Pound Sterling Price News and Forecast: GBP/USD technical rebound could be in the offing

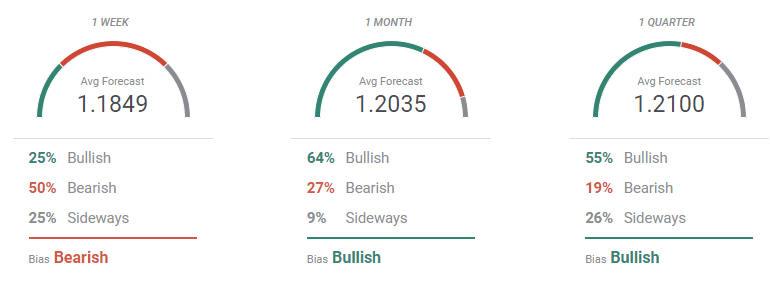

GBP/USD Weekly Forecast: A technical rebound could be in the offing

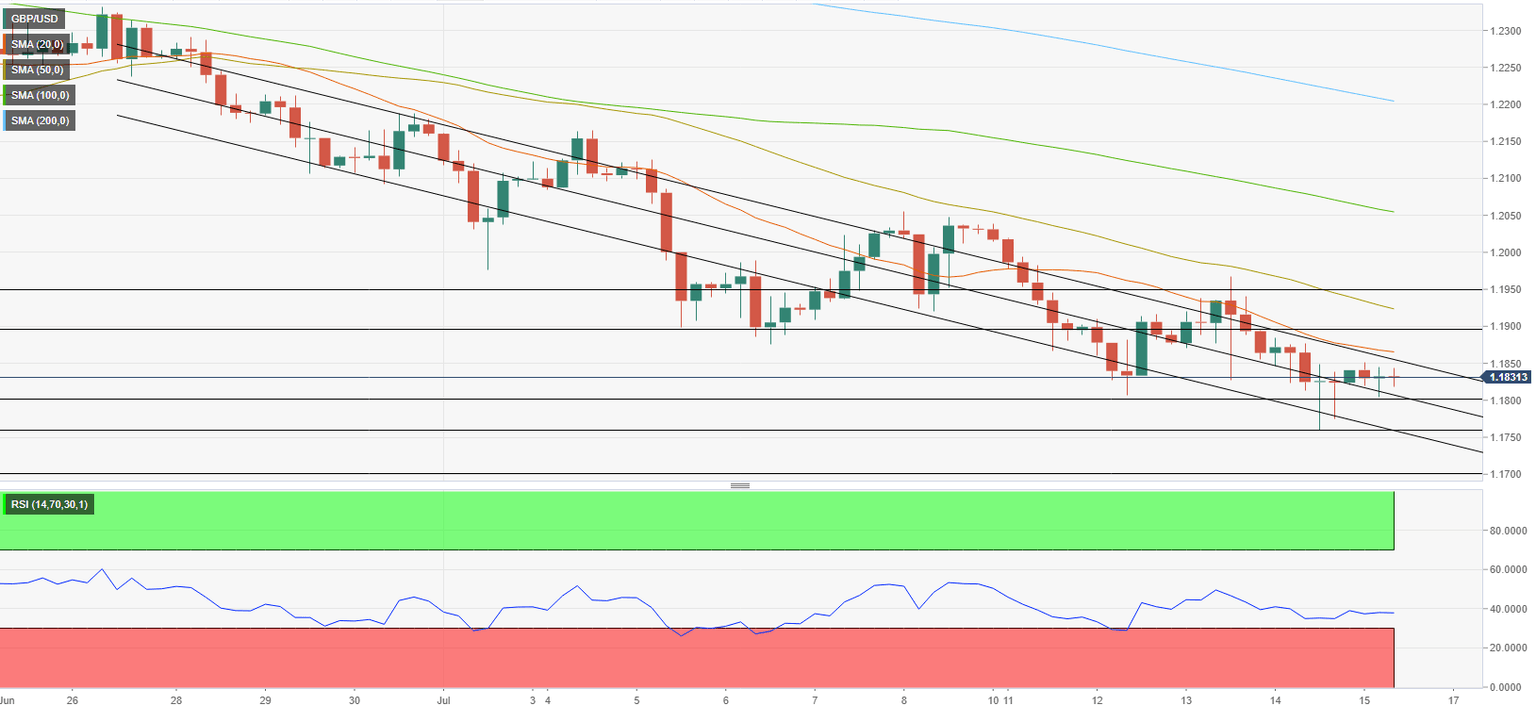

Having tested levels below 1.1900 a week ago, GBP/USD lost further ground and hit a new 28-month low of 1.1760 amid a combination of factors that worked against the British pound. The US inflation stood out in the week and added extra legs to the ongoing US dollar rally. Looking ahead, UK employment and inflation will hold the key as the Fed enters the ‘blackout period’. Read more...

GBP/USD sticks to modest gains below mid-1.1800s, moves little post-US Retail Sales

The GBP/USD pair held on to its modest intraday gains, below the 1.1850 region, through the early North American session and moved little in reaction to upbeat US macro data. Retail Sales rose 1% in June, better than estimates for a 0.8% increase. Adding to this, the previous month's reading was also revised higher to show a 0.1% decline as against the 0.3% fall reported earlier. Furthermore, excluding autos, core retail sales also surpassed expectations and climbed 1% in June, up from the 0.5% increase in the previous month. Read more...

GBP/USD Forecast: Pound could rebound on weak US data

GBP/USD has recovered and steadied above 1.1800 early Friday after having suffered heavy losses on Thursday. Investors await key macroeconomic data releases from the US and the dollar could face selling pressure in case the probability of a 100 basis points (bps) rate hike in July continues to decline. Read more...

Author

FXStreet Team

FXStreet