GBP/USD Forecast: Bulls could turn hesitant if 1.2700 support fails

- GBP/USD clings to modest gains near 1.2750 early Tuesday.

- Pound Sterling could come under technical selling pressure if 1.2700 support fails.

- Investors will have several key data releases from the US to assess later this week.

GBP/USD touched its highest level in five months above 1.2800 in the previous week but erased its gains ahead of the New Year holiday to close the week virtually unchanged. Early Tuesday, the pair trades modestly higher on the day at around 1.2750 as trading conditions are yet to normalize.

GBP/USD rose nearly 1% in December. Although the US Dollar (USD) weakened against its major rivals, it managed to limit its losses against Pound Sterling. Softer-than-forecast inflation data from the UK and concerning growth figures caused investors to second-guess the timing of the Bank of England's (BoE) policy pivot in 2024.

Pound Sterling price today

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies today. Pound Sterling was the strongest against the Swiss Franc.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.08% | -0.06% | 0.05% | -0.19% | 0.26% | 0.19% | 0.43% | |

| EUR | -0.07% | -0.13% | -0.02% | -0.26% | 0.18% | 0.12% | 0.36% | |

| GBP | 0.05% | 0.13% | 0.10% | -0.17% | 0.32% | 0.22% | 0.46% | |

| CAD | -0.05% | 0.02% | -0.11% | -0.23% | 0.21% | 0.14% | 0.39% | |

| AUD | 0.18% | 0.26% | 0.12% | 0.23% | 0.44% | 0.37% | 0.62% | |

| JPY | -0.26% | -0.17% | -0.32% | -0.20% | -0.44% | -0.06% | 0.19% | |

| NZD | -0.16% | -0.08% | -0.22% | -0.13% | -0.37% | 0.11% | 0.21% | |

| CHF | -0.44% | -0.34% | -0.47% | -0.36% | -0.63% | -0.15% | -0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Meanwhile, the CME Group FedWatch Tool shows that markets are pricing in a nearly 85% probability that the Federal Reserve (Fed) will lower the policy rate by 25 basis points in March.

There won't be any high-tier data releases in Tuesday's economic calendar, other than revisions to S&P Global Manufacturing PMI figures for the UK and the US.

In the second half of the week, ISM PMI surveys from the US and December jobs report will be watched closely by market participants.

GBP/USD Technical Analysis

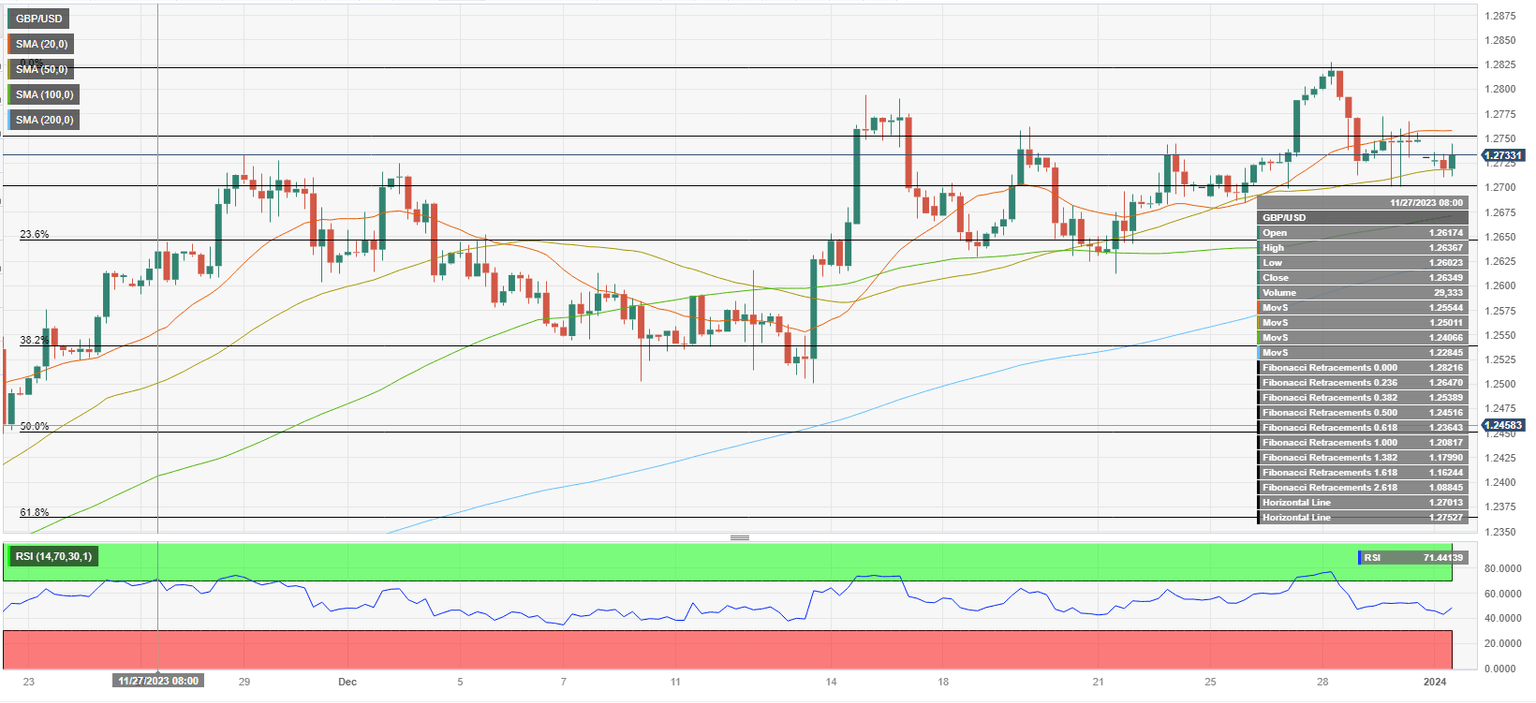

The 50-period Simple Moving Average (SMA) on the 4-hour chart acts as dynamic support at around 1.2720. If GBP/USD falls below that level, 1.2700 (psychological level, static level) aligns as next key support level. A 4-hour close below this support could attract technical sellers and open the door for an extended downward correction toward 1.2650 (Fibonacci 23.6% retracement of the latest uptrend).

On the upside, interim resistance is located at 1.2750 (20-period SMA, static level) before 1.2800 (psychological level, static level) and 1.2830 (December 28 high).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.