Pound Sterling strengthens as UK inflation accelerates faster than expected

- The Pound Sterling rises sharply after the UK inflation data for October came in hotter than expected.

- Hot UK inflation data could diminish the odds of the BoE delivering another interest-rate cut in December.

- Several Bank of England policymakers have warned about price pressures remaining persistent.

The Pound Sterling (GBP) gains sharply against the majority of its peers on Wednesday as data from the United Kingdom (UK) Office for National Statistics (ONS) showed inflation accelerated more than expected in October. The Consumer Price Index (CPI) report showed that the annual headline inflation quickened to 2.3% YoY, higher than estimates of 2.2% and the September reading of 1.7%.

Compared with the previous month, headline inflation rose sharply by 0.6%, higher than expectations of 0.5%, and after remaining flat in September.

The core CPI – which excludes volatile items such as food, energy, oil, and tobacco – grew by 3.3%, higher than the former reading of 3.2%. Economists had expected core inflation to fall to 3.1%.

Services inflation, a closely watched indicator by Bank of England (BoE) officials, accelerated to 5% from the prior release of 4.9%. Signs of further acceleration in price pressures could force traders to pare bets supporting interest rate cuts in the BoE December policy meeting.

On Tuesday, traders priced a roughly 80% chance that the BoE will cut interest rates by 25 basis points (bps) in the December meeting, according to Reuters.

Several Bank of England (BoE) policymakers – including Governor Andrew Bailey – also warned about price pressures remaining persistent in the monetary policy hearings before the Treasury Select Committee (TSC) on Tuesday. "Services inflation is still above a level that's compatible with on-target inflation," Andrew Bailey said. BoE external member Catherine Mann, an outspoken hawk, said: "Financial markets' inflation expectations suggest the BoE will not get to sustainable 2% inflation in the forecast horizon."

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.52% | 0.19% | 0.70% | 0.21% | 0.57% | 0.66% | 0.29% | |

| EUR | -0.52% | -0.32% | 0.15% | -0.31% | 0.05% | 0.13% | -0.22% | |

| GBP | -0.19% | 0.32% | 0.45% | 0.01% | 0.37% | 0.45% | 0.11% | |

| JPY | -0.70% | -0.15% | -0.45% | -0.47% | -0.10% | -0.03% | -0.38% | |

| CAD | -0.21% | 0.31% | -0.01% | 0.47% | 0.37% | 0.45% | 0.09% | |

| AUD | -0.57% | -0.05% | -0.37% | 0.10% | -0.37% | 0.09% | -0.27% | |

| NZD | -0.66% | -0.13% | -0.45% | 0.03% | -0.45% | -0.09% | -0.36% | |

| CHF | -0.29% | 0.22% | -0.11% | 0.38% | -0.09% | 0.27% | 0.36% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling declines against US Dollar

- The Pound Sterling performs strongly against its major peers but gives up its intraday gains after climbing to near 1.2700 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair surrenders gains as the US Dollar bounces back sharply, with the US Dollar Index (DXY), jumping around 106.70 on expectations of lower interest rate cuts from the Federal Reserve (Fed) in 2025.

- Given the fact that President-elected Donald Trump’s victory in both United States (US) will allow him to execute his economic agenda smoothly, market participants expect the Fed to follow a more gradual policy-easing cycle. US inflation and economic growth are expected to revamp when Trump takes office as policies such as higher import tariffs and lower taxes are expected to boost demand for domestic products and employment.

- Fed officials have refrained from providing projections about the likely impact of Trump’s policies on the economy. Also, they are confident about inflation remaining on a sustainable track towards the bank’s target of 2%.

- For the December meeting, the probability for the Fed to reduce interest rates by 25 basis points (bps) to 4.25%-4.50% has diminished to 59% from more than 82% a week ago, according to the CME FedWatch tool. Market expectations for Fed interest rate cuts diminished after Fed Chair Jerome Powell said last Thursday that the economy "is not sending signals that US central bank needs to be in a hurry to lower interest rates.”

- Going forward, investors will focus on the flash S&P Global Purchasing Managers’ Index (PMI) data for November, which will be published on Friday. The agency is expected to show that overall private sector activity expanded in the US but remained steady in the UK.

