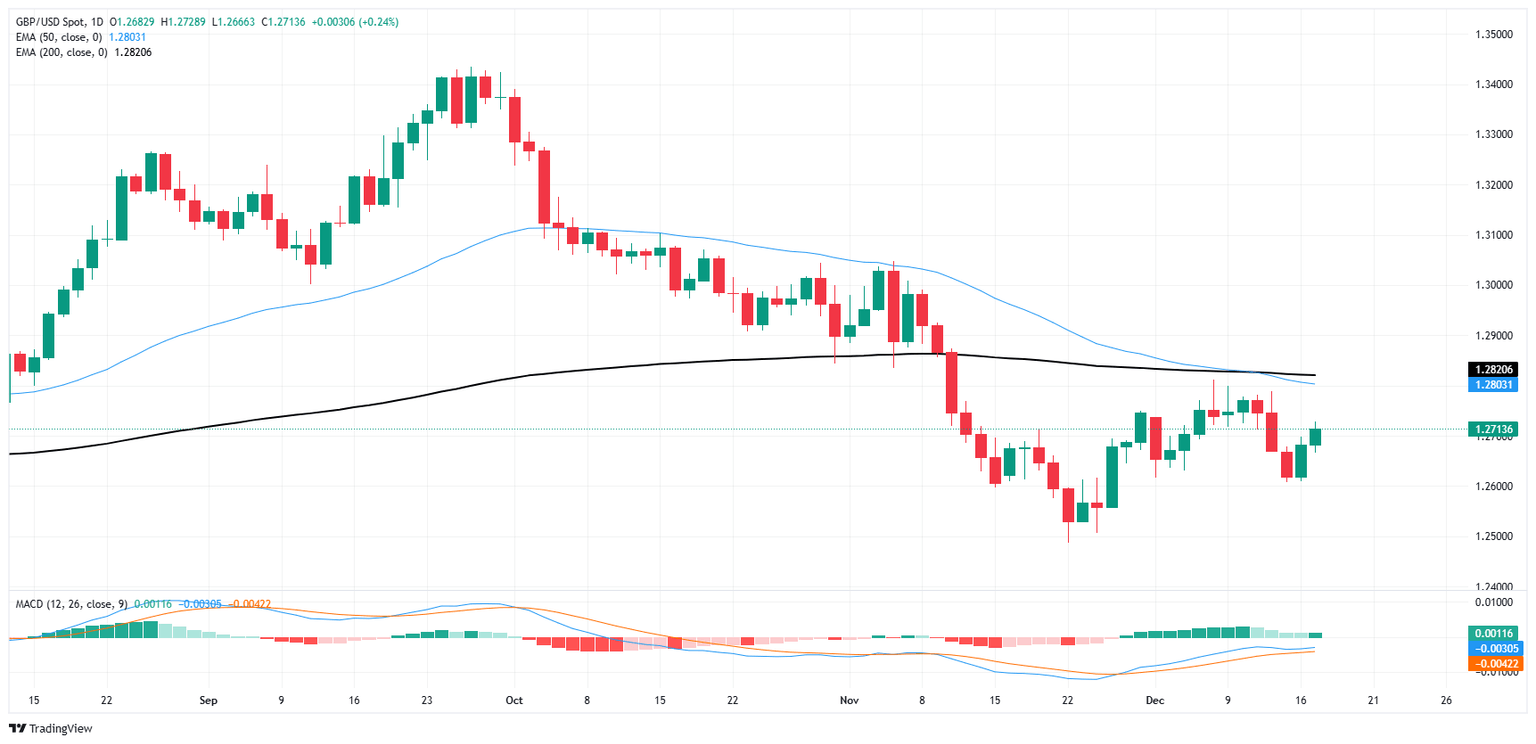

Pound Sterling Price News and Forecast: GBP/USD lacks any firm intraday direction and oscillates in a range

GBP/USD consolidates around 1.2700 mark ahead of UK CPI, FOMC decision

The GBP/USD pair struggles to capitalize on a two-day-old recovery move from the vicinity of the 1.2600 mark, or a three-week low touched on Monday and oscillates in a narrow band during the Asian session. Spot prices currently trade around the 1.2700 round figure, nearly unchanged for the day as traders keenly await the outcome of the highly-anticipated FOMC policy meeting before placing fresh directional bets.

The Federal Reserve (Fed) is widely expected to lower borrowing costs by 25 basis points and adopt a more cautious stance on cutting interest rates going forward. Hence, investors will closely scrutinize the so-called dot plot and Fed Chair Jerome Powell's comments at the post-meeting press conference for cues about the future rate-cut path. This, in turn, will influence the near-term US Dollar (USD) price dynamics and provide some meaningful impetus to the GBP/USD pair. Read more...

GBP/USD remains mired near 1.2700 as central bank decisions loom large

GBP/USD stretched into a two-day winning streak on Tuesday, gaining one-fifth of one percent and recapturing the 1.2700 handle, but only just. Cable is paring away last week’s losses to recover into a near-term middle ground as Pound Sterling traders brace for a hefty end-of-year docket that includes rate calls from the Federal Reserve (Fed) and the Bank of England (BoE), as well as one last update on UK Consumer Price Index (CPI) inflation.

US Retail Sales figures lurched higher to 0.7% MoM on Tuesday, stoking some mild concern among investors that maybe the Fed doesn’t need to pursue an aggressive rate-cutting strategy after all, especially when counting a recent uptick in inflation metrics. Despite this, markets are still broadly pricing in a third straight rate cut from the Fed on Wednesday, with 95% odds favoring a 25 bps rate trim according to the CME’s FedWatch Tool. Read more...

Author

FXStreet Team

FXStreet