Pound Sterling Price News and Forecast: GBP/USD begins 2024 in a muted tone

GBP/USD Forecast: Bulls could turn hesitant if 1.2700 support fails

GBP/USD touched its highest level in five months above 1.2800 in the previous week but erased its gains ahead of the New Year holiday to close the week virtually unchanged. Early Tuesday, the pair trades modestly higher on the day at around 1.2750 as trading conditions are yet to normalize.

GBP/USD rose nearly 1% in December. Although the US Dollar (USD) weakened against its major rivals, it managed to limit its losses against Pound Sterling. Softer-than-forecast inflation data from the UK and concerning growth figures caused investors to second-guess the timing of the Bank of England's (BoE) policy pivot in 2024. Read more...

GBP/USD begins 2024 in a muted tone

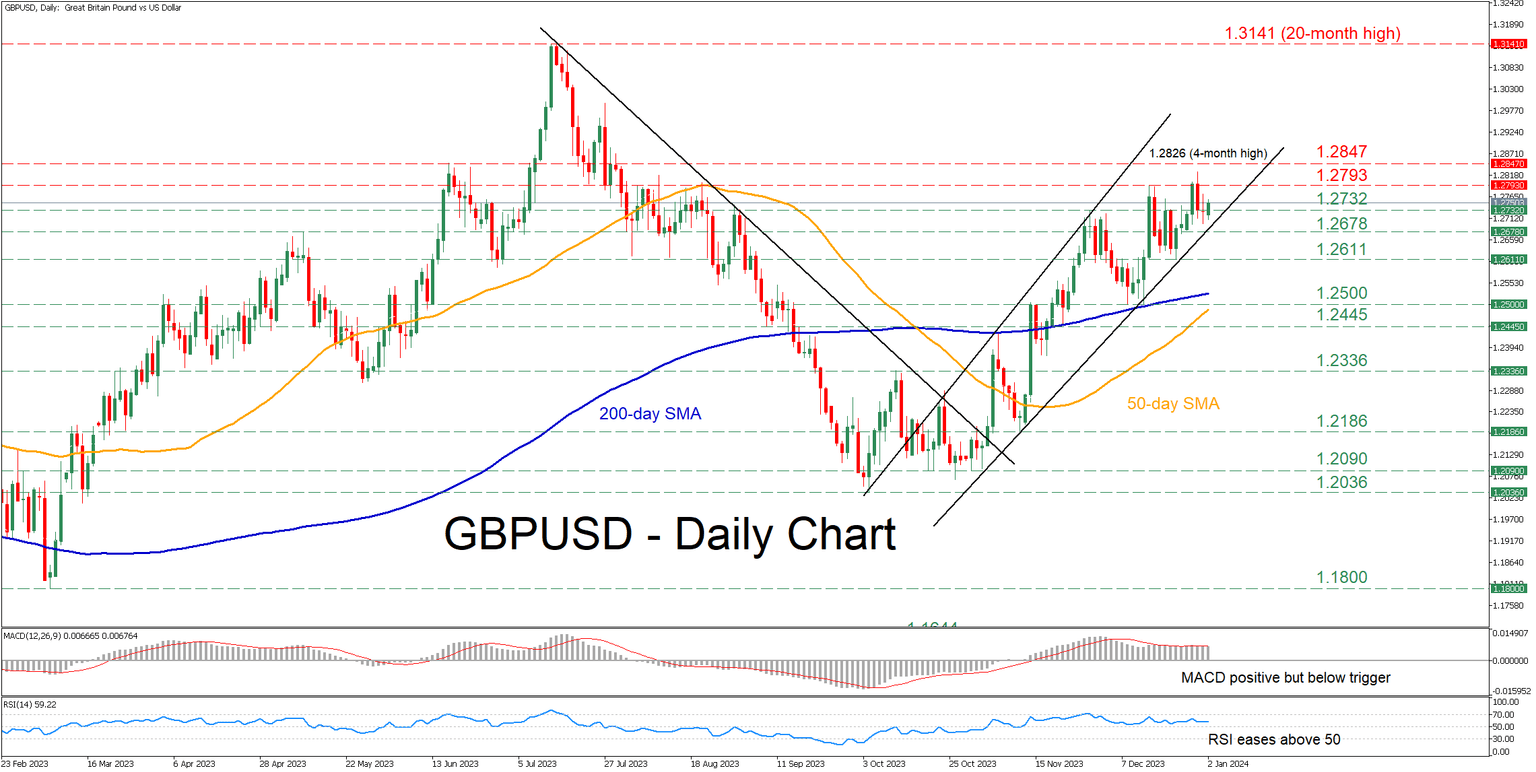

GBPUSD had been forming a profound structure of higher highs following its break above a crucial descending trendline in early November. Although the pair’s rally has temporarily paused at the four-month peak of 1.2826, the impending completion of a golden cross between the 50- and 200-day simple moving averages (SMAs) could infuse upside pressures.

Given that the short-term oscillators are providing cautiously positive signals, the bulls could attempt to erase the latest weakness and conquer the December resistance of 1.2793. A violation of that hurdle could open the door for the four-month peak of 1.2826. Failing to halt there, the pair might advance towards the June high of 1.2847. Read more...

Pound Sterling turns subdued after downbeat UK factory data

The Pound Sterling (GBP) faces nominal sell-off after the release of the weaker-than-projected S&P Global Manufacturing PMI for December. The factory data remained lower at 46.2 than expectations and the former reading of 46.4. The economic data below the 50.0 threshold indicates contraction in economic activities. The Manufacturing PMI remains below the 50.0 threshold for the 17-month in a row.

S&P Global commented that “UK manufacturing output contracted at an increased rate at the end of 2023. The demand backdrop also remains frosty, with new orders sinking further as conditions remain tough in both the domestic market and in key export markets, notably the EU. The downturn has hit manufacturers' confidence, which dipped to its lowest level in a year, and encouraged renewed cost caution with further cutbacks to stock levels, purchasing and employment. Read more...

Author

FXStreet Team

FXStreet