Pound Sterling outperforms US Dollar as US Jobless Claims surge

- The Pound Sterling rises as BoE Governor Andrew Bailey sticks to follow a gradual policy-easing approach.

- Financial market participants expect the BoE to keep interest rates steady in the policy meeting on December 19.

- Fed Powell expects that the central bank has the comfort of becoming “cautious” on interest-rate cuts.

The Pound Sterling (GBP) surges to near 1.2750 against the US Dollar (USD) in Thursday’s North American session. The GBP/USD pair strengthens as the US Dollar slumps after the release of the United States (US) Initial Jobless Claims data for the week ending November 29. The data showed that individuals claiming jobless benefits were 224K, higher than estimates and the prior release of 215K.

Higher US jobless claims data pushed the US Dollar Index (DXY) lower below 106.00, renewed fears of a slowdown in labor demand. For a clear picture of the current labor market status, investors will focus on the US Nonfarm Payrolls (NFP) data for November, which will be released on Friday. The NFP report is expected to show that the US economy added 200K fresh workers, significantly higher than 12K in October. The NFP report stated that payroll employment estimates in some industries were affected by the hurricanes last month. The Unemployment Rate is estimated to have increased to 4.2% from the former release of 4.1%.

The labor market data will influence expectations for the Federal Reserve (Fed) interest rate path. Meanwhile, Fed Chair Jerome Powell delivered less-dovish remarks in his commentary at the New York Times DealBook Summit on Wednesday.

“We can afford to be a little more cautious as we try to find neutral,” Jerome Powell said. His comments were backed by the assumption that the economy is stronger than what the central bank had anticipated in September, downside risks in the labor market appear to be fading and inflation has come in a little higher than anticipated.

Though Powell's comments were less dovish, they failed to tamper market speculation for the Fed to cut interest rates in December. According to the CME FedWatch tool, there is a 74% chance that the Fed will reduce its key borrowing rates by 25 basis points (bps) to 4.25%-4.50%, marginally higher than the 73% seen on December 3.

Daily digest market movers: Pound Sterling rises as BoE Bailey sticks to gradual rate cut approach

- The Pound Sterling gains against its major peers on Thursday amid firm expectations that the Bank of England (BoE) will follow a gradual approach while lowering its key borrowing rates compared to other central banks.

- BoE Governor Andrew Bailey said on Wednesday that interest rates should be cut “gradually” in a Financial Times (FT) Global Boardroom event, adding that the progress in taming price pressures is holding up. "This sort of disinflation process is now well embedded,” Bailey said.

- However, Bailey also emphasized that the central bank has still some work to do to bring inflation down below the bank’s target of 2%. Bailey added that price pressures have ticked up after returning to the bank’s target, a scenario that was already anticipated by the BoE. Meanwhile, one-year ahead forward consumer inflation expectations by the UK companies rose by another 0.1 percentage points to 2.7% in the quarter to December, according to the latest survey by Decision Maker Panel (DMP) quarterly survey.

- When asked about the interest-rate path ahead, Bailey said he sees four interest-rate cuts next year. The initial reaction from his commentary was negative for the Pound Sterling, but the currency managed to recover strongly as some of Bailey’s comments also pointed to caution. While the BoE Governor didn’t offer any cues about the decision in the monetary policy meeting on December 19, traders expect the BoE to leave interest rates unchanged at 4.75%.

- In Thursday’s session, investors will focus on BoE Monetary Policy Committee (MPC) external member Megan Greene’s commentary at the Global Boardroom event organized by the Financial Times (FT), which is scheduled at 17:00 GMT.

