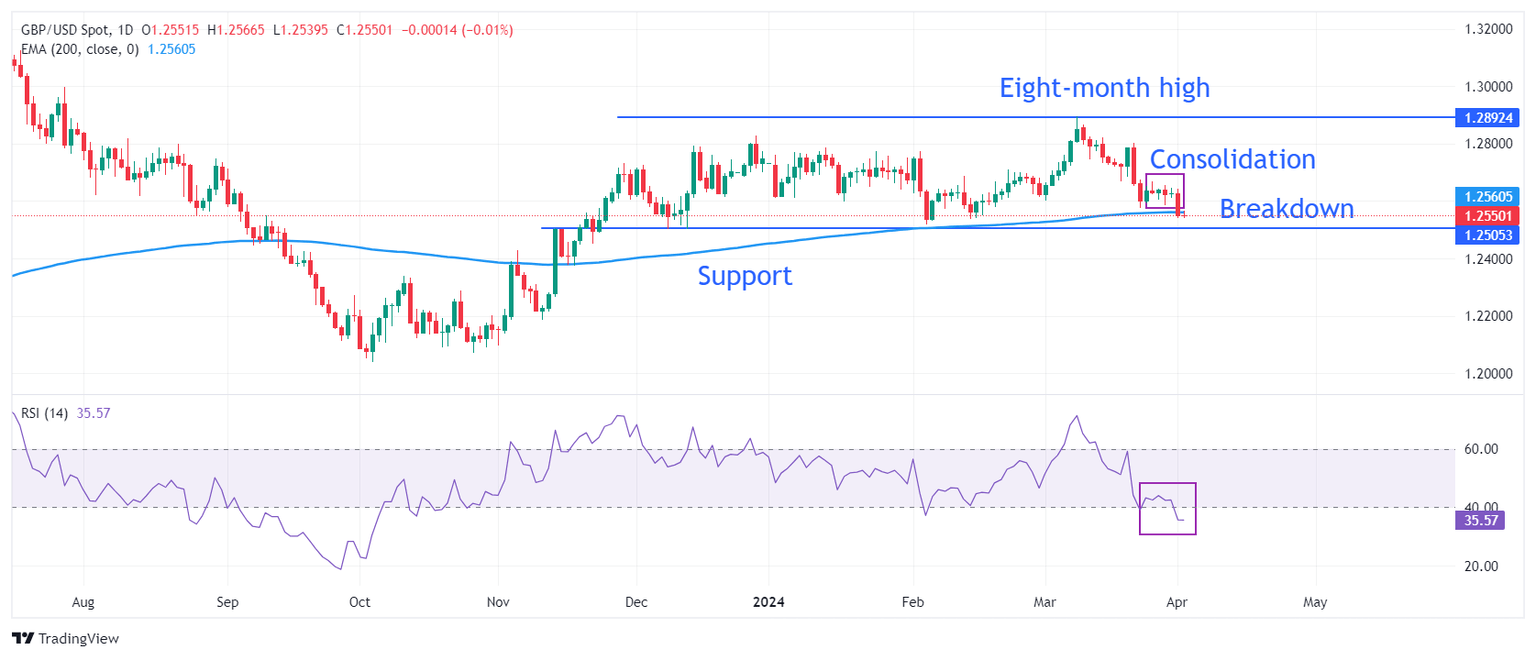

Technical Analysis: Pound Sterling hovers around 200-DEMA

The Pound Sterling delivers a breakdown of the consolidation formed in the range between 1.2575 and 1.2675 last week. The Cable seems vulnerable as it trades near the 200-day Exponential Moving Average (EMA) at 1.2568, indicating weak demand in the longer term.

On a broader time frame, the horizontal support from December 8 low at 1.2500 could provide further cushion to the Pound Sterling. Meanwhile, the upside is expected to remain limited near an eight-month high of around 1.2900.

The 14-period Relative Strength Index (RSI) dips below 40.00. If it sustains below this level, bearish momentum will trigger.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.