Pound Sterling Price News and Forecast: GBP/USD edges lower on Thursday amid the emergence of some USD buying

GBP/USD Price Analysis: Bulls turn cautious amid overbought RSI, downside potential seems limited

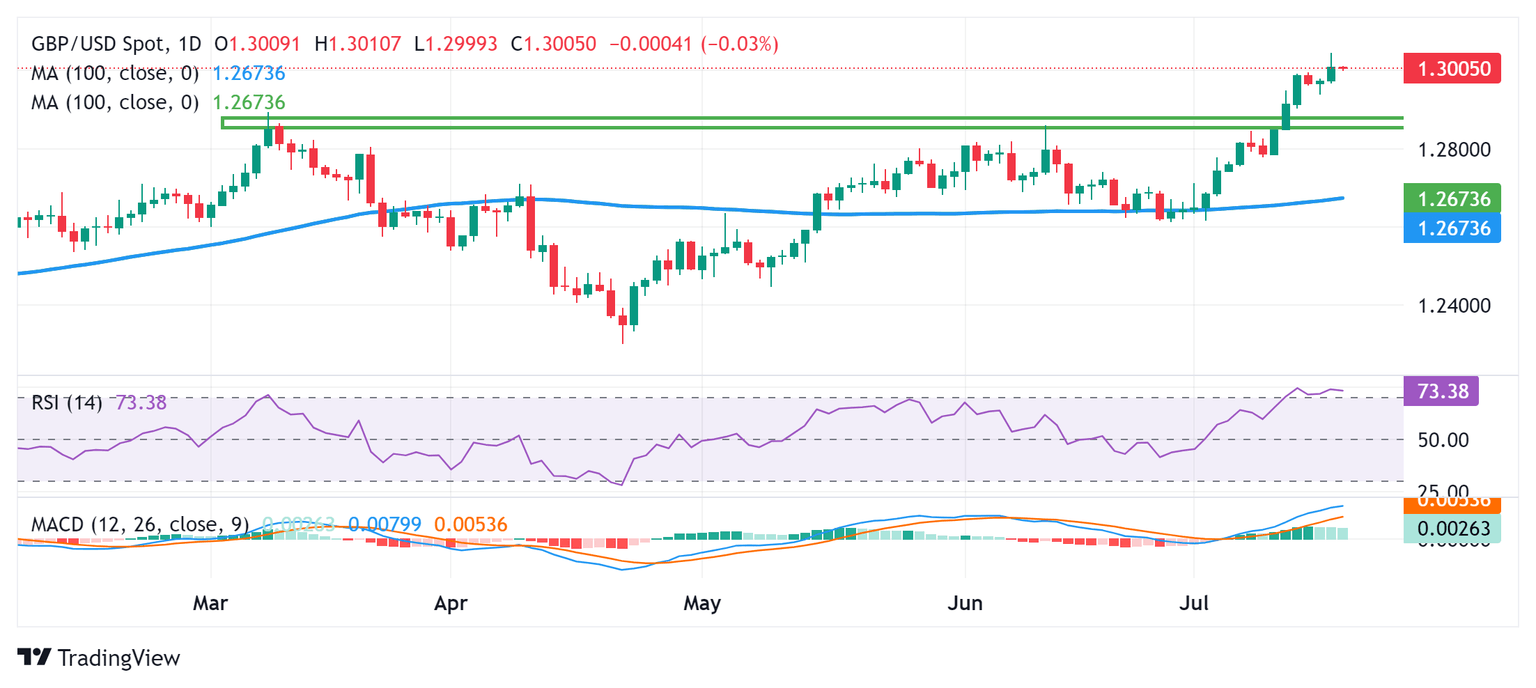

The GBP/USD pair trades with a mild negative bias during the Asian session on Thursday, albeit lacks follow-through selling and remains well within the striking distance of the one-year peak touched the previous day. Spot prices currently hover around the 1.3000 psychological mark and seem poised to prolong the recent uptrend witnessed over the past three weeks or so.

A modest pickup in the US Treasury bond yields assists the US Dollar (USD) in recovering a part of the previous day's heavy losses to a nearly four-month low, which, in turn, is seen acting as a headwind for the GBP/USD pair. That said, growing acceptance that the Federal Reserve (Fed) will start the rate-cutting cycle in September, along with the underlying strong bullish tone across the global equity markets, might cap the upside for the safe-haven Greenback. Read more...

GBP/USD reclaims 1.30 as markets tilt further into rate cut hopes

GBP/USD inched further into fresh highs, testing chart territory north of the 1.3000 handle on Wednesday. Broad-market hopes of a rate cut from the Federal Reserve (Fed) in September kept the Greenback underbid and gave the Pound Sterling (GBP) a leg up in the mid-week market session. Recent Fedspeak has been interpreted as firmly dovish, with market participants seeing the writing on the wall they wish to as Fed officials give a head nod to recent progress on inflation measures. Cable traders will also want to keep an eye out for any knock-on volatility from the European Central Bank's (ECB) Thursday rate call.

Rate markets have fully priced in at least a quarter-point rate trim when the Federal Open Market Committee (FOMC) gathers for a rate call on September 18, and July’s month-end meeting is still expected to keep rates flat. According to the CME’s FedWatch Tool, 98% odds of a September rate cut are fully priced in, with rate traders seeing three cuts in 2024 compared to the Fed’s own modest projections of one or two. Read more...

Author

FXStreet Team

FXStreet