Pound Sterling capitalizes on strong UK flash PMI

- The Pound Sterling capitalizes on upbeat preliminary UK S&P Global/CIPS PMI for July.

- UK's Composite PMI beats estimates and the former release.

- The Fed is expected to pivot to policy normalization in September.

The Pound Sterling (GBP) bounces back against its major peers in Wednesday’s New York session after upbeat preliminary S&P Global/CIPS Purchasing Managers’ Index (PMI) data for July. The Composite PMI came in higher at 52.7 than estimates of 52.6 and the former release of 52.3 due to an increase in activities in the manufacturing as well as service sectors. The Manufacturing and Services PMI expanded to 51.8 and 52.4, respectively, outperforming their former releases.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said, "The first post-election business survey paints a welcoming picture for the new government, with companies operating across manufacturing and services, having gained optimism about the future, reporting a renewed surge in demand and taking on staff in greater numbers. Prices have meanwhile risen at their lowest rate for three and a half years, further raising the prospect of a summer rate cut."

Earlier, the British currency was underperforming amid growing speculation that the Bank of England (BoE) will begin cutting interest rates in August. Market experts see the United Kingdom’s (UK) economy struggling to cooperate with BoE’s high interest rates. The consequences of a restrictive monetary policy stance are clearly visible in households’ spending, as the UK’s Retail Sales, a key measure of consumer spending that prompts inflationary pressures, contracted at a faster-than-expected pace in June.

Meanwhile, BoE officials refrain from endorsing rate cuts due to high inflation in the service sector. UK service inflation grew steadily by 5.7% in June.

Daily digest market movers: Pound Sterling recovers strongly against its major peers

- The Pound Sterling rises above 1.2900 against the US Dollar (USD) in European trading hours on Wednesday. The GBP/USD pair rebounds as the US Dollar corrects after weak preliminary US S&P Global PMI data for July. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, declines from a weekly high at around 104.50.

- The flash PMI report showed that the Composite PMI advanced due to robust growth in activities in the services sector. However, the Manufacturing PMI surprisingly contracted. The Composite PMI rose to 55.0 from June's reading of 54.8.

- This week, the main triggers for the US Dollar will be the preliminary annualized Q2 Gross Domestic Product (GDP) and the Personal Consumption Expenditures Price Index (PCE) data for June, which will be published on Thursday and Friday, respectively. The US economy is estimated to have grown by 1.9% from the former release of 1.4%.

- Investors will keenly focus on the core PCE inflation, the Federal Reserve’s (Fed) preferred inflation measure, to get fresh cues about when the central bank will start reducing interest rates. Currently, financial markets expect the Fed to begin lowering its key borrowing rates in September.

- Meanwhile, investors seek fresh developments on the US presidential elections in November. Market experts see Donald Trump winning the elections despite Democrats nominating Vice President Kamala Harris as their leader.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| GBP | EUR | USD | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | 0.12% | 0.16% | -0.97% | 0.13% | 0.26% | 0.31% | -0.59% | |

| EUR | -0.12% | 0.05% | -1.10% | 0.01% | 0.15% | 0.19% | -0.69% | |

| USD | -0.16% | -0.05% | -1.15% | -0.03% | 0.09% | 0.15% | -0.74% | |

| JPY | 0.97% | 1.10% | 1.15% | 1.16% | 1.27% | 1.30% | 0.42% | |

| CAD | -0.13% | -0.01% | 0.03% | -1.16% | 0.12% | 0.18% | -0.72% | |

| AUD | -0.26% | -0.15% | -0.09% | -1.27% | -0.12% | 0.04% | -0.84% | |

| NZD | -0.31% | -0.19% | -0.15% | -1.30% | -0.18% | -0.04% | -0.89% | |

| CHF | 0.59% | 0.69% | 0.74% | -0.42% | 0.72% | 0.84% | 0.89% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

