Pound Sterling weakens against US Dollar amid dismal market mood

- The Pound Sterling moves higher to 1.2480 as investors see the BoE delaying rate cuts.

- UK’s stable wage growth is limiting the slowdown in price pressures.

- The US Dollar corrects despite the Fed’s stance towards keeping interest rates higher for a longer period.

The Pound Sterling (GBP) retreats from 1.2480 in Thursday’s early New York session. The GBP/USD pair falls back as the US Dollar recovers amid expectations that the Federal Reserve (Fed) will keep interest rates higher for a longer period.

The US Dollar Index (DXY), which tracks the US Dollar against six major currencies, rises sharply from 105.75. The near-term demand for the US Dollar remains intact as Federal Reserve (Fed) policymakers keep emphasising the need for interest rates to remain higher for a longer period until they get convinced that inflation will return sustainably to the 2% target.

Meanwhile, expectations that the Bank of England (BoE) will delay rate cuts until the November meeting rose as the United Kingdom inflation for March decelerated slower than expected. Like the Federal Reserve (Fed), the BoE is also expected to delay rate cuts, which has faded potential fears of policy divergence between them.

The major catalyst that forced traders to pare BoE early rate cuts is the slow progress in inflation declining to the 2% target due to steady wage growth. The labor market report for the quarter ending February showed that Average Earnings including bonuses grew steadily by 5.6%, higher than expectations of 5.5%.

For inflation to return to the 2% target, the annual wage growth excluding bonuses should be close to 3.5%. Higher wage growth feeds inflationary pressures as businesses pass on labor cost to end consumers. Also, households with higher income for disposal ramp up overall demand in the economy.

Daily digest market movers: Pound Sterling surrenders intraday gains while US Dollar recovers

- The Pound Sterling falls from 1.2480 even though persistence in the United Kingdom’s inflation data for March forced traders to price out expectations for the Bank of England pivoting to rate cuts in the September meeting.

- Investors expect that the last mile for inflation to return to the 2% target will be bumpy. Currently, financial markets anticipate the BoE reducing interest rates only once this year in the November meeting.

- The UK Inflation data released on Wednesday indicated that annual core CPI data, which strips off volatile food and energy prices, grew by 4.2% year-over-year in March, above the consensus of 4.1% but significantly decelerated from February’s reading of 4.5%. The core inflation data is the Bank of England’s preferred inflation measure for decision-making on interest rates.

- A lower-than-expected decline in price pressures in March, combined with steady wage growth data for the three months ending February, forced traders to pare rate cut bets for the September meeting.

- After the release of the inflation data, BoE Governor Andrew Bailey said, “We’re pretty much on track for where we thought we would be in February on inflation. Bailey remains optimistic about a further drop in inflation next month. When asked about the impact of Middle East tensions, Bailey commented that the Oil price has not leaped as much as expected and the consequences of Middle East tensions are less than feared, reported FXStreet. https://www.fxstreet.com/news/boes-a-bailey-inflation-will-drop-strongly-in-the-next-month-202404171612

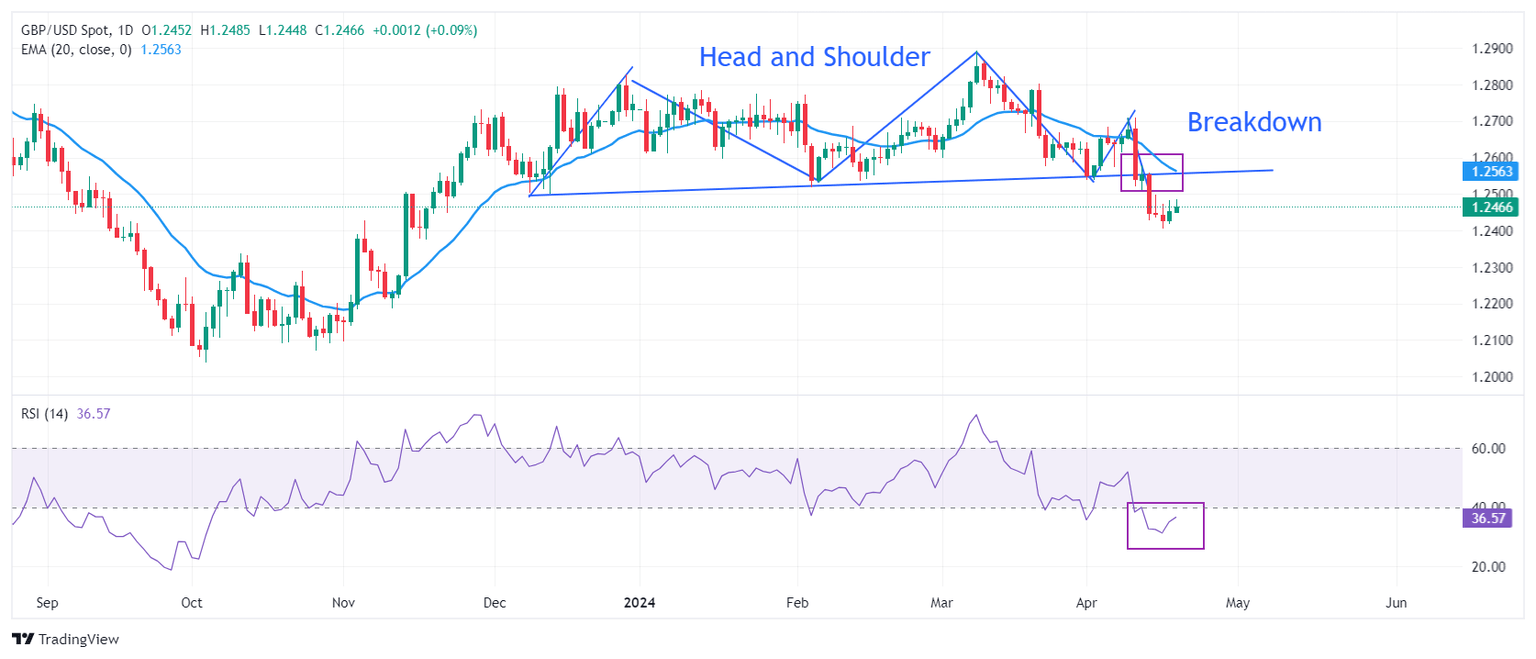

Technical Analysis: Pound Sterling drops from 1.2500

The Pound Sterling aims for firm footing after discovering strong buying interest near the round-level support of 1.2400. The GBP/USD pair rebounds from 1.2400 and focuses on recapturing the psychological resistance of 1.2500.

The near-term outlook of the Cable remains bearish due to a breakdown of the Head and Shoulder pattern and a declining 20-day Exponential Moving Average (EMA) near 1.2560.

In addition, the 14-period Relative Strength Index (RSI) oscillates inside the bearish range of 20.00-40.00, suggesting momentum leaned to the downside.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.