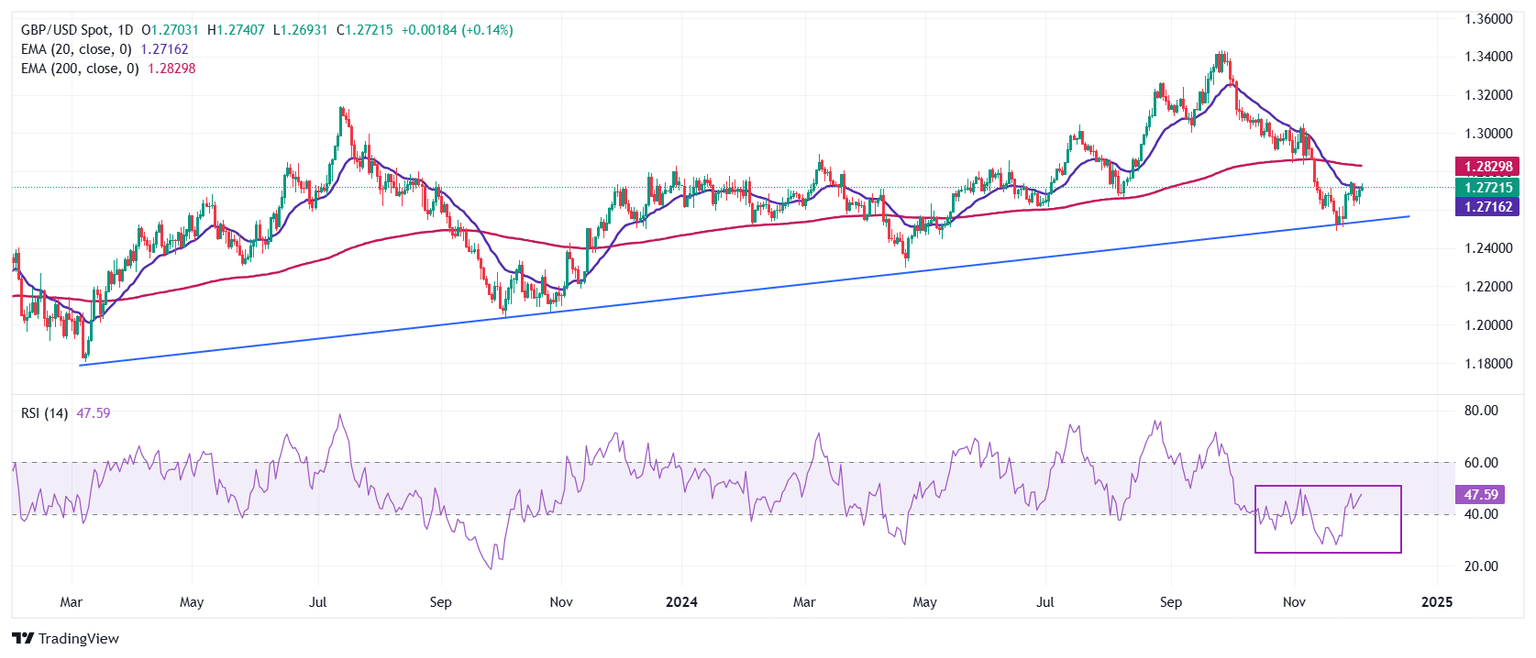

Technical Analysis: Pound Sterling climbs above 20-day EMA

The Pound Sterling jumps to near 1.2750 against the US Dollar in North American trading hours on Thursday. The GBP/USD pair climbs above the 20-day Exponential Moving Average (EMA) around 1.2715 and aims to sustain above the same. However, the outlook remains bearish as the pair stays below the 200-day Exponential Moving Average, which trades around 1.2825.

The 14-day Relative Strength Index (RSI) has rebounded after turning oversold on November 22. However, the downside bias is still intact.

Looking down, the pair is expected to find a cushion near the upward-sloping trendline around 1.2500, which is plotted from the March 2023 low near 1.1800. On the upside, the 200-day EMA will act as key resistance.

Economic Indicator

Initial Jobless Claims

The Initial Jobless Claims released by the US Department of Labor is a measure of the number of people filing first-time claims for state unemployment insurance. A larger-than-expected number indicates weakness in the US labor market, reflects negatively on the US economy, and is negative for the US Dollar (USD). On the other hand, a decreasing number should be taken as bullish for the USD.

Read more.Last release: Thu Dec 05, 2024 13:30

Frequency: Weekly

Actual: 224K

Consensus: 215K

Previous: 213K

Source: US Department of Labor

Every Thursday, the US Department of Labor publishes the number of previous week’s initial claims for unemployment benefits in the US. Since this reading could be highly volatile, investors may pay closer attention to the four-week average. A downtrend is seen as a sign of an improving labour market and could have a positive impact on the USD’s performance against its rivals and vice versa.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.