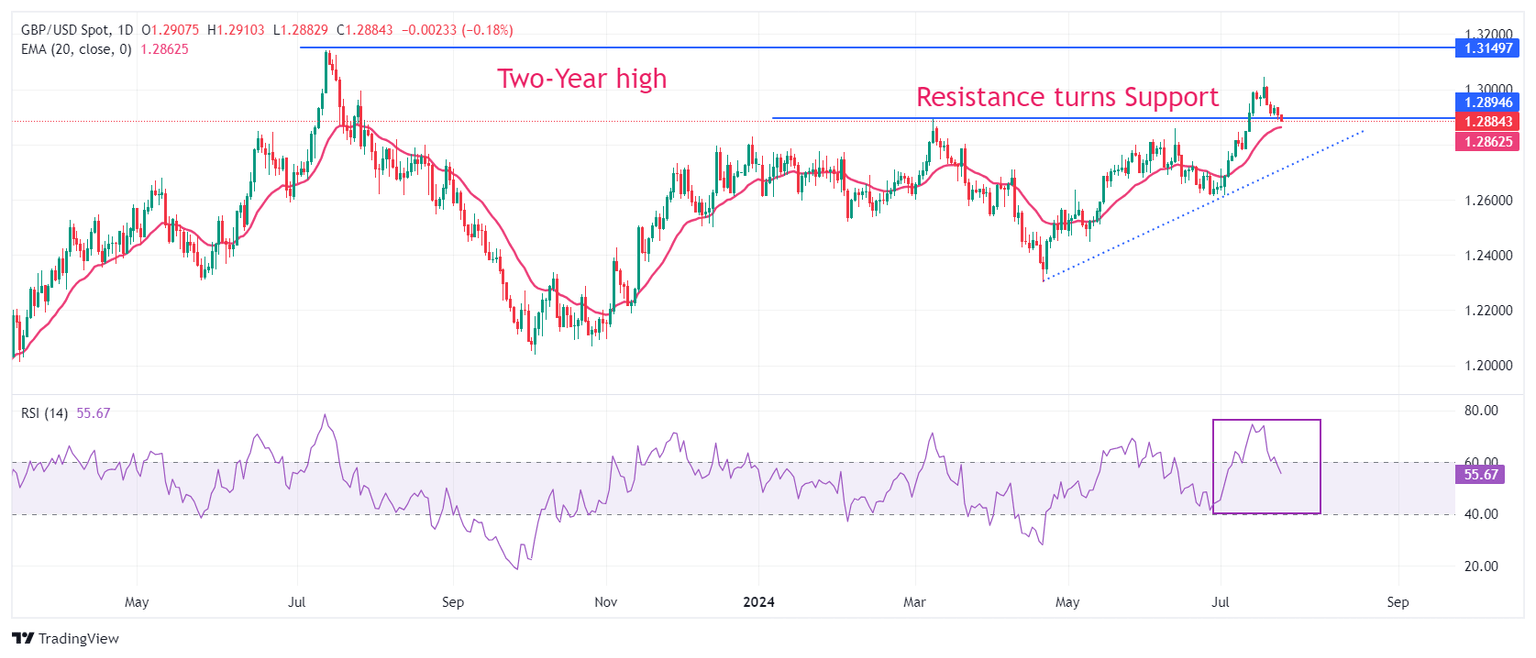

Technical Analysis: Pound Sterling moves higher above 1.2900

The Pound Sterling recovers after sliding below the crucial support of 1.2900 against the US Dollar. The GBP/USD pair moves higher after discovering buying interest near the horizontal support plotted from the March 8 high near 1.2900, which used to be a resistance for the Pound Sterling bulls. The Cable has dropped near the 20-day Exponential Moving Average (EMA), which trades around 1.2860.

The 14-day Relative Strength Index (RSI) returns within the 40.00-60.00 range, suggesting the bullish momentum has faded. However, the bullish bias remains intact.

On the upside, a two-year high near 1.3140 will be a key resistance zone for the pair. On the other hand, the upward-sloping trendline from the April 22 low will act as a major support zone around 1.2750.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.