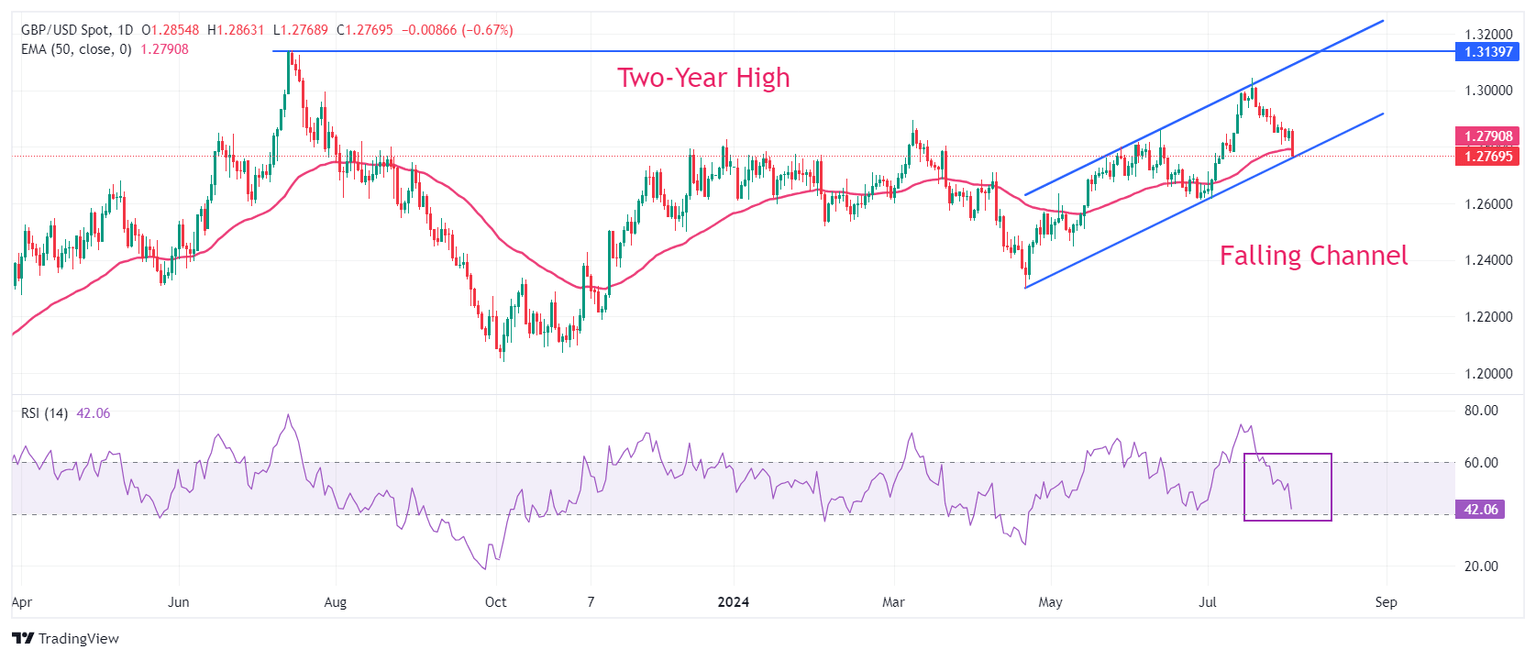

Pound Sterling Price News and Forecast: GBP/USD heads for 1.2700 after slumping to a one-month low

GBP/USD depreciates toward 1.2700 due to increased risk-off mood, BoE rate cut

GBP/USD extends its losses following the Bank of England‘s (BoE) decision to deliver a broadly expected 25-basis point rate cut at its August meeting held on Thursday. The GBP/USD pair trades around 1.2720 during the Asian session on Friday.

BoE Governor Andrew Bailey explained the decision to reduce the policy rate to 5% and addressed media questions. Bailey noted that the increase in the minimum wage has not been detrimental from their viewpoint. According to Bailey, while firms often cite higher minimum wages as compressing pay scales, the overall inflation trajectory, including upside risks, is now closer to the 2% target compared to the median forecast. Read more...

GBP/USD backslides after BoE rate cut with NFP looming ahead

GBP/USD found a new hole in the floor on Thursday, declining towards the 1.2700 handle after fresh recession fears off the back of a miss in US Purchasing Managers Index (PMI) figures that mixed poorly with easing Pound Sterling flows after the Bank of England (BoE) delivered a broadly-expected quarter-point rate trim.

Friday’s upcoming US Nonfarm Payrolls (NFP) will be a critical print this week after the Federal Reserve (Fed) laid out the track needed in economic data to deliver a widely-anticipated rate cut in September. Investors will be hoping for a continued, but not too steep, decline in new jobs additions in July. US NFP is expected to ease down to 175K net new hirings for the month compared to the previous month’s 206K. Read more...

Pound Sterling recovers some losses as BoE refrains from aggressive easing cycle

The Pound Sterling (GBP) recovers some of its losses but still remains negative against its major peers in Thursday’s New York session. The British currency bounces gradually as the Bank of England (BoE) avoids endorsing an aggressive policy-easing stance on interest rates ahead. BoE Governor Andrew Bailey said in the press conference, "We need to make sure inflation stays low, and be careful not to cut interest rates too quickly or by too much." On the United Kingdom's (UK) service inflation outlook, Bailey commented, "Services price inflation may rise slightly in August before easing in the rest of the year."

Earlier, the BoE has cut its key borrowing rates by 25 basis points (bps) to 5%, with a 5-4 majority in the Monetary Policy Committee (MPC) vote, which was also in line with market expectations. Policymakers who voted for a rate cut were Andrew Bailey, Sarah Breeden, Swati Dhingra, Dave Ramsden, and Clare Lombardelli. Read more...

Author

FXStreet Team

FXStreet