Pound Sterling surges to 1.3200 with Fed-BoE policy decision in focus

- The Pound Sterling surges to near 1.3200 against the US Dollar amid upbeat market sentiment.

- Investors expect the BoE to leave interest rates unchanged at 5% on Thursday.

- Traders remain divided over the size of the Fed’s likely interest-rate cut.

The Pound Sterling (GBP) jumps to near 1.3200 against the US Dollar in Monday’s North American session. The GBP/USD pair gains as investors expect that the BoE’s policy-easing cycle will be less aggressive than that of the Fed.

The Fed is almost certain to begin cutting interest rates on Wednesday. However, traders remain split about whether the rate cut size will be of 25 or 50 basis points (bps). According to the CME FedWatch tool, the probability of the Fed reducing interest rates by 50 bps to 4.75%-5.00% in September has increased sharply to 61% from 30% a week ago.

Market speculation for the Fed's outsize interest rate cut has been strengthened after the release of the Producer Price Index (PPI) report for August, which showed that the headline producer inflation decelerated at a faster-than-expected pace to 1.7%. Some media reports have also contributed to expectations that the Fed could opt for a large cut.

Before the Fed policy announcement, investors will focus on the United States (US) Retail Sales data for August, which will be published on Tuesday. Retail Sales data, a key measure of consumer spending, is estimated to have grown by 0.2%, slower than the 1.0% increase seen in July.

Daily digest market movers: Pound Sterling gains as BoE seems to leave interest rates unchanged

- The Pound Sterling performs strongly against its major peers at the start of the week, supported by the improved appeal for risk-perceived currencies and a weakening US Dollar, which is pressured by growing prospects that the Federal Reserve (Fed) will opt for a large interest rate cut on Wednesday.

- Firm Fed rate cut prospects have weighed on the US Dollar (USD), with the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, posting a fresh weekly low near 100.80.

- On the United Kingdom (UK) front, the Pound Sterling will be guided by the Consumer Price Index (CPI) data for August and the Bank of England’s (BoE) monetary policy decision, which are scheduled for Wednesday and Thursday, respectively.

- Economists estimate the annual UK core CPI – which excludes volatile components – to have grown at a faster pace of 3.5% from 3.3% in July, with headline inflation rising steadily by 2.2%. Investors will also focus on the UK service inflation data, a closely-watched indicator by BoE officials that has remained high.

- The inflation data will significantly influence market speculation for BoE interest rate policy. Currently, financial market participants expect that the BoE will leave interest rates unchanged at 5% and expect it to deliver only one additional interest-rate cut in the remainder of the year.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.47% | -0.62% | -0.13% | -0.07% | -0.55% | -0.44% | -0.36% | |

| EUR | 0.47% | -0.21% | 0.30% | 0.39% | -0.14% | -0.04% | 0.06% | |

| GBP | 0.62% | 0.21% | 0.43% | 0.57% | 0.07% | 0.19% | 0.28% | |

| JPY | 0.13% | -0.30% | -0.43% | 0.07% | -0.37% | -0.30% | -0.29% | |

| CAD | 0.07% | -0.39% | -0.57% | -0.07% | -0.56% | -0.38% | -0.40% | |

| AUD | 0.55% | 0.14% | -0.07% | 0.37% | 0.56% | 0.10% | 0.20% | |

| NZD | 0.44% | 0.04% | -0.19% | 0.30% | 0.38% | -0.10% | 0.09% | |

| CHF | 0.36% | -0.06% | -0.28% | 0.29% | 0.40% | -0.20% | -0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

