Pound Sterling seems vulnerable near 1.2400 after weak UK labor market dat

- The Pound Sterling stays on the backfoot as the UK ONS reported weaker-than-expected labor market data.

- Employers laid off workers in February, exhibiting the negative impact of higher UK interest rates.

- The market sentiment remains risk-off amid fears of an escalation in Middle East tensions.

The Pound Sterling (GBP) remains on the backfoot in Tuesday’s early New York session. The GBP/USD pair remains vulnerable as the United Kingdom Office for National Statistics (ONS) reported that labor market conditions have significantly cooled down in the three months ending February. The Unemployment Rate grew strongly to 4.2% and the overall labor market witnessed that 156K workers were laid-off.

The labor market data demonstrates uncertainty over the economic outlook, which could force Bank of England (BoE) policymakers to start reducing interest rates earlier than previously expected. Job-seekers and current employees compromise with salary hikes when labor market conditions cool down, which results in slower wage growth that allows high inflation to return to its desired target sustainably.

More volatility is anticipated in the Pound Sterling as the UK ONS will report the consumer and producer inflation data for March, which will be published on Wednesday. The headline Consumer Price Index (CPI) is estimated to rise 3.1%, slower than the prior reading of 3.4%. The core CPI, which strips off volatile food and energy prices, is forecasted to rise 4.1%, slower than 4.5% in February. An expected decline in the inflation data would increase speculation for the BoE beginning to reduce interest rates from the August meeting.

Daily digest market movers: Pound Sterling remains under pressure while US Dollar holds strength

- The Pound Sterling extends its downside to 1.2410 as the United Kingdom ONS has reported weak labor market data. The ILO Unemployment Rate for the three months ending February rose sharply to 4.2% from expectations of 4.0% and the prior reading of 4.0% (revised from 3.9%). In February, employers fired 156K workers, higher than the prior reading of 89K, upwardly revised from 21K.

- In March, Claimant Count Change, which indicates the change in number of individuals claiming jobless benefits, was lower at 10.9K vs. expectations of 17.2K and the prior reading of 4.1K (revised from 16.8K).

- In the three months ending February, Average Earnings including bonuses rose steadily by 5.6%, beating the consensus of 5.5%. In the same period, Average Earnings excluding bonuses slowed to 6.0% against the former reading of 6.1%.

- Weak labor demand clearly shows the consequences of interest rates remaining higher by the Bank of England (BoE). The rising jobless rates and poor labor demand exhibit a vulnerable economic outlook, which could force the BoE to pivot to rate cuts sooner than expected.

- The market sentiment remains risk-averse amid fears of further escalation in Middle East tensions and deepening uncertainty about when the Federal Reserve will start reducing interest rates. Eventually, strong demand for safe-haven assets has pushed the US Dollar Index (DXY) to 106.30.

- The Israeli military said it would respond to Iran’s attack in their territory that happened on April 13 in which the latter launched hundreds of missiles and drones. This has deepened fears of war spreading beyond Gaza in the Middle East region.

- United States robust Retail Sales data, combined with strong labor demand and higher consumer price inflation in March have strengthened the argument that Fed policymakers could delay rate cuts later this year.

- San Francisco Fed Bank President Mary Daly said on Friday that there is absolutely no urgency to start reducing interest rates. Daly added that there is still more work to do to make sure that inflation is on course to return to the desired rate of 2%. She emphasized keeping interest rates restrictive for a longer period.

Technical Analysis: Pound Sterling finds cushion near 1.2400

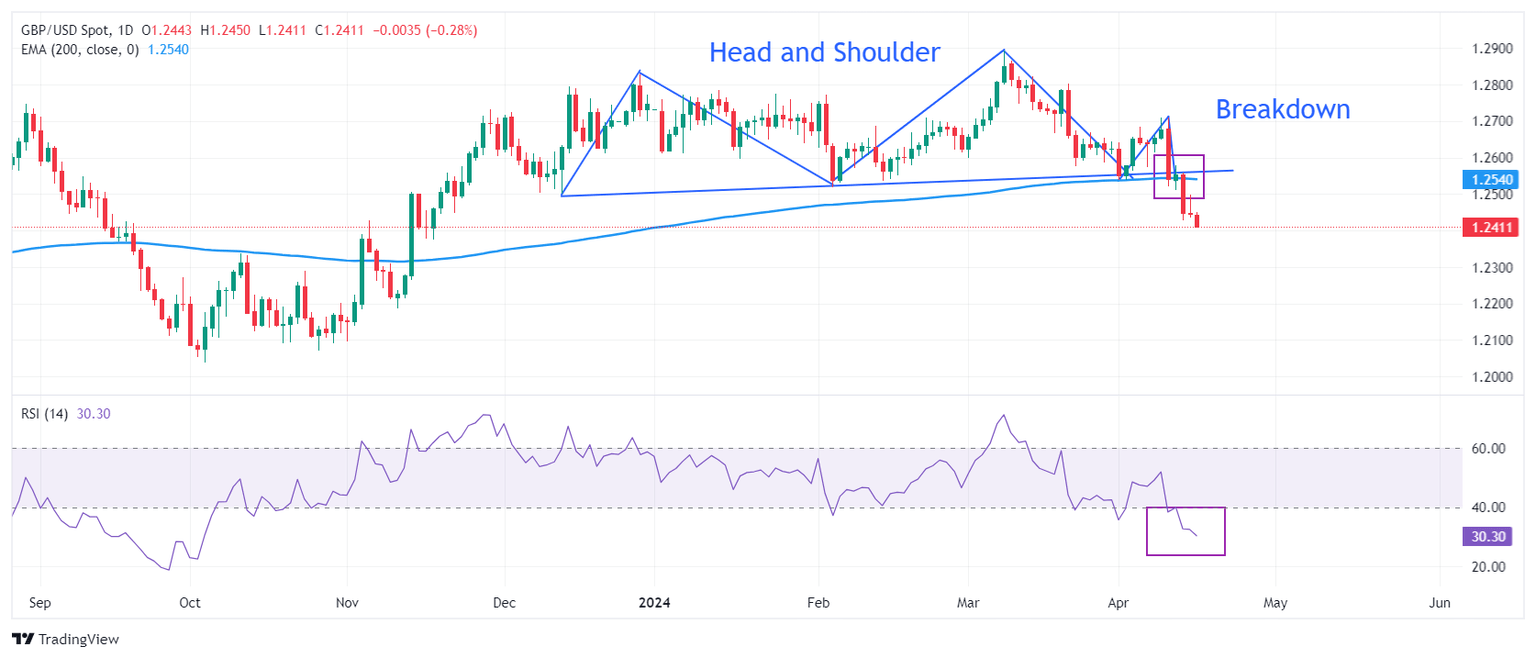

The Pound Sterling declines further to 1.2410 after extending its losing spell for the third trading session on Tuesday. The GBP/USD pair is expected to extend its downside to the round-level support at 1.2400. The Cable remains on the backfoot after a breakdown of the Head and Shoulder chart pattern, which exhibits a bearish reversal. The neckline of the aforementioned chart pattern is plotted from December 8 low near 1.2500.

The long-term outlook turns bearish as the Cable drops below the 200-day Exponential Moving Average (EMA), which trades around 1.2540.

The 14-period Relative Strength Index (RSI) shifts into the bearish range of 20.00-40.00, suggesting an active bearish momentum.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.