Pound Sterling Price News and Forecast: GBP/USD struggles to gain any meaningful traction on Monday

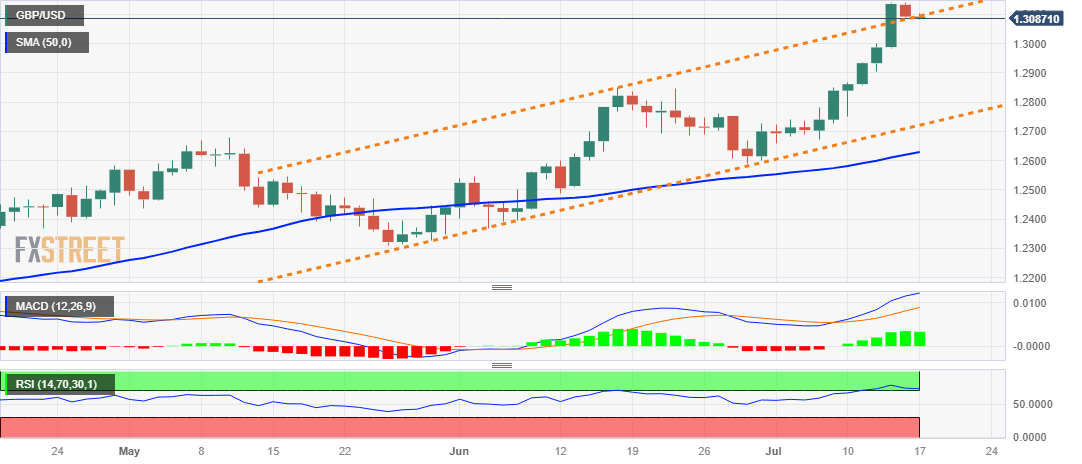

GBP/USD Price Analysis: Bulls have the upper hand, ascending channel breakout in play

The GBP/USD pair lacks any firm directional bias and oscillates in a narrow trading band, just below the 1.3100 round-figure mark through the first half of the Asian session on Monday. Spot prices, however, remain well within the striking distance of the highest level since April 2022, around the 1.3140 region touched on Friday, and seem poised to prolong the recent upward trajectory witnessed over the past two weeks or so.

The US Dollar (USD) struggles to capitalize on Friday's modest bounce from a 15-month low in the wake of firming expectations that the Federal Reserve (Fed) will end its rate-hiking cycle after the anticipated 25 bps lift-off in July. The British Pound (GBP), on the other hand, remains well supported by rising bets for a more aggressive policy tightening by the Bank of England (BoE) to curb high inflation. This suggests that the path of least resistance for the GBP/USD pair is to the upside and any meaningful corrective slide might still be seen as a buying opportunity. Read more...

GBP/USD stays defensive around 1.3100 on mixed news, focus on UK inflation, US Retail Sales

GBP/USD remains sidelined around 1.3090 amid Monday’s early Asian session, after reversing from the highest levels in 15 months. In doing so, the Pound Sterling struggles to cheer news of the UK’s biggest trade deal after Brexit due to the economic fears surrounding Britain. Also challenging the Cable buyers are the latest doubts on the market’s concerns about the Federal Reserve (Fed) during the two-week blackout period for the US central bank policymakers ahead of the late July monetary policy meeting.

The UK’s official joining of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), unveiled Sunday, marks London’s biggest trade victory since Brexit. However, a slump in the UK’s home price and fears of witnessing more medical strikes challenge the trade optimism. Additionally, the news that the UK consumer group calls for government action on grocery prices, shared via Reuters, also raise grim concerns about the UK economy and prod the GBP/USD bulls. Read more...

Author

FXStreet Team

FXStreet