Pound sterling drops as US Dollar rebounds due to hot US core PCE Inflation

- The Pound Sterling comes under pressure as the US Dollar rebounds due to hot US core PCE Price Index data

- US annual inflation grew at a higher pace of 2.7% against the consensus of 2.6%.

- Firm speculation for BoE rate cuts weigh on the Pound Sterling.

The Pound Sterling (GBP) faces selling pressure near 1.2500 against the US Dollar (USD) in Friday’s early American session. The GBP/USD pair drops as firm expectations that the Bank of England (BoE) will start reducing interest rates from the June meeting. BoE policymakers see inflation receding sharply in upcoming months but still refrain from providing a concrete time frame for interest-rate cuts. In the press conference after the last monetary policy meeting, BoE Governor Andrew Bailey said market expectations for two or three rate cuts this year are not “unreasonable”.

Meanwhile, the United Kingdom's economic outlook has improved even though the Bank of England (BoE) is maintaining interest rates higher. The preliminary PMI report from S&P Global/CIPS for April, released on Tuesday, showed that activity in the services sector remains robust, pushing overall activity higher despite a lagging Manufacturing PMI. The data also showed that new business inflows in the service sector remain strong.

Higher demand for services tends to boost employment and wages in the sector, contributing to inflation pressures. This could stall progress in inflation easing to the desired rate of 2%. Also, BoE policymakers have remained worried about high service inflation. Currently, the UK annual service inflation is at 6%, higher than what is required to be consistent for bringing down inflation to the 2% target.

Daily digest market movers: Pound Sterling falls as US Dollar recovers

- The Pound Sterling struggles to hold strength near a ten-day high at around the psychological figure of 1.2500 against the US Dollar. The US Dollar rebounds as the US core Personal Consumption Expenditures Price Index (PCE) data for March remains hotter-than-expected.

- Annually, the underlying inflation grew at a higher pace of 2.7% from the estimates of 2.6% but remains lower than the former reading of 2.6%. On a monthly basis, the inflation data rose steadily by 0.3%.

- Stubborn inflation data could allow the Fed to maintain a hawkish rhetoric. Fed policymakers have been reiterating that interest-rate cuts are only appropriate when they are convinced that inflation will return sustainably to the 2% target.

- After the underlying inflation data, investors will focus on the Fed’s monetary policy decision, which will be announced on Wednesday. The Fed is widely anticipated to keep interest rates unchanged in the range of 5.25%-5.50%. Investors will keenly focus on the Fed’s guidance for interest rates.

- On Thursday, the US Dollar came under pressure after the preliminary United States Gross Domestic Product (GDP) growth in the first quarter turned out weaker than expected.

- The US Bureau of Economic Analysis (BEA) reported on Thursday that the economy expanded at a slower pace of 1.6% in Q1, below expectations of 2.5% and the prior reading of 3.4%. Despite the data miss, traders maintain strong bets for the Federal Reserve to start reducing interest rates from September or in the fourth quarter as the GDP Price Index was significantly higher. The inflation measure rose to 3.1% from the prior reading of 1.7%.

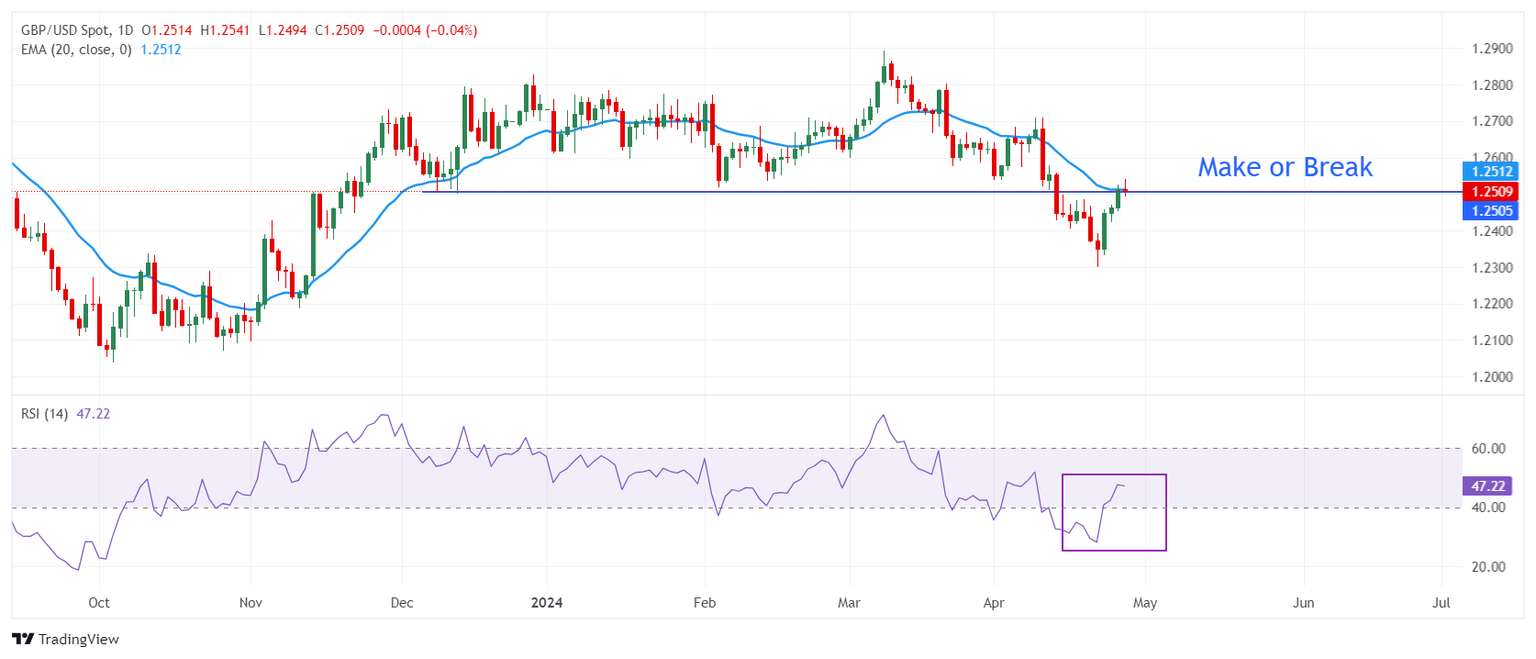

Technical Analysis: Pound Sterling faces resistance near 1.2500

The Pound Sterling trades near Thursday’s high at around 1.2500 against the US Dollar. The GBP/USD pair struggles to extend the upside above the 20-day Exponential Moving Average (EMA), which trades around 1.2510.

The 14-period Relative Strength Index (RSI) rebounds above 40.00, suggesting that a bearish momentum might have concluded for now. However, the long-term bearish bias remains intact.

A sustainable move above the psychological resistance of 1.2500 will drive the pair towards the 200-day EMA, which hovers around 1.2550. On the other side, a downside move below Wednesday’s low at around 1.2430 will expose GBP/USD to a five-month low at around 1.2300.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.