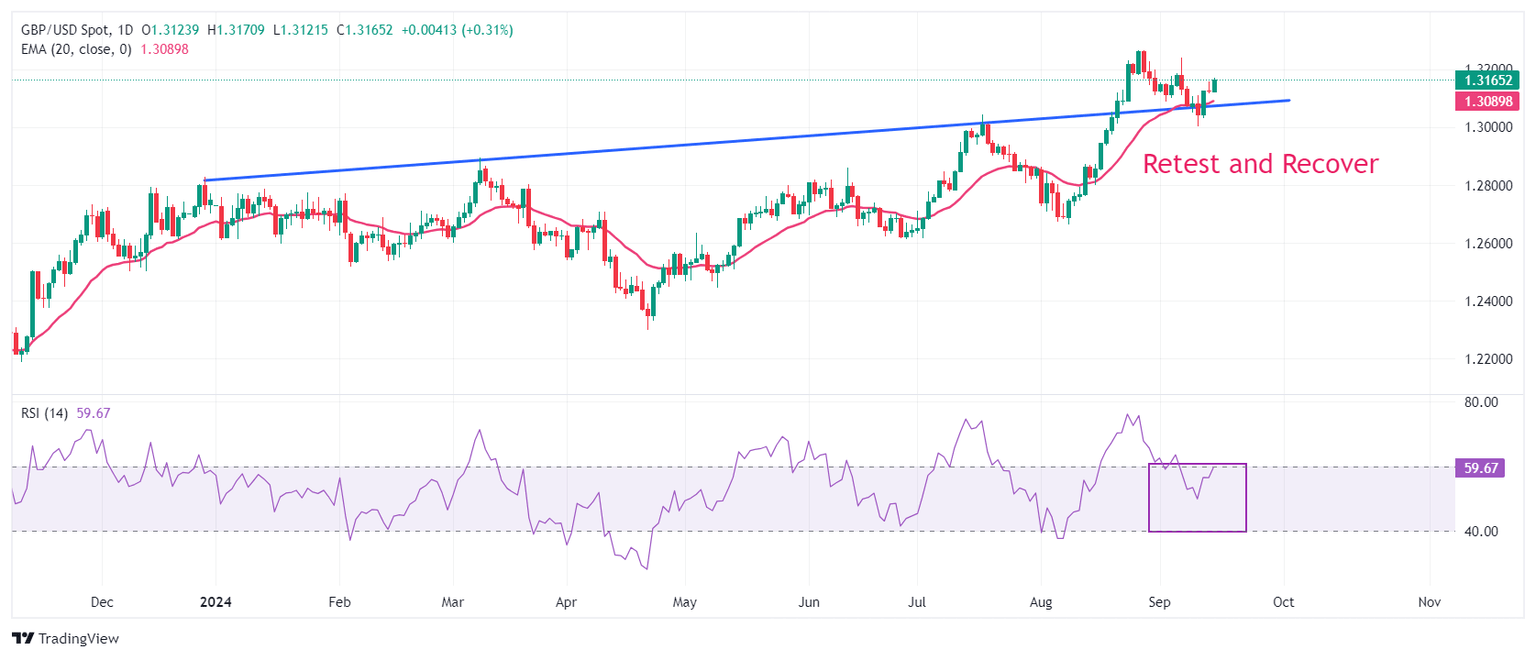

Technical Analysis: Pound Sterling gathers strength to stabilize above 1.3200

The Pound Sterling gains to near 1.3160 against the US Dollar. The GBP/USD pair extends its recovery after a corrective move to near the trendline plotted from the December 28, 2023, high of 1.2828, from where it delivered a sharp increase after a breakout on August 21. Also, the 20-day Exponential Moving Average (EMA) near 1.3080 has acted as major support for the Pound Sterling.

The 14-day Relative Strength Index (RSI) reaches 60.00. A fresh round of bullish momentum could occur if the oscillator breaks above this level.

Looking up, the Cable will face resistance near the round-level resistance of 1.3200 and the psychological level of 1.3500. On the downside, the psychological level of 1.3000 emerges as crucial support.

Economic Indicator

Core Consumer Price Index (YoY)

The United Kingdom (UK) Core Consumer Price Index (CPI), released by the Office for National Statistics on a monthly basis, is a measure of consumer price inflation – the rate at which the prices of goods and services bought by households rise or fall – produced to international standards. The YoY reading compares prices in the reference month to a year earlier. Core CPI excludes the volatile components of food, energy, alcohol and tobacco. The Core CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Next release: Wed Sep 18, 2024 06:00

Frequency: Monthly

Consensus: 3.5%

Previous: 3.3%

Source: Office for National Statistics

The Bank of England is tasked with keeping inflation, as measured by the headline Consumer Price Index (CPI) at around 2%, giving the monthly release its importance. An increase in inflation implies a quicker and sooner increase of interest rates or the reduction of bond-buying by the BOE, which means squeezing the supply of pounds. Conversely, a drop in the pace of price rises indicates looser monetary policy. A higher-than-expected result tends to be GBP bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.