Pound Sterling Price News and Forecast: GBP/USD bulls eye the 1.33 figure

GBP/USD Price Analysis: Bulls eye the 1.33 figure

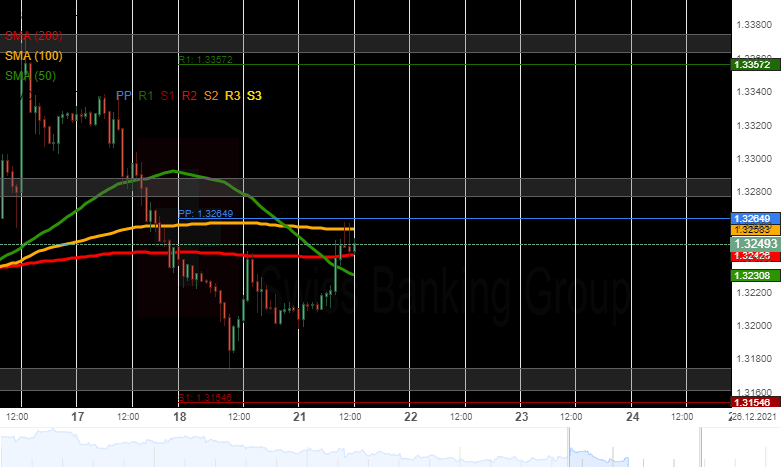

GBP/USD bulls are looking for a run to test 1.33 the figure. Bears need to commit at this juncture or face continued pressures for the sessions ahead. GBP/USD is not showing any signs of an imminent break of daily ranges. However, the 4-hour chart's imbalance between spot and 1.33 the figure is compelling. Read more...

GBP/USD Forecast: Pound needs to overcome 1.3260 to extend recovery

GBP/USD has gathered recovery momentum after dipping below 1.3200 on Monday and continues to edge higher in the early trading hours of the European session. Some inspiring Brexit headlines seem to be helping the British pound find demand but the pair could struggle to stretch higher if the UK decides to impose additional Omicron-related restrictions. Earlier in the day, Irish Prime Minister Micheál Martin told Newstalk radio that the talks between Britain and the European Union (EU) were on track for progress. "We were on a track - the European Union and the United Kingdom. I think we still are. I think Liz Truss gets it in terms of what is required," Martin said. Read more...

GBP/USD analysis: Continues to recover

Since mid-Monday's trading, the GBP/USD bounced off the resistance of the 200-hour simple moving average, retraced and found support in the 1.3200 mark and succeeded to pass the 200-hour SMA. At mid-day on Tuesday, the pair had reached the 1.3260 level, where the GBP/USD faced the resistance of the 100-hour SMA and the weekly simple pivot point. In the case that the pair passes the resistance of the weekly simple pivot point at 1.3265, the GBP/USD might encounter resistance in the zone above 1.3280. Higher above, take into account the weekly R1 at 1.3357, before the December high level. Read more...

Author

FXStreet Team

FXStreet