GBP/USD Forecast: Boris' issues, strong US economy set to outweigh technicals, push the pound down

Fundamentals or technicals? The last day of the month is already set to be choppy amid last-minute portfolio adjustments, and the contradicting signals between both approaches may cause more confusion. However, two factors may outweigh what the charts show.

First, the greenback is making a comeback and this is set to extend. The dollar suffered from the Federal Reserve's dovish decision on Wednesday, in which the central bank rejected tapering down its bond-buying scheme, stressed inflation is transitory and said that the economy has a "long way to go." However, figures published on Thursday showed that way is shorter. Read more...

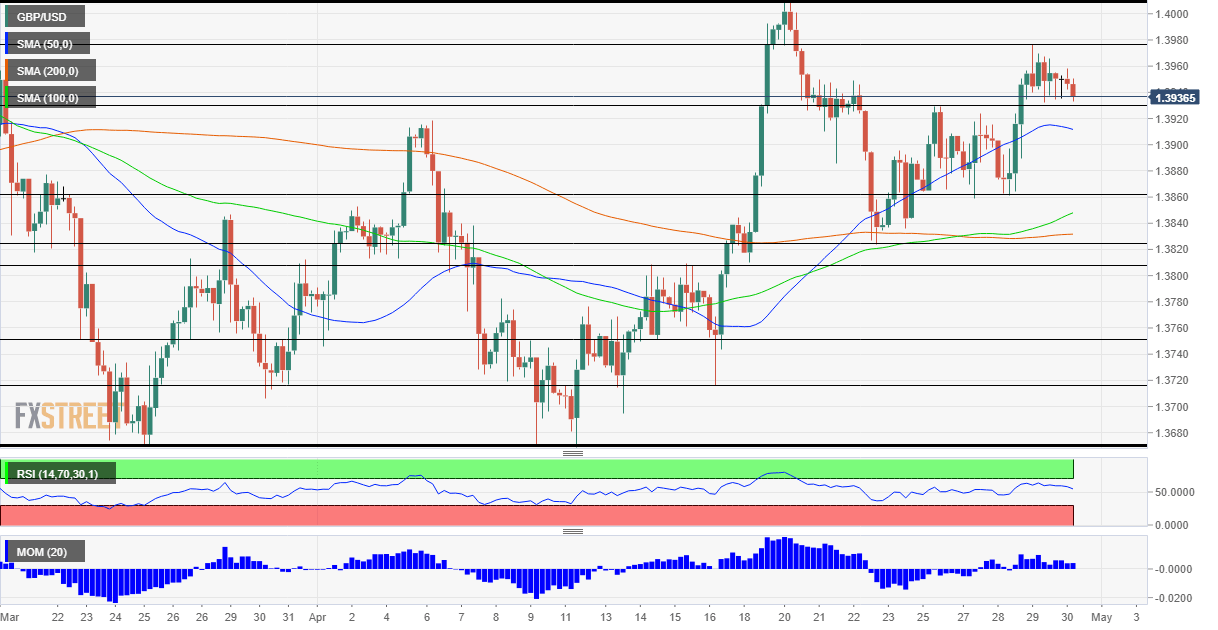

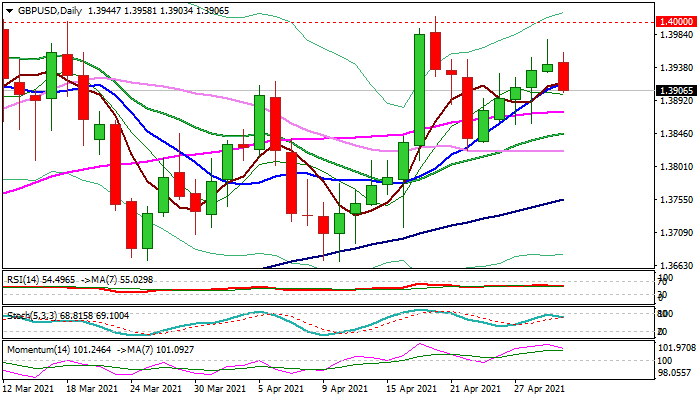

GBP/USD outlook: Thursday's shooting star and stronger dollar weigh on sterling

Cable accelerated lower in early Friday, driven by fading risk appetite and a stronger dollar. Five-day rally 1.3823 (Apr 22 trough) showed signs of stall and Thursday’s action formed a shooting star candle, while today’s weakness added to signals of reversal on the daily chart.

Narrowing daily cloud twists next Tuesday (1.3878) and also attracts fresh bears which pressure 1.3900 support (50% retracement of 1.3823/1.3976), with a weekly close below here further weaken near-term structure and risk deeper drop towards 1.3877 (55DMA) and 1.3860 higher bases. Read more...

GBP/USD drops to 1.3900 neighborhood, fresh session lows

The GBP/USD pair refreshed daily lows during the early European session, with bears now awaiting a sustained break below the 1.3900 round-figure mark.

The pair extended the previous day's retracement slide from over one-week tops, around the 1.3975 region, and witnessed some selling on the last trading day of the week. This marked the first day of a negative move in the previous six trading sessions and was sponsored by a modest US dollar strength. Read more...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.