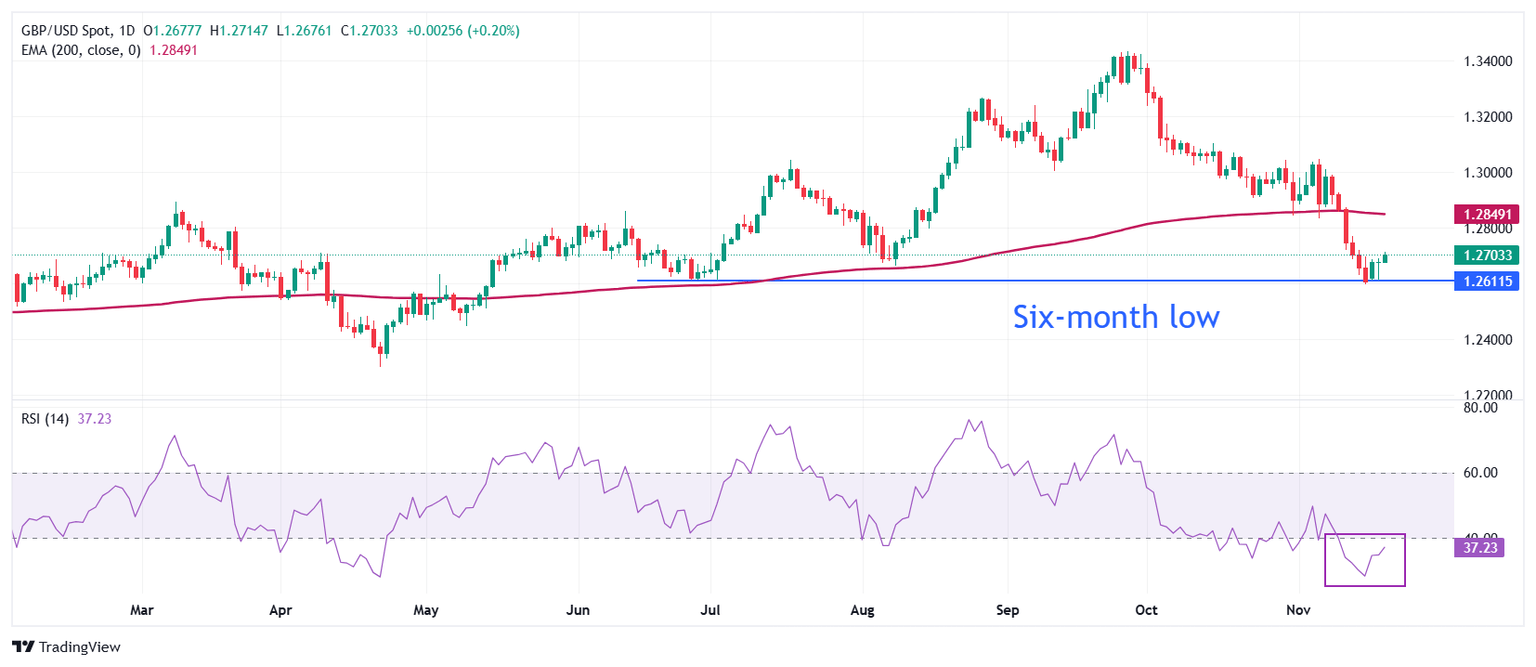

Technical Analysis: Pound Sterling retraces to near 1.2700

The Pound Sterling retreats after facing selling pressure above the round-level resistance of 1.2700 against the US Dollar. The GBP/USD pair declines as the overall outlook is bearish, given that the asset stays below the 200-day Exponential Moving Average (EMA), which hovers around 1.2850.

The 14-day Relative Strength Index (RSI) rebounds after turning oversold below 30.00. However, the overall momentum is likely to remain bearish until it breaks above 40.00 decisively.

The Cable could decline to near the psychological support of 1.2500 if it breaks below the six-month low of 1.2600. On the upside, the 200-day EMA will act as key resistance.

Economic Indicator

Core Consumer Price Index (YoY)

The United Kingdom (UK) Core Consumer Price Index (CPI), released by the Office for National Statistics on a monthly basis, is a measure of consumer price inflation – the rate at which the prices of goods and services bought by households rise or fall – produced to international standards. The YoY reading compares prices in the reference month to a year earlier. Core CPI excludes the volatile components of food, energy, alcohol and tobacco. The Core CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Last release: Wed Nov 20, 2024 07:00

Frequency: Monthly

Actual: 3.3%

Consensus: 3.1%

Previous: 3.2%

Source: Office for National Statistics

The Bank of England is tasked with keeping inflation, as measured by the headline Consumer Price Index (CPI) at around 2%, giving the monthly release its importance. An increase in inflation implies a quicker and sooner increase of interest rates or the reduction of bond-buying by the BOE, which means squeezing the supply of pounds. Conversely, a drop in the pace of price rises indicates looser monetary policy. A higher-than-expected result tends to be GBP bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.