Pound Sterling gains on firm Fed rate cut prospects, US Inflation in focus

- The Pound Sterling exhibits strength against the US Dollar as Fed’s Powell sees softness in the US labor market strength.

- The Fed chief did not guide any specific rate-cut path.

- UK GDP for May and US Inflation for June have come under the spotlight.

The Pound Sterling (GBP) edges higher against the US Dollar (USD) in Wednesday’s American session after a mild correction from almost a four-week high of 1.2850 this week. The broader appeal of the GBP/USD pair remains firm amid strong speculation that the Federal Reserve (Fed) will start reducing interest rates during the September meeting.

The odds for the Fed pivoting to policy normalization remain firm even though Fed Chair Jerome Powell reiterated in his semi-annual Congressional testimony on Tuesday, refrained from providing any specific rate-cut path for this year. Powell argued in favor of maintaining interest rates at their current levels for long until they get evidence that inflation will return to the desired rate of 2%.

What was unexpected from Fed Powell’s commentary before Congress is his acknowledgement that the United States (US) economy is no longer overheated, with cooling job market conditions. Powell said that the labor market has moderated to where it was before pandemic-era.

Now that risks have become two-sided, a rate-cut move by the Fed in September appears to be a done deal. For more clarity, investors will focus on the US Consumer Price Index (CPI) report for June, which will be published on Thursday. The report is expected to show that the core inflation, which strips off volatile food and energy items, grew steadily by 0.2% and 3.4% on a monthly and annual basis, respectively. Annual headline inflation is estimated to have decelerated to 3.1% from May’s reading of 3.3%, while the monthly figure is expected to have barely grown after remaining unchanged.

A scenario in which price pressures remain sticky or hot would ease expectations for rate cuts in September. On the contrary, soft numbers will boost them.

Daily Digest Market Movers: Pound Sterling remains firm with UK GDP/US CPI in focus

- The Pound Sterling performs strongly against its major peers due to multiple tailwinds. The British currency strengthens as the outright victory of the United Kingdom (UK) Keir Starmer-led Labour Party in parliamentary elections against Rishi Sunak-led Conservative Party has brought political stability to the economy. The uncertainty over the Bank of England (BoE) rate-cut path has deepened after hawkish guidance from BoE policymaker Jonathan Haskel.

- On Monday, Jonathan Haskel, who has been amongst major hawks, said no to a rate cut in August as inflation in the labor market is still higher due to strong wage growth. Haskel said, "I would rather hold rates until there is more certainty that underlying inflationary pressures have subsided sustainably," Reuters reported.

- On the contrary, financial markets currently expect that the BoE will begin cutting its key rates from the August meeting. The expectations for BoE rate cuts in August have been prompted by the return of the annual headline inflation to bank’s target of 2%.

- Meanwhile, investors shift focus to the monthly Gross Domestic Product (GDP) and factory data for May, which will be published on Thursday. Economists expect that the economy expanded by 0.2% after remaining unchanged in April. Industrial and Manufacturing Production are expected to have grown on a monthly and annual basis after declining in April.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| GBP | EUR | USD | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | 0.01% | 0.10% | 0.17% | 0.11% | 0.00% | 0.74% | 0.00% | |

| EUR | -0.01% | 0.09% | 0.14% | 0.10% | -0.00% | 0.74% | 0.01% | |

| USD | -0.10% | -0.09% | 0.05% | -0.01% | -0.08% | 0.67% | -0.06% | |

| JPY | -0.17% | -0.14% | -0.05% | -0.05% | -0.15% | 0.57% | -0.14% | |

| CAD | -0.11% | -0.10% | 0.01% | 0.05% | -0.08% | 0.66% | -0.08% | |

| AUD | -0.00% | 0.00% | 0.08% | 0.15% | 0.08% | 0.74% | -0.01% | |

| NZD | -0.74% | -0.74% | -0.67% | -0.57% | -0.66% | -0.74% | -0.73% | |

| CHF | -0.01% | -0.01% | 0.06% | 0.14% | 0.08% | 0.00% | 0.73% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

