GBP/USD Forecast: Boris' issues, strong US economy set to outweigh technicals, push the pound down

- GBP/USD has been edging off the highs as rising US yields boost the dollar.

- PM Johnson's issues and upbeat US data could drag cable down.

- Friday's four-hour chart is pointing to gains.

Fundamentals or technicals? The last day of the month is already set to be choppy amid last-minute portfolio adjustments, and the contradicting signals between both approaches may cause more confusion. However, two factors may outweigh what the charts show.

First, the greenback is making a comeback and this is set to extend. The dollar suffered from the Federal Reserve's dovish decision on Wednesday, in which the central bank rejected tapering down its bond-buying scheme, stressed inflation is transitory and said that the economy has a "long way to go." However, figures published on Thursday showed that way is shorter.

Gross Domestic Product grew by 6.4% annualized in the first quarter, and while that was only within estimates, it points to robust growth. Moreover, a surge in personal consumption, investment– and a drawdown in inventories – all point to even stronger growth down the line. Prices figures released alongside the data also point to the upside.

US GDP Quick Analysis: Strong growth now, stronger even later, three reasons for the dollar to rise

Another bulk of figures for March is due out on Friday. Personal Income and Personal Spending are set to jump as that was the month Americans received their stimulus checks. Investors will likely focus on the Core Personal Consumption Expenditure (Core PCE) figure – the Fed's preferred inflation gauge. It is set to jump to around 1.8%, closer to the bank's 2% target. The figures may give the greenback another boost.

US Personal Consumption Expenditure Price Index March Preview: Inflation is here

On the other side of the pond, there are no notable British releases, but politics will likely weigh on sterling. Prime Minister Boris Johnson has come under growing scrutiny for allegedly asking Conservative Party donors to pay for renovating his official residence. It joins offensive comments about preferring "bodies piling in the streets" over forcing another lockdown.

The PM's issues may hobble the government's efforts to manage the recovery. Moreover, the UK's successful vaccination campaign –with jabs now available to 42-year-olds – is already well into the pound's price.

All in all, fundamentals are pointing lower. What about technicals?

GBP/USD Technical Analysis

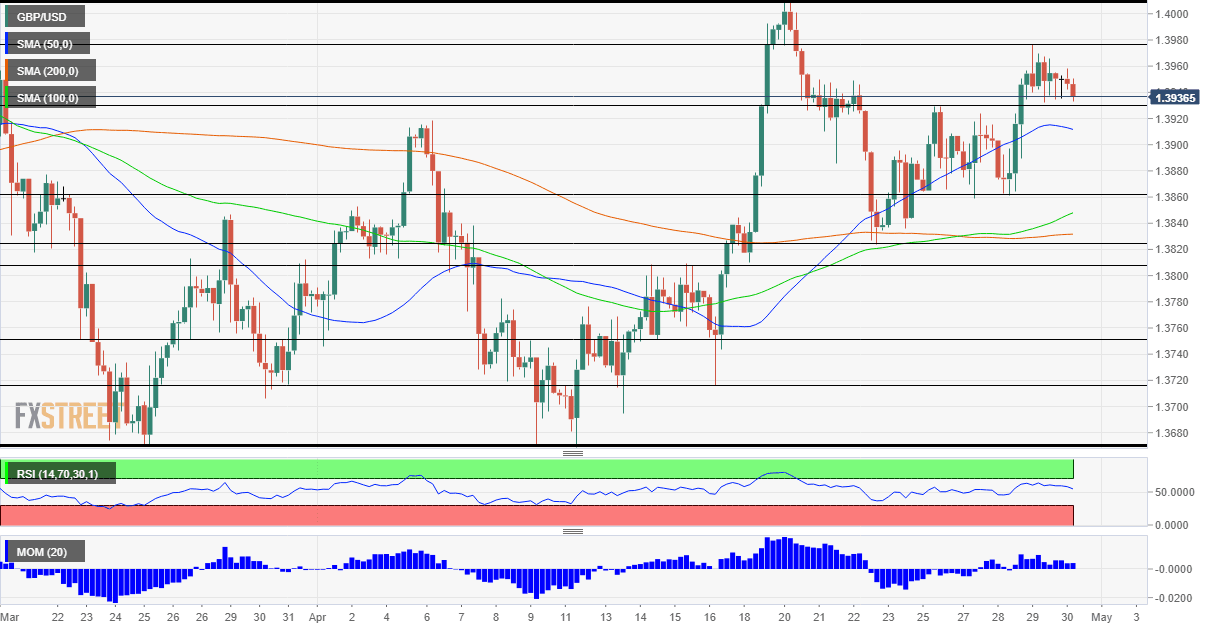

Pound/dollar has been holding up above the 50 Simple Moving Average (SMA) on the four-hour chart, and also benefits from upside momentum. The Relative Strength Index (RSI) is balanced, thus far from causing worries about overbought conditions.

Some support awaits at 1.3930, the daily low, followed by 1.3860, a cushion seen earlier this week. It is followed by 1.3825 and 1.3810.

Resistance is at 1.3975, the daily high, and then by the all-important 1.4010 cap. The next noteworthy cap is 1.4140.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.