Pound Sterling drops as UK Average Earnings deceletrates expectedly

- The Pound Sterling declines as the US Dollar rebounds due to increased risk aversion.

- UK Claimant Count Change, claiming jobless benefits, rose to 32.3K in June, surpassing market expectations of 23.4K.

- Rising expectations for Fed rate cuts in September may limit the upside of the US Dollar.

The Pound Sterling (GBP) weakens against its major peers in Thursday’s American session. The British currency drops as United Kingdom (UK) Average Earnings data, a key measure of wage growth that fuels inflation in the service sector and has been a major barrier to the Bank of England’s (BoE) confidence for interest rate cuts, decelerated as expectedly.

Annual Average Earnings (Including and Excluding bonuses) rose by 5.7% in the three months ending in May, below the 5.9% and 6%, respectively, from the previous month. Though the wage growth momentum slowed, it is still higher than what is needed to be consistent for achieving price stability.

Meanwhile, the Office for National Statistics (ONS) reported that employers hired 19K job-seekers in the three months ending in May, against a drawdown of 140K employees in the previous reading. In the same period, the ILO Unemployment Rate was recorded at 4.4%, remaining in line with estimates and the former release.

Expectations for the BoE to begin reducing interest rates from the August meeting have already diminished due to sticky core Consumer Price Index (CPI) data for June. UK’s core CPI grew steadily by 3.5% due to sticky service inflation data.

Daily digest market movers: Pound Sterling weakens while US Dollar gains ground

- The Pound Sterling edges lower near the psychological support of 1.3000 against the US Dollar (USD) in Thursday’s European session. The broader appeal of the GBP/USD pair remains firm as the Federal Reserve (Fed) is widely expected to start lowering its key borrowing rates from the September meeting.

- The scenario of higher expectations for Fed rate cuts is unfavorable for the US Dollar (USD). The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, hovers near an almost four-month low at around 103.70.

- Firm speculation for Fed rate cuts has been prompted by meaningful signs from June’s Consumer Price Index (CPI) report that the disinflation process has resumed after stalling in the first quarter of the year. Annual headline and core CPI, which excludes volatile food and energy prices, decelerated at a faster-than-expected pace.

- Cooling inflationary pressures have also improved Fed officials’ confidence that price pressures are on track to return to the central bank’s target of 2%. On Wednesday, Richmond Fed Bank President Thomas Barkin cited broadening disinflation as “very encouraged.” Barkin added he is sure policymakers will debate at the July policy meeting whether it is still appropriate to describe inflation as elevated, Reuters reported.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Euro.

| GBP | EUR | USD | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | 0.01% | -0.22% | 0.00% | -0.21% | -0.27% | -0.01% | -0.10% | |

| EUR | -0.01% | -0.24% | -0.02% | -0.19% | -0.27% | -0.02% | -0.11% | |

| USD | 0.22% | 0.24% | 0.20% | 0.02% | -0.05% | 0.19% | 0.11% | |

| JPY | 0.00% | 0.02% | -0.20% | -0.20% | -0.25% | -0.03% | -0.08% | |

| CAD | 0.21% | 0.19% | -0.02% | 0.20% | -0.07% | 0.18% | 0.09% | |

| AUD | 0.27% | 0.27% | 0.05% | 0.25% | 0.07% | 0.26% | 0.19% | |

| NZD | 0.00% | 0.02% | -0.19% | 0.03% | -0.18% | -0.26% | -0.09% | |

| CHF | 0.10% | 0.11% | -0.11% | 0.08% | -0.09% | -0.19% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

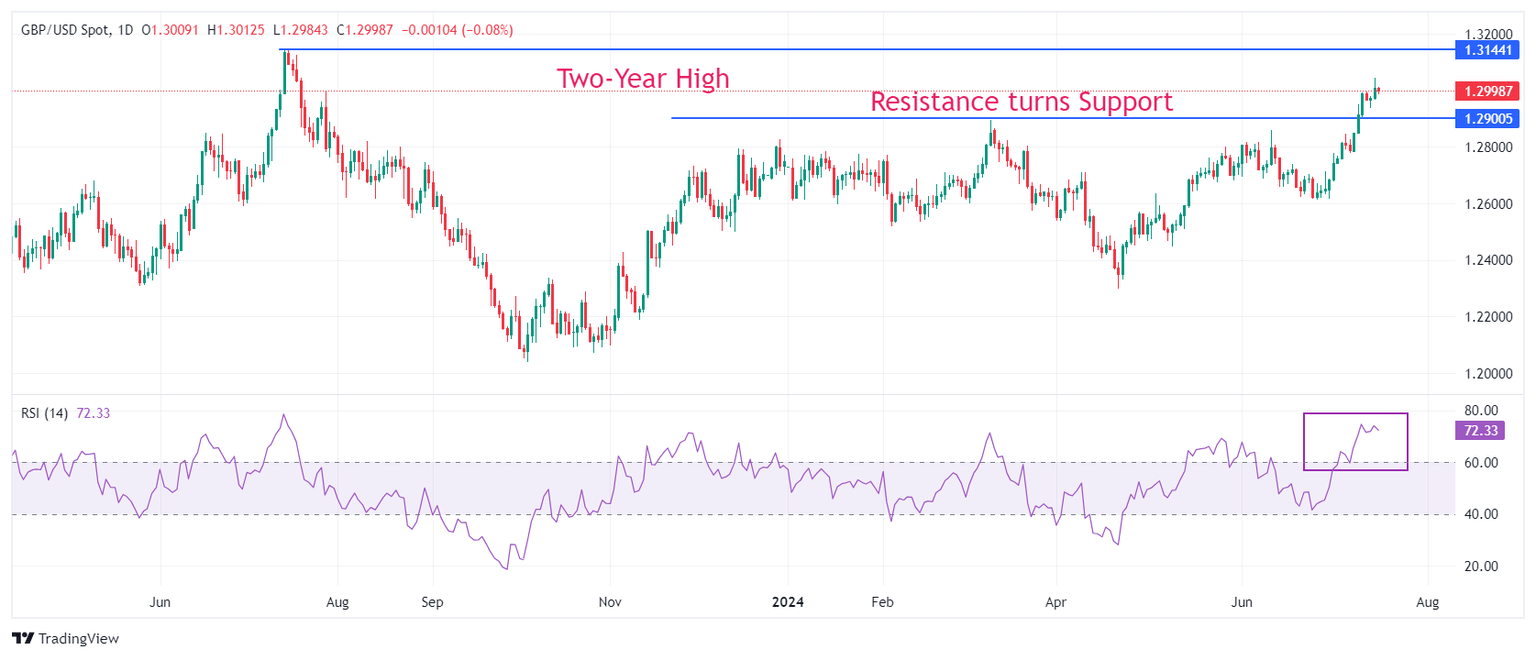

Technical Analysis: Pound Sterling aims to recapture 1.3000

The Pound Sterling drops to near 1.3000 against the US Dollar on a steady decline in the UK wage growth measure. However, the overall trend remains firm as the GBP/USD pair trades close to a fresh two-year high of 1.3044 recorded on Wednesday.

All short-to-long-term Exponential Moving Averages (EMAs) are sloping higher, suggesting a strong bullish trend.

The 14-period Relative Strength Index (RSI) jumps to near 70.00 for the first time in more than a year, indicating strong momentum towards the upside.

The major is expected to extend its upside towards the two-year high near 1.3140. If the GBP/USD pair faces selling pressure after UK data, the March 8 high near 1.2900 will be a key support for the Pound Sterling bulls.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.