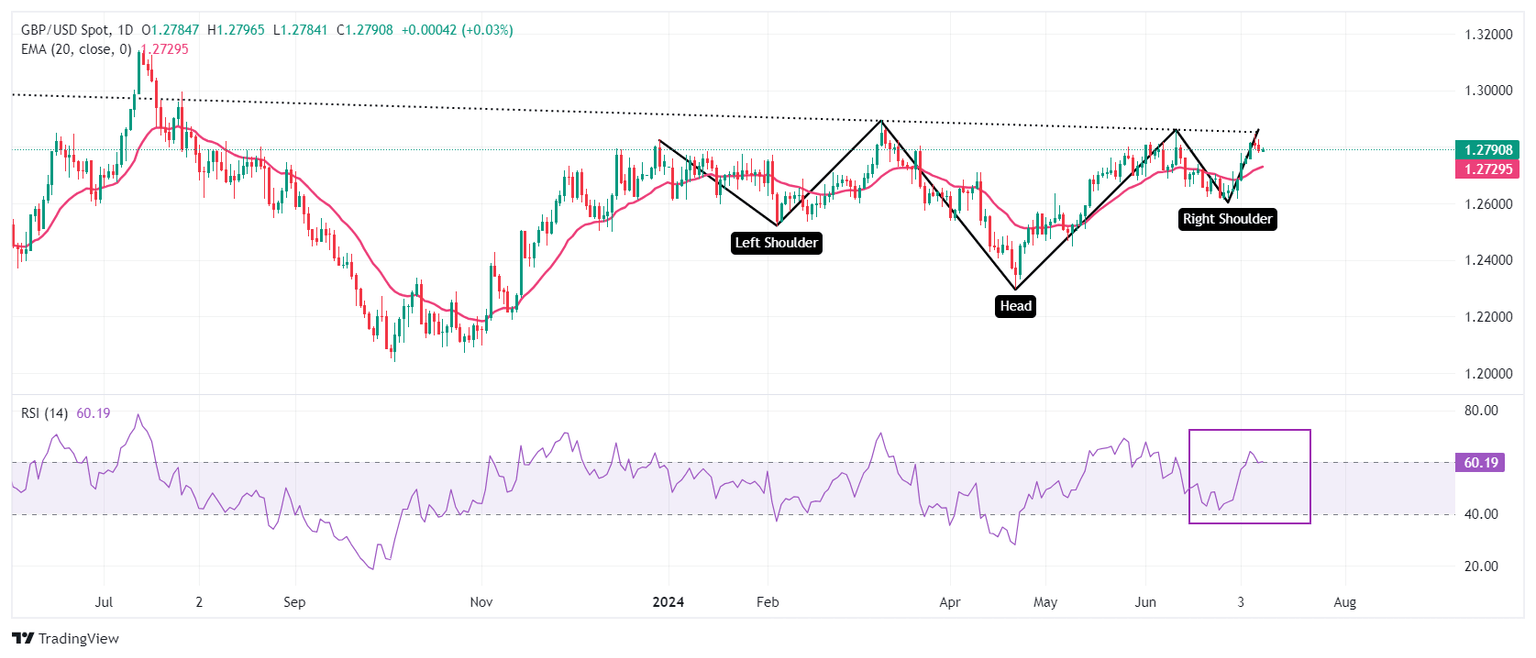

Technical Analysis: Pound Sterling clings to gains near 1.2800

The Pound Sterling aims to hold the key figure of 1.2800 against the US Dollar. The GBP/USD pair gathers strength for a decisive breakout of the Inverted Head and Shoulder (H&S) chart formation on a daily timeframe whose neckline is plotted near 1.2850. A breakout of the H&S formation results in a bullish reversal.

Advancing 20-day Exponential Moving Average (EMA) near 1.2730, suggests that the near-term trend is bullish.

The 14-day Relative Strength Index (RSI) climbs into the bullish range of 60.00-80.00. A sustained move above the same will keep the momentum towards the upside.

BoE FAQs

The Bank of England (BoE) decides monetary policy for the United Kingdom. Its primary goal is to achieve ‘price stability’, or a steady inflation rate of 2%. Its tool for achieving this is via the adjustment of base lending rates. The BoE sets the rate at which it lends to commercial banks and banks lend to each other, determining the level of interest rates in the economy overall. This also impacts the value of the Pound Sterling (GBP).

When inflation is above the Bank of England’s target it responds by raising interest rates, making it more expensive for people and businesses to access credit. This is positive for the Pound Sterling because higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls below target, it is a sign economic growth is slowing, and the BoE will consider lowering interest rates to cheapen credit in the hope businesses will borrow to invest in growth-generating projects – a negative for the Pound Sterling.

In extreme situations, the Bank of England can enact a policy called Quantitative Easing (QE). QE is the process by which the BoE substantially increases the flow of credit in a stuck financial system. QE is a last resort policy when lowering interest rates will not achieve the necessary result. The process of QE involves the BoE printing money to buy assets – usually government or AAA-rated corporate bonds – from banks and other financial institutions. QE usually results in a weaker Pound Sterling.

Quantitative tightening (QT) is the reverse of QE, enacted when the economy is strengthening and inflation starts rising. Whilst in QE the Bank of England (BoE) purchases government and corporate bonds from financial institutions to encourage them to lend; in QT, the BoE stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive for the Pound Sterling.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.